Security is a key warehousing factor. You have to protect your assets. Poor security can lead to theft, inaccurate inventory control, and lowered employee morale. Many businesses understand why security is key to good warehousing in Ghana, Mozambique, and Cote d’Ivoire. For that reason, many companies have turned to logistics parks that include security solutions to protect their assets and make a positive impact on the global supply chain.

Why security is important to good warehousing in Ghana, Mozambique, and Cote d’Ivoire

Security is key to good warehousing regardless of geographical location. And in countries and industries that play a large role in the supply chain, it’s even more important.

What role does security play in warehousing in Ghana, Mozambique, and Cote d’Ivoire?

Warehouse security plays a large role in sub-Saharan Africa countries like Ghana, Mozambique, and Cote d’Ivoire. There are several benefits to investing in warehouse security:

- Protecting your facility and employees against potential violence that can occur in rural or urban areas.

- Keeping your employees healthy and safe, even during outbreaks like malaria, HIV, and the COVID-19 pandemic. This includes health screenings and access to lifesaving medicine, including the COVID-19 vaccine.

- Encouraging stakeholders to invest more into your company. Investors want assurance that they’re investing their money wisely, and a secure warehouse helps achieve that.

What are the biggest security problems faced in warehouses in Ghana, Mozambique, and Cote d’Ivoire?

Unfortunately, many African countries face security problems. And this largely stems from lack of infrastructure and resources. Sub-Saharan Africa, home to some of the world’s fastest growing economies in recent years, has been hit hard by the pandemic. The IMF’s 2022 growth projection for the region is 3.8 percent – well below the 5 percent plus rates enjoyed in many years prior to the COVID-19 outbreak. Lack of widespread access to the COVID-19 vaccines will continue to hamper economic activity across the region.

These obstacles detract focus from security. The labor shortage and health risks caused by the COVID-19 pandemic have forced companies to choose between focusing on secure warehousing and running daily operations. The World Bank, among others, is trying to help stabilize the economy. As the economy stabilizes, more companies will have the resources to move into logistics parks with built-in security.

What can happen to warehousing in Ghana, Mozambique, and Cote d’Ivoire without good security?

Warehousing in any country can fail—including countries like Ghana, Mozambique, and Cote d’Ivoire. Subpar security can lead to theft by employees or outside parties, data breaches, and severe supply chain interruptions. Since all of this could lead to losses on your company’s bottom line, you need to make sure that your warehouse security is top notch.

Best security practices for warehouse space in Ghana, Mozambique, and Cote d’Ivoire

The best security practices for warehouse space in souther and West Africa rely on infrastructure and technology. There are also factors that affect security needs in these regions, and it’s important to understand them.

What factors affect security needs in warehouse space in Ghana, Mozambique, and Cote d’Ivoire?

All warehouse space faces security threats like burglary, vandalism and data breaches. However, many African countries are up against challenges that much of the Western world isn’t.

However, there is good news that can increase security and help alleviate safety concerns. And it comes in the form of logistics parks.

What do you need to have the best security in warehouse spaces in Ghana, Mozambique, and Cote d’Ivoire?

Logistics parks offer more than just warehousing. They are full-service work environments for your employees, clients, and operations. And because they offer 24-7 security solutions, they are the safest ways to do business in West and South Africa.

Here are a few ways that a logistics park can increase your safety and security:

- Walled compound to protect your facility, employees, and products

- Closed-circuit TV recording

- Fire-safety features like sprinkler systems

Additionally, logistics parks provide electricity, internet infrastructure, and custom amenities created to fit your company’s needs. In other words, to have the best security in warehouse spaces in Ghana, Mozambique, and Cote d’Ivoire, you need a logistics park.

What role does technology play in security for warehouse space in Ghana, Mozambique, and Cote d’Ivoire?

The best security for warehouse spaces involves technology. Here are a few examples of security measures that you can add to your logistics park to boost security:

- Security cameras and surveillance system

- Alarm system

- Trained guards

- Inventory tracking as an anti-theft measure

- Security software to prevent data breaches

To obtain the technology and resources for these security measures, you need the infrastructure to support the electrical, personnel, and internet needed to run them. And with the increase in profitable businesses like the automobile industry and solar power throughout Africa in recent years, the infrastructure needed to improve warehouse security is growing.

Improvements to warehousing security in Ghana, Mozambique, and Cote d’Ivoire

With the evolution of the African Growth and Opportunity Act in the United States, warehousing security is improving in Africa. This is especially true in countries like Ghana, Mozambique, and Cote d’Ivoire.

Who is developing improvements to warehousing security in Ghana, Mozambique, and Cote d’Ivoire?

Africa displays strong resilience in the face of its challenges. African economies are competing in the world market, attracting the interest of international investors, and beginning to trade with more countries around the world.

Thanks to these promising improvements, much of sub-Saharan Africa is trending toward economic growth. Companies like Agility Africa who see the region’s potential are providing technical assistance and building logistics parks to increase Africa’s presence in the global supply chain.

What factors drive improvements to warehousing security in Ghana, Mozambique, and Cote d’Ivoire?

The world economy is changing, and Africa wants to be part of it. The desire to increase their presence in the global supply chain is a significant factor that drives improvements to warehouse security.

Logistics parks are also increasing secure warehousing in West and southern Africa. The best parks offer on-site security management and routine perimeter sweeps to ensure the safety and security of the entire company. And as the African infrastructure improves, so will the capacity to make facilities even more secure.

How will improving warehousing security in Ghana, Mozambique, and Cote d’Ivoire impact the African economy?

Improving warehousing security in these nations should have a positive effect in the overall economy. As security improves, more companies will open facilities in the area. Each facility creates jobs, productivity, and innovation. And because more people will be working, the money they’ll put back into the economy will stimulate economic growth.

Best bonded warehousing in Ghana, Mozambique, and Cote d’Ivoire

Bonded warehousing can be difficult to come by. You need security to protect the goods, a strong warehouse receipt system to prove where the goods came from and are sold to, and the land and labor to support the warehouse’s operations. Fortunately, there are bonded warehousing opportunities throughout sub-Saharan Africa.

What is bonded warehousing?

A bonded warehouse stores imported or exported goods without having to pay customs duty or value added tax until the goods are sold to customers.

In other words, bonded warehousing provides a secure facility and logistics control for international goods. And since the logistics company doesn’t have to pay duties up front, it’s a lucrative way to warehouse.

What factors do the best bonded warehouses in Ghana, Mozambique, and Cote d’Ivoire share?

One of the factors is ethics compliance. To successfully compete in the global supply chain, warehouses and logistics parks must set high standards to attract new investors and avoid government scrutiny. When a company is on the up and up, it’s less of a risk for investors to finance their operations.

Additionally, high-end logistics parks have become a key factor in the best bonded warehouses. Logistics parks offer the storage, distribution, and operation capabilities that a bonded warehouse needs to efficiently transport their goods to their customers.

Technology is also a factor. In fact, 64 percent of supply chain executives believe that digitization and robotics are large elements to overcoming the economic recession caused by the COVID-19 pandemic.

Where can you find the best bonded warehousing in Ghana, Mozambique, and Cote d’Ivoire?

Bonded warehousing has become more available in West and southernm Africa in recent years. Land and labor are available in countries like Ghana, Mozambique, and Cote d’Ivoire, and companies are building logistics parks and increasing production in these developing regions.

Logistics parks are the best way to secure your warehousing in Ghana, Mozambique, and Cote d’Ivoire

You need an expert partner when you open warehouse space in southern and West Africa. Agility is that expert! Agility Logistics Parks provide infrastructure, round-the-clock services, and all the facility necessities and amenities to set you up for success.

Visit our website to find out how are flexible solutions fit your needs.

The physical and geographic features of a commercial real estate property determine its value. Rather than listing a long series of features, agents and brokers can summarize this value with a classification system ranging from A to C. At the high end are international-standard Class A warehouses.

More than simply storage buildings, international-standard Class A warehouses are the linchpin in modern, efficient supply chain logistics strategies. Read on to learn more about the characteristics and benefits of state-of-the-art Class A warehouses, the difference between a Class A warehouse and a Class A facility, and how to choose a Class A warehouse.

Characteristics of an international-standard, Class A warehouse

In short, international-standard Class A warehouses are state-of-the-art properties built specifically for warehousing and logistics. They have not been converted or renovated for this purpose. They are designed and built from the ground up to benefit the supply chain.

Before delving further into Class A characteristics, a brief look at other levels might prove helpful. A step down from Class A is Class B. Such a building may be a little older but renovated to have the latest and greatest technology. It will also have lower ceilings than a Class A building and may have multiple floors, which is not ideal for warehousing.

Class D and Class C buildings fall at the low end. They are typically older buildings converted from their original purposes, such as former hangars and manufacturing facilities. They often lack modern amenities, such as climate control and accessibility.

Building specifications and materials

Noncombustible or fireproof raw materials, flexibility, and mobility are essential aspects of Class A warehouse construction. Steel and sealed concrete are the most common structural elements with the possible addition of masonry, plaster, gypsum, or other noncombustible materials. Note that sealing concrete is essential to reduce dust that can cause wear and tear on equipment.

Glass, ceramic or stone tile, and stucco can enhance the aesthetic value of interior and exterior walls. Few people want to work in a bare steel and concrete box.

The warehouse might store a variety of inventory with different storage needs. To accommodate these needs, a Class A warehouse will have ceilings at least thirteen meters high, support columns at least twelve meters apart, and spans of at least twenty-four meters.

And that’s just inside the building—what’s outside is just as important. It must have at least one automatic docking gate for every five hundred square meters of interior space and sufficient outdoor space to maneuver large trucks and for employee parking.

Warehousing innovation

Technology and innovation are increasingly important in warehousing logistics. Four walls, support structure, and a roof are no longer sufficient. At a minimum, a Class A warehouse includes climate control, fire safety features, security monitoring and alarms, high-speed internet, and an electrical substation.

Beyond those requirements, automation is the future. An automated warehouse will include tech-based solutions such as drones that easily reach the highest shelves, robots (or “cobots” that work alongside humans), composite panels that improve the building’s energy efficiency, and more. Smart warehouses make smarter, more agile supply chains.

Location, location, location

The old adage that location is everything in real estate is particularly true with warehouses. Class A warehouses are located at the confluence of airports, railways, ports, and highways for quick access to major domestic and export markets.

Other building classes might not be as ideally located if their region has grown and changed since their construction. For example, industrial facilities built before 2000 are often converted and renovated, but they might be gridlocked within cities that have grown up around them.

Benefits of an international-standard, Class A warehouse

Because Class A warehouses are built specifically to suit a modern supply chain, the benefits are innumerable, ranging from optimized retail logistics to sustainability to safety. A few highlights include reduced carbon footprint and increased efficiency and accuracy.

Reduced carbon footprint

Inefficient heating and cooling systems—such as those you might find in a Class C building—mean high carbon emissions. Just by virtue of being new construction, Class A warehouses have the proper insulation and roofing materials to maximize indoor climate control.

Green warehouse design is also a common feature in Class A warehouses. Such sustainable design might include solar panels for alternative energy, skylights for daytime lighting, LED bulbs to reduce electricity consumption, xeriscaping to reduce water usage, and regionally sourced building materials to reduce transportation-related emissions. Individually and collectively, these features reduce the building’s carbon footprint.

Finally, a prime location reduces transit times and fuel use, giving you both increased efficiency and a reduced carbon footprint.

Increased efficiency and accuracy

Many of the features built into Class A warehouses increase efficiency right from the start. Smart warehouse management can then further reduce warehousing challenges and inefficiencies.

Optimal warehouse layout and layout flexibility, in particular, are huge time savers. High ceilings and wide spaces between columns and spans provide this flexibility. Stacking shelves higher puts related products in closer proximity. Wider aisles give people and equipment more room to maneuver quickly and safely.

Creating and adapting your rack design to your particular workflow ensures optimal movement throughout the space. A flexible layout also allows you to reorganize as inventory changes with supply and demand.

Zoning, both inside and outside the warehouse, is another important aspect of efficiency enabled by Class A space. With more automatic docking gates, some gates can be dedicated to receiving and others to dispatching to reduce traffic jams. Positioning popular products in proximity to dispatch areas gets them to market faster.

And as we all know, haste equals waste. Employees have more time to do their jobs thoroughly and effectively when efficiency is increased. Paired with warehouse automation, errors and waste are minimal.

Class A warehouse versus Class A facility

Unfortunately, building classification isn’t always consistent from market to market, and confusing language sometimes arises. Commercial real estate agents use the Class A designation on a variety of facilities, such as office space, light industrial space, distribution centers, and even warehouse space that doesn’t quite meet the criteria of a Class A warehouse.

In the case of warehouses in particular, distinguishing between these types of buildings is important. A large space dubbed a Class A “facility” instead of “warehouse” might have lower ceilings (at least ten meters instead of thirteen), which reduces options for shelving, and fewer automatic docking gates (one for every seven hundred meters of interior space instead of five hundred).

While these differences may seem small, each amenity can impact effective warehouse management and inventory management. In either case, however, “Class A” designates best-in-class property, and warehousing innovation can happen in a variety of settings.

How to choose a Class A warehouse

The first step in choosing a Class A warehouse is asking yourself and your team the right questions and sharing that information with your internal or external commercial real estate team. Here are just a few of the questions to consider:

- What functions will you perform on this property? Will it simply serve as well-staged storage for your company’s internal use? Will it be a distribution center with order picking, packing, and processing? Will you need co-located manufacturing facilities? Will you need a designated area for office space?

- How much space do you need now and in the next five to ten years? (Remember to plan for your success.)

- What type of inventory will you store and process, and will these goods have specialized storage needs, such as refrigeration or reinforced rack design?

- Do you already have a warehouse inventory management system, or do you need help creating one?

- How will you maximize warehouse efficiency? If you aren’t sure, consider consulting one of Agility’s experts.

- What warehouse technology and automation would be nice to have, and what do you absolutely require to meet your goals?

- What warehouse layout will you need to maximize traffic flow and safely maneuver people and equipment?

- Do you need rack design consultation?

- What location optimally positions your goods for your supply chain needs?

- What security features do you require to protect your assets (people and products)?

- Do you need a bonded warehouse or bonded space within a warehouse to manage dutiable goods?

- What’s your budget? Be sure to factor in how the features and benefits will offset your warehouse space’s costs.

Your answers will help determine the class of warehouse you truly need and prioritize the features and benefits of each promising property identified in your search.

Warehousing solutions simplified

Agility Logistics Parks designs, engineers, and operates the most advanced international-standard warehousing complexes and light industrial facilities in emerging markets. Our flexible solutions are ready. Contact our team to begin your search for an international-standard, Class A warehouse in the Middle East, Africa, or South Asia.

Since the outbreak of the COVID-19 pandemic, companies across virtually every goods-based industry have been re-examining their reliance on China, which accounts for roughly 28% of global manufacturing and is a leading source of critical commodities such as rare earth minerals and ingredients for pharmaceutical products.

The China re-think didn’t start with COVID-19

Well before the pandemic, many companies relying on Chinese producers for finished goods and parts were looking to de-risk by finding alternative suppliers in other countries. Why? Geopolitical tensions, trade disputes, and rising costs in China.

Trade tensions and national security concerns have led to a wave of legislation in the United States, where there are more than 60 bills pending in Congress aimed at changing economic relations with China. In addition, U.S. brands and manufacturers comparing China’s labor costs to those in Mexico have seen China’s labor costs rising faster. That has eroded China’s competitiveness and made Mexico more attractive.

Outward migration of production was underway before the pandemic because tariffs imposed by the U.S. and China had increased supply chain costs by up to 10% for as much as 40% of companies sourcing in China, according to Kamala Raman, a senior director analyst at Gartner.

The U.S., Germany, Japan and other countries have expressed strategic concerns about overreliance on China for critical products: 5G telecommunications gear, semiconductors, steel, cranes, electrical power equipment and more. McKinsey identified 180 different products for which one country — most often China — accounts for more than 70% of the global export market. Many of the products are chemicals and pharmaceuticals.

Intel recently divested itself of a business in politically sensitive memory chips because the business was heavily dependent on China sales. Samsung and others have cited cost considerations for production moves or asset sales.

The pandemic is turning concern to action

China’s assertive response to the pandemic included lengthy, mandatory lockdowns that froze manufacturing and stranded global cargo shipments for several weeks in the spring of 2020. That caused unprecedented disruption in supply chains and led to shortages of everything from household goods and consumer electronics to industrial components and healthcare products.

The pandemic exposed the fragility of sprawling global supply chains. In one recent survey, one-quarter of businesses sourcing from China indicated plans to transition all or some of their operations to other countries over the next three years. In a Gartner survey, an even higher percentage – 33% — said they intend to pull manufacturing or sourcing out of China in the next two to three years. Sixty-four percent of North American manufacturing and industrial professional said they were likely to bring manufacturing production and sourcing back to North America, in a Thomas Publishing survey.

Look for knock-on effects

Any exodus from China will ripple around the world so expect huge and uneven consequences in other markets. The modest movement to other production and sourcing locations has already led to overheated labor markets and infrastructure bottlenecks in other Asian manufacturing countries.

In some cases, the effort to build supply chain resilience is felt most in far off warehousing and distribution hubs, where companies are adding safety stock or shifting from just-in-time inventory to beefed up “just-in-case” models.

Sourcing diversification is altering the flow of goods into U.S. ports. West Coast ports continue to have a lock on ocean traffic from China and serve as the primary gateway for Chinese goods. But now East Coast ports are receiving higher volumes of containerized ocean goods because, in addition to vessels traversing traditional routes from Europe, the Mediterranean and the Caribbean, they receive cargo from Vietnam, Thailand, Malaysia and India, which have found it economical to ship via the Indian Ocean and Suez Canal.

In turn, the shift toward the East Coast has driven up industrial real estate prices along the eastern seaboard of the U.S. as companies scramble to set up distribution hubs and e-commerce facilities.

Japan is pushing an ‘Exit China’ strategy

At least 87 Japanese companies have shuttered production in China, moving it back home to Japan or relocating to Southeast Asian countries in response to incentives offered under the Japanese government’s $2 billion Exit China program. Nikkei Asia says Japanese companies “wary of rising labor costs in China and geopolitical factors had already begun reorganizing production prior to the pandemic.”

Japanese investment in Southeast Asian manufacturing – specifically in Vietnam, the Philippines, Malaysia, Indonesia and Thailand – was already increasing at twice the rate of investment in China.

It’s not just China

Supply chain risk has been rising for years as costly disruptions become regular occurrences.

McKinsey says weather disasters alone accounted for 40 separate incidents involving damage in excess of $1 billion in 2019. Add the risk from trade disputes, retaliatory tariffs — and a doubling of cyberattacks in a single year at a time when companies are increasing their reliance on digital systems.

Geopolitical risk is unavoidable. Today, 80% of trade involves countries with declining stability scores. “Companies can now expect supply chain disruptions lasting a month or longer to occur every 3.7 years, and the most severe events take a major financial toll,” McKinsey says.

Agility’s Take

Economic trauma caused by COVID-19 will initially shrink the universe of suppliers, not expand it. And new layers of protectionism will leave companies with even fewer choices of supply because they will rob efficient producers — in China and elsewhere — of their competitiveness and make them too expensive.

Uprooting from China is not as easy as it seems. Forty years after it began modernizing, China today holds advantages available nowhere else: unmatched scale; abundant skilled and unskilled labor; sophisticated automation, engineering and sciences; world-class infrastructure and logistics; closely synchronized and integrated supplier networks both in-country and across Asia.

Twenty-five years ago, leaving China meant leaving a low-cost manufacturing center. Today, for some multi-nationals, it would mean giving up on the world’s largest consumer market and an economy growing at twice the rate of the United States before the COVID-19 crisis.

Willy Shih, a Harvard Business School professor, says: “There’s a lot of impatience about this supply chain resilience and reshoring. I like to remind people that it took 20 to 25 years for China to capture the supply chain for many products. And if you want to move the supply chain, we’re not talking about something that will happen in a year, or in a couple of years.”

As the World Economic Forum comes to Ha Noi for this year’s ASEAN meeting, we’re reminded of how far Viet Nam has come since the country first hosted the gathering in 2010. Viet Nam experienced over 6% GDP growth last year, but it’s not the only country in the region with a remarkable growth story.

Indonesia, Thailand, Myanmar, the Philippines and Cambodia – countries that all followed in the footsteps of Viet Nam as first-time hosts of WEF’s annual Asian regional meeting – along with others in the ASEAN bloc, are experiencing strong growth too. The 10 member states are expected to generate GDP growth rates between 3% and 8% over 2017-2021.

While the growth of these individual countries is impressive, the real success story belongs to the region. ASEAN has long heeded the connectivity imperative, and the benefits of regional cooperation and economic integration, through initiatives such as the ASEAN Economic Community (AEC), are paying dividends. ASEAN commands a combined GDP of about $2.4 trillion, and GDP per capita has increased by 63.2% from 2007 to 2015. If it were a single country, it would be among the top 10 economic powers in the world. To further drive growth, ASEAN and its six strategic partners will come together in November for the hotly anticipated signing of the Regional Comprehensive Economic Partnership. This will create the world’s largest free-trade area, representing nearly 30% of global GDP, and demonstrates ASEAN’s commitment to removing barriers to trade and expanding market access both within the region and with its partners.

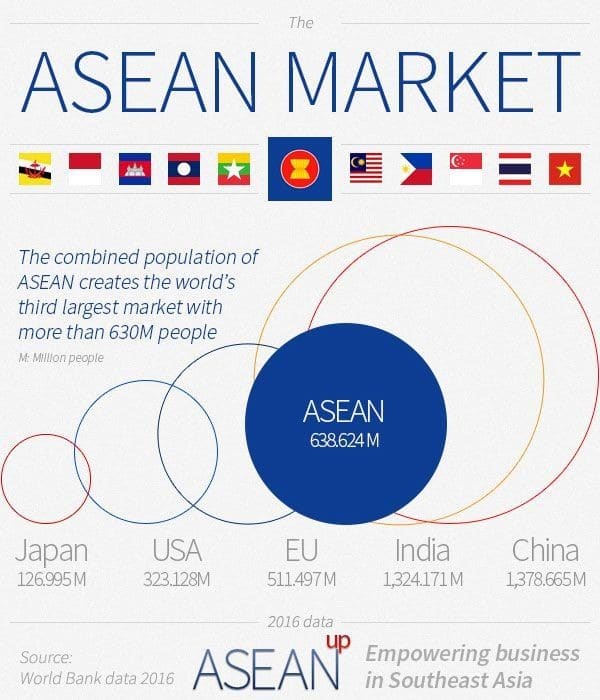

With a population of over 600 million, ASEAN is the world’s third-largest market. It also offers the third-largest labour force, behind China and India, and has some 67 million households that are part of the “consuming class”, a figure that could almost double to 125 million by 2025. Between 2007 and 2014, ASEAN trade increased by a value of nearly $1 trillion. While nearly a quarter (24%) of trade was within the region, this was followed by trade with China (14%), Europe (10%), Japan (9%) and the United States (8%). During the same period, foreign direct investment rose from $85 billion to $136 billion. As nations elsewhere redefine their approach to international trade, one thing’s for sure: ASEAN is open for global business.

Embracing the 4IR

While significant steps have been made to enhance the free flow of goods, services, investments and people, new challenges lie ahead. The technological advancements brought on by the Fourth Industrial Revolution (4IR) are placing new demands on governments and businesses across the region. However, the 4IR also presents great opportunity, if member states can respond to its challenges with speed, flexibility and agility in order to make these new technologies part of its success. Entrepreneurship could play a key role here. SMEs are the backbone of local economies across ASEAN, and often the largest source of local employment across all economic sectors. In countries such as Thailand and Viet Nam, for example, they account for nearly 99% of all registered businesses and employ more than 70% of the workforce. To unleash this potential, the region must ensure that policy reflects the interests of SMEs, affording them the best environment for growth.

E-commerce is a prime example of how 4IR technologies are disrupting traditional sectors. While e-commerce remains relatively underdeveloped in ASEAN today, accounting for less than 1% of total retail sales, this will soon change as internet penetration spreads and the region’s consumer base continues to grow. Given this potential, large local providers such as Lazada and Tokopedia are competing for market share with global players. With SMEs poised to play such a key role in the region’s success, it will be crucial for governments to ensure the internet infrastructure they require is in place, so that entrepreneurs can future-proof their businesses and actively participate in e-trade.

Image: ASEAN Up

4IR technologies are also enabling logistics providers to take supply chains to the next level in terms of speed and accessibility. This is contributing to the rise of e-commerce, but also driving business more broadly across the region. Drones are operating in warehouses, artificial intelligence is automating processes and blockchain has the potential to transform decentralised supply-chain functions. Logistics providers are also offering online freight forwarding platforms that ease the process of doing business for SMEs, both within the region and more globally. Unsurprisingly, global logistics hub Singapore is leading the way in adoption of technologies into the supply chain, through its Smart Logistics initiative.

Taking an agile approach

However, to truly ascend the global value chain, ASEAN needs to look beyond trade facilitation and advancements in technology. In reality, the very 4IR technologies that are driving growth are at the same time disrupting the region’s traditional strengths in low-end manufacturing in the form of automation, robotics and 3D printing.

Have you read?

- These Asian cities are best equipped for the future

- How to power a bright future for ASEAN

- The ‘ASEAN way’: what it is, how it must change for the future

Governments and businesses need agile approaches to upgrade education, R&D, lifelong learning and skills development. This will create the necessary conditions for ASEAN to better close income gaps, create employment, support SMEs, expand the pool of knowledge workers and – ultimately – to rise in global value chains. Therefore, preparing the capable and young workforce for new realities must happen with close coordination between industry, governments and civil society. These will complement the tremendous efforts leaders are already making in supporting cross-border trade and enhancing mobility.

While there is much for the region to consider as it sets its sights on ascending the global value chain, what is clear is that now is the time for ASEAN to shine. The theme of this year’s World Economic Forum summit, ASEAN 4.0: Entrepreneurship and the Fourth Industrial Revolution, could not be a more timely one.

Written by Sushant Palakurthi Rao, Head of Global Partnerships, Agility