UAE, Qatar, Kuwait gain ground in 50-country logistics rankings, along with Jordan, Morocco

DUBAI – February 8, 2022 – Key Gulf economies have inched up the annual Agility Emerging Markets Logistics Index, improving their overall competitiveness, dominating the rankings for best business conditions, and leading most other emerging economies in “digital readiness.”

The UAE (3), Saudi Arabia (6) and Qatar (7) ranked among the top 10 emerging markets in the 2022 Index, which was led by China (1) and India (2). Also performing well: Oman (14), Bahrain (15) and Kuwait (17).

The 2022 Agility Emerging Markets Logistics Index is the company’s 13th annual ranking of the world’s 50 leading emerging markets. The Index ranks countries for overall competitiveness based on their logistics strengths, business climates and, for the first time, their digital readiness — factors that make them attractive to logistics providers, freight forwarders, air and ocean carriers, distributors and investors. The Index includes a survey of 756 supply chain industry professionals.

The UAE out-performed all 50 countries in business fundamentals, an area where Gulf and MENA countries are clear leaders. Others near the top: Saudi Arabia (3), Bahrain (5), Oman (6), Morocco (9), Jordan (10), and Kuwait (12).

The UAE also ranked highest for digital readiness, a new category in the Index. Digital readiness assesses digital skills, training, Internet access, e-commerce growth, investment climate, and ability to nurture startups, as well as sustainability factors such as renewable energy mix, lower emissions intensity and green initiatives.

Top 10 in digital readiness: UAE, Malaysia, China, Saudi Arabia, India, Thailand, Qatar, Indonesia, Chile and Philippines. Kuwait (12) and Oman (15) also ranked highly.

“The connection between a country’s digital capabilities and growth prospects is undeniable,” Agility CEO Tarek Sultan said. “The competitiveness of emerging markets countries will be determined by their ability to develop digitally skilled businesses and talent pools, and find the resolve to lower their emissions in ways that spur growth rather than sacrificing it.”

The importance of digital readiness was apparent in the survey. Logistics executives identified adoption of technology as the leading driver of economic and business growth for emerging markets. The top focus areas for their companies: technology and sustainability.

Most logistics industry executives see moderate-to-strong economic growth and little or no chance of recession in 2022, even without immediate relief from the snarled supply chains and sky-high ocean and air freight rates triggered by the COVID-19 pandemic.

Roughly two-thirds of the 756 industry professionals surveyed for the believe shippers will see cargo rates come down by the end of the year. Eighty-percent see port bottlenecks, air capacity shortages and trucking issues easing by year end.

“The industry’s optimism reflects the fact that emerging economies are getting more resilient and figuring out ways to weather supply chain disruption,” Sultan said. “If emerging markets can get better access to vaccines and give small business a boost, they can help power a broad, dynamic global recovery.”

- China and India, the world’s two largest countries, held their spots at No. 1 and 2 in the overall rankings. UAE, Malaysia, Indonesia, Saudi Arabia, Qatar, Thailand, Mexico and Turkey rounded out the top 10. Vietnam, No. 8 in 2021, fell to 11th, switching places with Thailand. South Africa ranked No. 24, highest ever for a country in Sub-Saharan Africa.

- Powerhouse exporters China, India and Mexico topped the rankings for international logistics. China, India and Indonesia ranked highest for domestic logistics.

- Overall Index rankings for Latin America: Mexico (9), Chile (12), Brazil (16), Uruguay (23), Colombia (25), Peru (26), Argentina, (31), Ecuador (38), Paraguay (41), Bolivia (44), Venezuela (48).

- Index rankings for Sub-Saharan Africa: South Africa (24), Kenya (28), Ghana (32), Nigeria (34), Tanzania (42), Uganda (43), Ethiopia (45), Mozambique (46), Angola (47).

- In the Middle East and North Africa, rankings were: UAE (3), Saudi Arabia (6), Qatar (7), Turkey (10), Oman (14), Bahrain (15), Kuwait (17), Jordan (19), Morocco (20), Egypt (21), Iran (30), Lebanon (35), Tunisia (36), Algeria (37), Libya (50).

- Rankings in Asia: China (1), India (2), Malaysia (4), Indonesia (5), Thailand (8), Vietnam (11), Philippines (18), Kazakhstan (22), Pakistan (27), Sri Lanka (33), Bangladesh (39), Cambodia (40), Myanmar (49).

Transport Intelligence (Ti), a leading analysis and research firm for the logistics industry, compiled the Index.

John Manners-Bell, Chief Executive of Ti, said: “How quickly emerging markets recover from the crisis of the last two years is heavily reliant on the speed of the vaccine rollout, not least from the perspective of social, economic and political cohesion. At the same time, the links connecting these economies with western markets need to be reinstated if shippers are to be integrated back into the global trading system. COVID has meant that shipping has become even more costly, complicated and slower, especially for small and medium-sized businesses. Digitization will play an important role in facilitating frictionless cross-border movements, but in the long run the benefits of globalization will only be shared with emerging markets if supply chains and logistics can be made more resilient in the face of future crises.”

2022 Agility Emerging Markets Logistics Index: https://www.agility.com/en/emerging-markets-logistics-index/

Through the project, the company also reduces GHG emissions by 280 tons

Agility’s investment partner, TVP Solar, announces a partnership with Pepsico on a solar thermal plant in Brazil. The original press release appeared on Business Wire, and is reproduced here.

SÃO PAULO–(BUSINESS WIRE)–PepsiCo, one of the largest food and beverage companies in the world, implemented an innovative project in its Sete Lagoas (MG) snacks operation: a solar thermal plant that captures sunlight and converts it into thermal energy for heating process water. Through this technology, it was possible to reduce natural gas consumption by 140’000 m³ in the unit – which will also reduce greenhouse gas (GHG) emissions by almost 280 tons. This number is equivalent to the planting of almost 18’000 trees.

The thermo-solar plant is made up of high-vacuum solar thermal flat panels, running automatically, without supervision and without the need for cleaning. The first results show that the plant generated about 3.9 kWh/m²/day of thermal energy during the summer months, providing hot water at 60-75°C, even in the dry climate of Sete Lagoas. The energy targets were hit. The water heated by the system is used in several factory processes. “To give an example, we use the water heated by the thermo solar system to cook the corn in our snacks. The difference is that the water is already heated to the process, so we have to use less flame time to reach the temperature we use at this stage of production”, describes Bruno Guerreiro, Sustainability Manager at PepsiCo Brazil.

With the new solar thermal plant, PepsiCo moves towards its global goal of reducing carbon emissions by 40% by 2030 (2015 baseline) and Net-zero by 2040. “It is an important innovation to use thermal energy from the solar plant in the country. With this initiative, we became more sustainable, a premise that is at the heart of the way we do business at the company, continually seeking to evolve towards a Positive Value Chain”, explained Guerreiro. According to him, the solution is scalable and should be implemented in other PepsiCo Brazil plants in the coming years, with even larger areas of solar panels.

The solar thermal plant at the Sete Lagoas site is the result of a partnership between PepsiCo and TVP Solar, a Swiss company specializing in solar thermal technology with state-of-the-art solutions. TVP Solar designs, develops, manufactures and markets high vacuum, mirrorless solar thermal collectors based on patented technology. Solar thermal energy is carbon-free and a cheaper alternative than that generated by liquid fuels.

Piero Abbate, CEO of TVP Solar, highlights that the partnership with PepsiCo is emblematic for the company, because it highlights the importance of solar thermal energy for the food and beverage industry. “We hope this will be the beginning of a long-term collaboration with PepsiCo,” says Piero.

In 2021, PepsiCo announced the launch of the PepsiCo Positive (pep+) platform, which puts sustainability at the heart of how the company creates growth and value, operating within the limits of the planet and inspiring positive change for the environment and people. As a result, sustainability starts to guide the way PepsiCo operates its business: from sourcing ingredients, manufacturing and selling its products in a more sustainable way, to inspiring people to make choices that are better for themselves and the planet. “Our solar thermal plant is another step on our journey towards sustainability. We are constantly evolving in our processes and innovating on several fronts to do our part to contain climate change, reducing greenhouse gas (GHG) emissions throughout our value chain”, said the CEO of PepsiCo Brasil Alimentos, Alex Carretero.

To learn more about the PepsiCo Positive agenda, visit

https://www.pepsico.com.br/sustentabilidade/pepsicopositive.

About PepsiCo

PepsiCo products are enjoyed more than a billion times a day by consumers in more than 200 countries and territories worldwide. PepsiCo generated more than $70 billion in global net revenue in 2020, driven by a complementary food and beverage portfolio that, in Brazil, includes PEPSI®, GATORADE®, QUAKER®, LAY’S®, DORITOS®, RUFFLES®, CHEETOS ®, KERO COCO®, H2OH!®, TODDY® among others. PepsiCo’s product portfolio includes a broad range of food and beverage products, including 23 brands that generate more than $1 billion each in estimated annual sales.

PepsiCo is guided by the vision of Being the Global Leader in Convenient Food and Beverages by Winning with Purpose, which reflects our drive to win sustainably in the marketplace and embed purpose in all aspects of the business. For more information, visit www.pepsico.com.br.

About TVP Solar

TVP Solar SA is a Swiss company which designs, develops, manufactures and markets innovative high-vacuum solar thermal collectors based on patented technology. TVP revolutionized solar thermal, decarbonizing industrial processes in large-scale deployments. TVP has been installed across 9 countries and 3 continents, supplying carbon-free renewable heat, the cheapest thermal energy cutting OPEX and CO2 emissions, while securing energy supply. For more information please visit: www.tvpsolar.com

Agility unit will provide upstream camp support for Total Energies’ Tilenga project

DUBAI – January 24, 2022 – GCC Services, a leader in integrated remote site services, has been selected by international engineering and construction giant McDermott to provide camp services for the Tilenga Project Upstream Facilities in the Lake Albert Basin of Uganda.

GCC’s work, to take place over 6 years, begins in February and is to include camp management, catering and camp support services for an international and local workforce that is expected to peak at 3,500 workers.

The Tilenga project, under the overall operation of Total Energies, is the centerpiece of oil projects projected to bring investments of over $10 billion to Uganda and Tanzania. It will eventually have the capacity to process 190,000 to 700,000 barrels of oil a day.

“We understand the importance of this project to Ugandans and their future. We’ve been operating in Uganda since 2010, so we have a strong reputation there and an understanding of the market,” said GCC Services CEO Rashad Sinokrot. “Our local presence, international footprint and record of performance on critical energy projects were defining elements of our winning proposal.”

Sinokrot said GCC is planning “significant local engagement” that will include training and upskilling of the local workforce, as well as support and development of local vendors and suppliers, including farmers in the region.

GCC has extensive experience as a provider and manager of services for large, complex projects in remote, hard-to-reach areas and conflict zones. In Papua New Guinea, GCC managed camp facilities at multiple locations, serving more than 22,000 workers on the country’s massive LNG project. As a supply chain and procurement specialist, GCC also has served as the food-supply contractor for peacekeeping forces in Africa and elsewhere.

Total Energies, the overall leader of Uganda’s Tilenga project, has pledged to act transparently in its development of the oil and gas resources of the Lake Albert region. The company has made commitments to use the highest international standards in land acquisition, consult with local communities, protect sensitive natural areas, and generate a “positive net impact on biodiversity” in the region.

During construction, the Tilenga project and related EACOP pipeline build are expected to generate 58,000 direct and indirect jobs, 2.1 million hours of training to build local skills, and $1.7 billion worth of work for local companies, Total Energies says.

About GCC Services

GCC Services, based in Dubai, is an integrated remote site services company operating in more than nine geographic locations. It serves energy, mining, peacekeeping, NGO, defense and government customers, and others, providing catering, camp management, construction, and logistics and supply chain services. GCC provides skilled and unskilled manpower, as well as facilities management, utilities and environmental services for complex, capital-intensive projects.

KUWAIT – December 1, 2021 – Agility Chairperson Henadi Al-Saleh signed the Women’s Empowerment Principles, designed to advance gender equality in the workplace and community. Agility is working to recognize and foster female talent and participation across its businesses and investments. Established by UN Global Compact and UN Women, the WEPs are informed by international labour and human rights standards and grounded in the recognition that businesses have a stake in, and a responsibility for, gender equality and women’s empowerment.

“Agility’s goal is to provide equal opportunities, as well as the supporting infrastructure that allows women to succeed,” said Al-Saleh. “We believe that empowering talented people with diverse experience makes for better companies and stronger communities.”

Dubai, UAE, 29 November 2021 – National Aviation Services (NAS), the fastest growing aviation services provider in emerging markets, will now provide best-in-class line maintenance services to airlines at the two international airports in Dubai and Sharjah. Through a partnership agreement with Global Jet Technic (GJT), one of the leading independent providers of maintenance solutions in the Gulf region, NAS will offer comprehensive line maintenance services approved under the European Union Aviation Safety Agency (EASA) certification.

Lukas Skorupa, Group Chief Commercial Officer, from NAS Group said, “We are delighted to collaborate with Global Jet Technic who is known for quality and reliability. NAS offers high quality systems and procedures on par with the best international standards that include the latest Safety Management Systems. With NAS’s record of accomplishments, GJT is the perfect partner for us to deliver our line maintenance services to airlines in Dubai and Sharjah. We look forward to working together and delivering quality, excellence and safety to ensure a seamless experience for airline customers.”

With a presence in more than 55 airports across the Middle East, Africa and South Asia, NAS has been serving over 100 airline customers across its network, including five of the world top ten airlines as well as key aviation hubs. This includes ground handling, passenger handling, ramp, engineering and line maintenance, alongside lounge management, meet and assist services, innovative technology solutions, travel solutions and aviation training.

Global Jet Technic, approved by the UAE General Civil Aviation Authority (GCAA) currently operates line maintenance stations at Dubai International (DXB) and Sharjah Airport (SHJ) in the UAE. GJT’s capabilities include handling a wide range of aircraft types. The company’s skilled engineers and technicians are trained on operational procedures of contracted airlines and are geared towards delivering unified services to customers.

Capt. Khamis Al Kaabi, Chairman, of GJT highlighted, “In line with the vision of GJT to expand outside the UAE and bring its quality services and technical expertise to customers in the region, GJT is partnering with NAS, to tap into the potential that the wide network NAS can provide.”

GJT and NAS will offer standard pre-flight inspections, daily and weekly checks for a variety of aircrafts. NAS contributes its experience and expertise in line maintenance while GJT will offer local line maintenance proficiency, airport facilities and resources to the partnership.

| Q3 2021 (Million KD) | Q3 2020 (Million KD) | Variance (%) | 9 months 2021 (Million KD) | 9 months 2020 (Million KD) | Variance (%) | |

| Revenue | 124.5 | 97.5 | 27.7% | 344.7 | 292.4 | 17.9% |

| Net Revenue | 65.8 | 50.6 | 30.2% | 185.8 | 161.4 | 15.1% |

| EBIT | 19.6 | 18.4 | 6.6% | 59.7 | 47.1 | 26.7% |

| Net Profit | 926.9 | 15.3 | 5952.4% | 978.1 | 31.5 | 3002.7% |

| EPS (fils) | 440.34 | 7.27 | 5957.0% | 464.67 | 14.97 | 3004.0% |

KUWAIT – November 14, 2021 – Agility, a leader in supply chain services, innovation and investment, today reported third quarter 2021 earnings of 440.34 fils per share on net profit of KD 926.9 million, an increase of 5,952.4% over the same period in 2020. EBIT increased 6.6% to KD 19.6 million, and revenue grew 27.7% to KD 124.5 million. Adjusted for revaluation impact of investments measured at fair value through profit and loss, net profits from continuing operations increased 17.1% to KD 12.7 million from same period in 2020.

For the first nine months of 2021, earnings were 464.67 fils per share on net profit of KD 978.1 million, an increase of 3,002.7% over the same period in 2020. EBIT increased 26.7% to KD 59.7 million, and revenue grew 17.9% to KD 344.7 million. Adjusted for the revaluation impact of investments measured at fair value through profit and loss, net profits from continuing operations for the nine months stood at KD 35.9 million an increase of 45.3%.

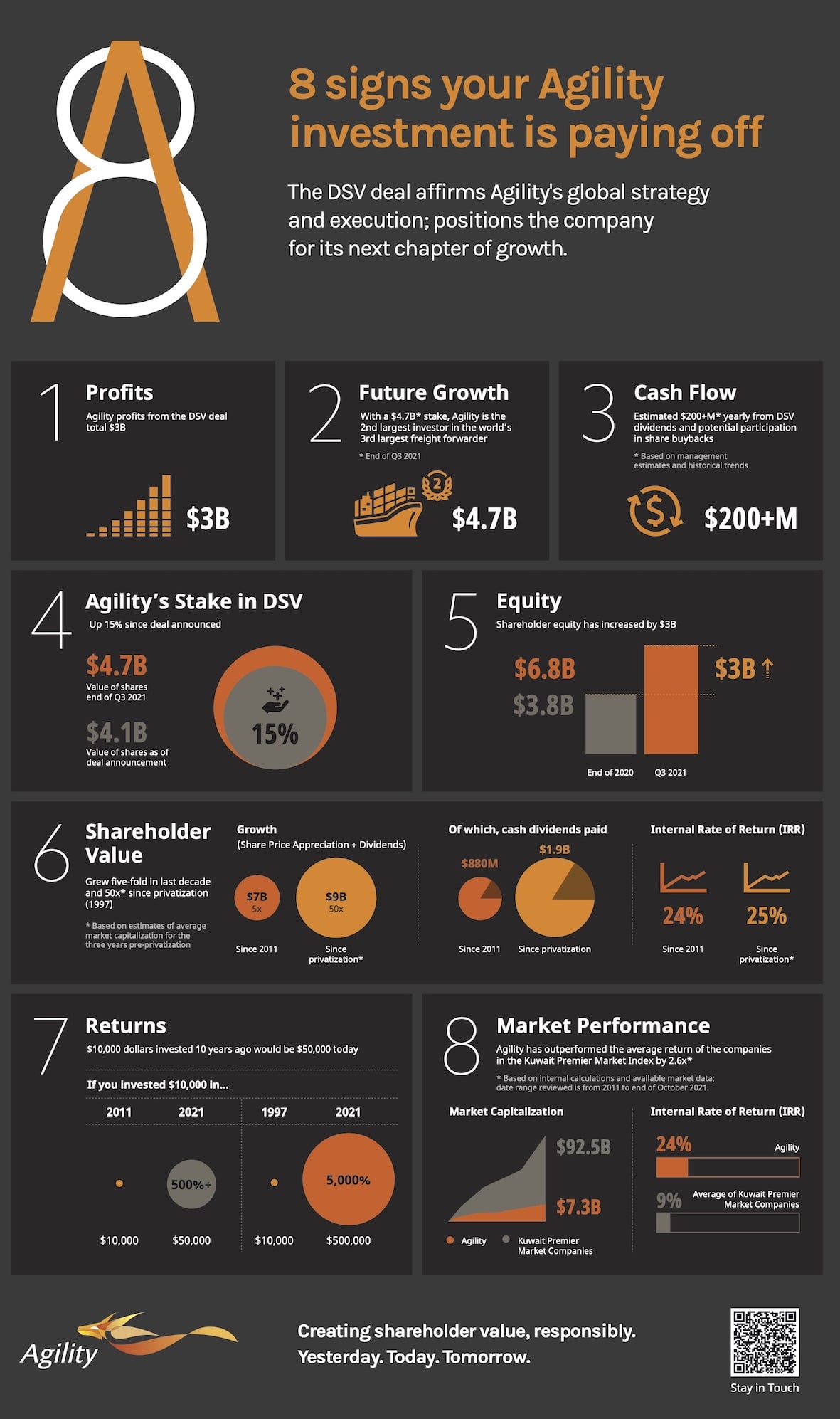

Agility’s profit from DSV deal

For Q3, Agility reported an exceptional gain stemming from the sale of its Global Integrated Logistics unit to DSV in exchange for shares in DSV. The profit from discontinued operations that GIL reported in Q3 was KD 918.4 million and for the nine months was KD 952.8 million.

“Agility has consistently created shareholder value, which has grown fifty-fold[i] with an internal rate of return of 25% since privatization in 1997. Over the past decade, we were able to grow shareholder value five-fold[ii] and generated a 24% internal rate of return (IRR), outperforming the average return of companies on the Kuwait Premier Market Index by 2.6 times[iii],” said Tarek Sultan, Agility Vice Chairman and CEO.

“We believe our best days lie ahead though,” Sultan said. “We still own and operate the businesses that have historically generated 80% of Agility profits. Our stake in DSV has already appreciated 15% since the sale was announced in April, and we expect a return of an estimated $200m a year in cash through dividends and participation in DSV’s share buy-back program[iv]. Looking to the future, we are investing in high-growth markets, industries, and technologies.”

Agility’s Stake in DSV

In August, Agility finalized the sale of GIL to DSV in exchange for an 8% stake in DSV (19.3 million shares of DSV common stock). The deal makes Agility the second-largest shareholder in DSV, which is the world’s third-largest freight forwarding company.

“In building GIL, we demonstrated that we had a unique vision and the ability to turn that vision into a successful, global business that created value for our shareholders. DSV’s acquisition of GIL is an affirmation of Agility’s ability to build, nurture and monetize businesses at a global scale,” Sultan said. “The sale of GIL to DSV has already generated returns for Agility shareholders. From a strategic standpoint, it allows Agility to maintain global reach and market access to an attractive and growing supply chain industry,” Sultan said.

Agility’s stake in DSV will be reported, as per IFRS 9, as financial asset at fair value through other comprehensive income, and will replace GIL’s equity value on the balance sheet. As of the date of closing, the difference between GIL’s equity value and the fair value of Agility’s DSV stake was booked as a one-time, non-cash gain from disposal of discontinued operations.

Agility’s Infrastructure Companies

Agility’s Infrastructure portfolio of companies, the main drivers of the company’s profitability in recent years, continue to perform strongly.

Agility Logistics Parks’ (ALP) performance has been in line with 2020 results. Demand for warehousing space continues to grow. ALP is both optimizing its existing land bank and growing its supply of available land to meet customer demand. Operations in Kuwait, Saudi Arabia and Africa are strong, and ALP is looking for new markets to achieve additional growth.

Tristar, a fully integrated liquid logistics company, posted a 26.5% increase in revenue for Q3. This performance is driven by strong recovery in international oil prices, good performance in the Road and Transport segments, and favorable dry bulk charter rates in the Maritime segment. We expect this strong performance to continue into the fourth quarter.

National Aviation Services (NAS) reported 77.6% growth in Q3 revenue. NAS’s performance reflects a major recovery in aviation and increasing passenger and cargo volumes across NAS’s network. NAS’s development of pandemic-related technology platforms and applications, intended to help aviation and health authorities facilitate safe travel, have been highly profitable. New businesses and the addition of operations at Baghdad and in the DR Congo and South Africa have also been profitable and positive contributors.

United Projects for Aviation Services Company (UPAC) experienced an 11% increase in Q3 revenue compared with the same period in 2020. The increase was primarily the result of higher revenue from airport-related services and parking following a gradual increase in traffic and the phased Q3 opening of operations and facilities at Kuwait International Airport. That said, UPAC revenue continues to be affected by pandemic-related travel restrictions that remain in place and constrain passenger traffic. UPAC continues to take measures to reduce the pandemic’s impact on its business. Amid a successful vaccination campaign in Kuwait, UPAC operations have begun to show steady signs of recovery. UPAC anticipates gradual growth in aviation traffic in Q4 2021 and into 2022.

UPAC reports that construction of Abu Dhabi’s Reem Mall is more than 90% complete. The mall, on Reem Island, will contain 2 million square feet of retail, leisure, dining, and entertainment choices. It will feature the region’s first fully integrated omni-channel retail ecosystem with fully enabled digital, e-commerce and logistics capabilities. Reem will be home to the world’s largest snow play park, Snow Abu Dhabi.

At Global Clearance House System (GCS), Agility’s customs digitization company, Q3 revenue grew 48.6%. The increase was driven by higher trade volumes and initiatives implemented by the company to spur growth.

Recap of Agility Q3 2021 Financial Performance

- Agility’s Adjusted Net Profit from continuing operations increased 17.1% to KD 12.7 million from 10.8 million a year earlier.

- Agility’s EBIT increased 6.6% to KD 19.6 million.

- Agility’s Revenue increased 27.7%, to KD 124.5 million and Net Revenue increased by 30.2%.

- Agility enjoys a healthy balance sheet with KD 3 billion in assets including KD 1.4 billion of DSV shares. Net Debt for continued operations stood at KD 305.4 million as of September 30, 2021. Reported operating cash flow was KD 127 million for the third quarter of 2021 an increase of 10.2% from same period last year.

The World Economic Forum, in partnership with US Special Presidential Envoy for Climate John Kerry, announced the First Movers Coalition – a new platform for companies to make purchasing commitments that create new market demand for low carbon technologies. Agility is a founding member of the First Movers Coalition.

The commitments aim to be collectively significant enough to commercialize decarbonization technologies. The First Movers Coalition will create long-term impact by driving milestones this decade through investment into these technological solutions.

Read the full press release: weforum.org/press/2021/11/first-movers-coalition-launched-to-drive-demand-for-zero-carbon-tech-70b0384c82

Logistics park facilities in Kuwait to be equipped with latest ICT technologies

KUWAIT – October 31, 2021 – Agility, a leader in supply chain services, innovation and investment, has signed a memorandum of understanding (MoU) with Huawei, a leading provider of information and communications technology and infrastructure, to develop solutions for smart campus services at Agility Logistics Parks (ALP) facilities in Kuwait and other locations.

The agreement was exchanged by official representatives from both Agility and Huawei sides, and represents the first step towards equipping ALPs with centralized information and communications technologies (ICT) and services that can transform ALPs into smart industrial campuses.

Smart campuses use next-generation technologies such as Artificial Intelligence (AI) among others that will improve operational efficiency; enhance cybersecurity and physical security; and optimize movement of goods.

The agreement includes evaluation of technologies and systems that will help manage visitor management and vehicle entrances; create “smart streets” covered by WiFi; and improve safety at the ALP complexes.

ALP and Huawei teams will work to identify the requirements for solutions and innovations that will best optimize operations at each facility. ALP aims to increase management efficiency, decrease operational costs, present customers with a better service experience, and provide stronger security while generating less energy waste. Agility has commenced implementing these technologies at its logistics park in Mina Abdullah.

Nader Sakeen, CEO of ALP Kuwait and GCC, said:“Working with a leader in ICT technologies will give ALP an edge and enable us to provide customers with unparalleled services at our facilities. Agility’s goals are in line with the ‘New Kuwait’ 2035 vision, which aims to boost Kuwait’s industrial, logistics, crafts and workshops sectors by providing the right business landscape and ecosystem.”

“Sustainability is an integral part of our strategy and is an essential element in the design of our facilities. We design our facilities to help lower energy costs and reduce waste. We’re not only building for Kuwait and its industrial sector, but we’re also trying to build a more sustainable future for the next generation. We’re excited about the partnership with Huawei as we build future smart facilities in Kuwait and in the region,” Sakeen said.

The Huawei Smart Campus solutions help make commercial and industrial complexes secure, comfortable, efficient, and green. The company’s technologies focus on digital security, smart property management, and smart offices.

Liam Zhao, CEO of Huawei Gulf North, said: “We are proud to have the opportunity to support a leading supply chain services company such as Agility with our world-class smart city solutions. As smart cities are a priority for Kuwait’s national agenda, Huawei is committed to doing all it can to support achieving the nation’s vision by empowering enterprises through our advanced solutions to further drive the country’s digital transformation journey.”

Agility Logistics Parks is a world leader in the design and construction of logistics parks and warehousing solutions. Logistics warehouses provide essential infrastructure required for both multinational companies and local businesses that need storage, distribution, packaging, processing and light manufacturing space.

ALPs offer ambient and air-conditioned warehousing; freezers and chillers; asphalted container-storage yards; and racked warehousing. In addition, Agility’s warehouses meet international environmental standards and feature eco-friendly construction materials, using energy-efficient roof and side-insulated panels, wind-driven roof fans, skylights for natural lighting, along with LED and energy-saving light fittings.