Mobility ecosystems are transitioning as economies recover and move to zero-emission road transport by 2030. The aim of this session is to enhance global collaboration on the path to inclusive and sustainable mobility recovery.

The economic damage and costly business disruption brought on by the global spread of the COVID-19 virus have failed to slow the gathering momentum behind environmental sustainability and the array of efforts to battle climate change.

After decades of doubt on the part of business leaders, sustainability is delivering ROI. Businesses, investors, consumers, governments and others see it as a source of post-pandemic resiliency, efficiency and competitive advantage. Why is it proving durable now?

1. A green recovery could be a stronger one

“A low-carbon recovery could not only significantly reduce emissions, but also create more jobs and economic growth than a high-carbon recovery would,” McKinsey says.

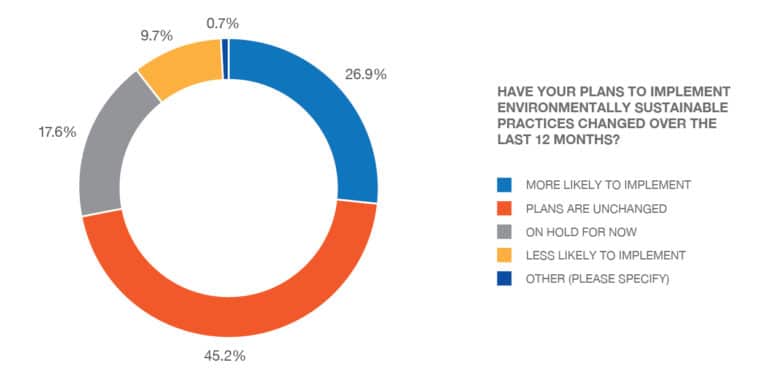

Many industries are doubling down on sustainability investments. Few are backing off. In an Agility survey of 1,200 global supply chain executives, 72% of respondents said their companies will maintain or increase their environmental sustainability commitments coming out of the pandemic.

Want more proof? In May, the International Energy Agency slashed its forecast for the amount of renewable energy capacity to be added worldwide in 2020. But by year’s end, the IEA was forced to backtrack.

“The renewables industry has adapted quickly to the challenges of the COVID crisis. We have revised the IEA forecast for global renewable capacity additions in 2020 upwards by 18% from our previous update in May. Supply chain disruptions and construction delays slowed the progress of renewable energy projects in the first six months of 2020. However, construction of plants and manufacturing activity ramped up again quickly, and logistical challenges have been mostly resolved with the easing of cross-border restrictions since mid-May,” the IEA says.

2. Investors want more

Global asset managers want in on sustainability. In 2020, they poured more than $5 billion into so-called blank-check companies created to invest in businesses that are driven by environmental, social or governance (ESG) principles or formed to bring ESG ideas to market.

“Capital markets are wide open for investment in green businesses in a way that they’ve never been before: Interest rates are at historical lows, technology costs have fallen, and financial regulators are beginning to nudge investors, so the risk-reward equation is beginning to shift,” says Dickon Pinner, who leads McKinsey’s global Sustainability practice.

There were 20 ESG-focused blank-check companies — also known as Special Purpose Acquisition Companies (SPACs) – launched last year, according to Pitchbook. (Agility said in January that it invested $35 million in Queen’s Gambit Growth Capital, a blank-check company that will target businesses offering sustainable solutions in clean energy, healthcare, financial technology, industrials, mobility and emerging technology.)

3. It’s a culture thing now

A report by SAP and media firm Which-50 indicated a “strong shift to sustainability” among the corporations tracked by consultants and research firms such as BCG, Gartner, Juniper and Forrester.

“Sustainability has shifted from a discussion largely driven by compliance to one at the centre of business strategy,” says Which-50.

Companies are taking aggressive steps to stay ahead of the pack. VF Corp., parent of Timberland, North Face and Vans brands, is one of many companies drilling deeper into their own supply chains. VF’s traceability mapping gives the company a view of its tier 1 through tier 4 suppliers. In a show of transparency, VF has posted 46 of 100 anticipated product maps online.

4. Businesses can’t afford to be out of step with consumers

In a recent survey of European consumers, 57% of respondents said they had made significant changes to their lifestyles to ease the environmental impact. More than 60% said they were taking steps to recycle and buy products in environmentally friendly packaging.

“Consumer behavior and changing tastes are all moving in the direction of sustainability and adding pressure on companies and brands to do the same,” says Mohammed Esa, Agility GIL’s Senior Vice President of Global Business Development. “Social media plays a big role because it gives consumers a much bigger voice than they ever had.”

5. There is competition … and cooperation

Thousands of companies have announced ambitious goals. Apple, for instance, vows to be carbon-neutral by 2030.

Fifty-three companies signed the Climate Pledge, co-founded by Amazon, committing to getting themselves to net-zero carbon emissions by 2050 – 10 years ahead of the Paris Agreement. The pledge requires them to adopt rigorous reporting, cut emissions and neutralize remaining emissions with credible offsets. Climate Pledge signatories include Microsoft, IBM, Johnson Controls, Unilever, Canary Wharf Group, Uber, Henkel, Siemens, Mercedes-Benz, Infosys, Real Betis, Daabon Group,

Another group has promised to share best practices for achieving net-zero emissions. The Transform to Net Zero initiative includes Maersk, Danone, Mercedes-Benz, Microsoft, Natura & Co., Nike, Starbucks, Unilever, and Wipro. The initiative makes business plans and other resources available online.

6. Technology is making it easier

TextileGenesis, based in Hong Kong and India, is one of many apparel companies adopting blockchain so it can track the sourcing of raw materials through to production and shipment of finished garments.

The fashion and apparel industry is moving to introduce sustainable materials such as recycled cotton, lyocell (made from wood pulp) and viscose (made from wood) in place of less environmentally friendly fibers like polyester and nylon, which contain petroleum, coal and chemicals. Blockchain would help apparel manufacturers source, track and certify their use of the new materials.

Piramal Glass, an Indian company that makes bottles and glass packaging for the pharma, cosmetics and perfume industries, is using blockchain to get supply chain transparency and auditability.

Another important advance is the use of digital or virtual twinning.

The flood of data available from the Internet of Things (IoT) and cloud computing makes it possible and cost effective to create digital “twins” that model and simulate processes with potential to deliver environmental benefits.

“This pairing of the virtual and physical worlds allows analysis of data and monitoring of systems to head off problems before they even occur, prevent downtime, develop new opportunities and even plan for the future by using simulations,” says Forbes.

The Port of Rotterdam is using digital twinning to model automation, design and sustainability features that are part of its push to become “the world’s smartest port.” Twinning gives port planners the ability to virtually test use of autonomous ships, “digital handshakes” for documentation exchanged between vessels and the port, and emissions-lowering port call practices.

Without digital twinning, port officials would have no way to test the transformational processes without disrupting operations at a sprawling port that handles 8.8 million containers and 15 million twenty-foot equivalent units a year.

“In a virtual environment, we can verify and validate solutions before the real tests begin, maturing solutions much faster. We also don’t have the safety risks or hazards we would in real-life tests and that’s why this digital environment is better and faster for development and validation work,” says Karno Tenovuo, CEO of Awake.AI, the Finnish company that is Rotterdam’s smart-port development partner.

Tenovuo says ports will able to lower CO2 emissions 10% by adopting the features and optimization methods that will be harnessed in Rotterdam.

7. The ocean industry is racing to catch up

Slow to embrace sustainability, the maritime logistics industry is now an area to watch.

Leading container lines and ports are working on standards for a just-in-time port call process that would eliminate wasteful delays and dwell times. JIT port calls would allow ships to optimize steaming speed, lower fuel use, cut CO2 emissions, and avoid getting stranded outside ports waiting for berthing slots.

Singapore’s futuristic Tuas port is being built to handle 65 million TEUs a year. By consolidating existing container-handling facilities at a single location, Singapore will cut inter-terminal trucking hauls and emissions. Reused and recycled materials make up half of the land reclamation work, and the port is moving sensitive coral colonies that would have been damaged by the construction.

Maersk, the world’s largest container line, is accelerating development and deployment of the world’s first carbon-neutral container ship. Maersk says the vessel, a smaller ship known as a feeder, will run on biomethanol, made from paper-mill waste and other byproducts. It will join the Maersk fleet in 2023.

RightShip, a maritime risk-management company, created a ratings system to compare the efficiency of different cargo ships, along with operational performance used to score ships on safety. RightShip ratings allow shippers to choose vessels with lower CO2 footprints, better fuel efficiency, and higher safety ratings.

8. There are carrots to go with sticks

European Union companies that rely on imports from South Asia are promising broader market access, training and gap assessments for Sri Lankan exporters whose products can meet international sustainability standards.

The initial group of Sri Lankan companies are providers of rubber, apparel and food products, but a German and EU business delegation has agreed to help Sri Lanka extend the project to its critical tourism sector.

Banks and venture capital firms are offering preferential terms to companies that agree to meet environmental criteria, such as reporting CO2 emissions and implementing emissions-reduction strategies.

9. The sticks are real

In early 2020, BlackRock, the world’s largest asset manager, notified hundreds of listed companies in its portfolio that it had started to factor environmental issues and performance into its investment decisions.

A year later, BlackRock told its own investors that it had voted against the management of 53 companies – including some of the biggest global names in manufacturing and industrial supply – because those companies failed to “make sufficient progress regarding climate risk disclosure or management.”

Too many companies still rely strictly on internal data to get a picture of their supply chains. To strengthen their post-pandemic supply chains and drive sustainability, many realize they need to exchange data with suppliers and customers.

10. There’s nowhere to hide

Seventy-percent of shippers look at sustainability as part of RFPs, and more are requiring their vendors to report on sustainability metrics on a regular basis. They want to know about fuel efficiency; CO2 emissions; alternative fuel use; personnel & staffing devoted to sustainability; and fleet age.

Climate TRACE, an alliance of climate research groups, is close to launch of an initiative that will track and publish greenhouse gas emissions traceable to individual factories and ships.

“Our work will be extremely granular in focus – down to specific power plants, ships, factories, and more. Our goal is to actively track and verify all significant human-caused GHG emissions worldwide with unprecedented levels of detail and speed,” the alliance founders say.

Climate TRACE will give business leaders, investors, NGOs and climate activists a powerful tool “while ensuring that no one – corporation, country, or otherwise – will ever again have the ability to hide or fake their emissions data.”

Environmentally conscious businesses often ask a critical question: What are green supply chain practices, and what’s the first step to developing a more sustainable strategy? Green supply chain practices incorporate sustainability concepts into traditional supply chain management. The goal is to help industries reduce their carbon emissions and minimize waste while maximizing profit. Every area of the supply chain has room for green improvements—from manufacturing and purchasing to distribution, warehousing, and transportation.

Wondering how to get started? Agility can help. We’re a leader in building green supply chains, with a commitment to helping our customers achieve their sustainability goals. In this article, we’ll cover the fundamentals of achieving a greener supply chain, why it matters, and how you can do your part to drive change.

Importance of implementing green supply chain practices today

Green supply chain management (GSCM) practices offer substantial benefits for the environment. For one, striving for supply chain sustainability by using less energy reduces carbon dioxide (CO2) emissions and other air pollutants. Produced by activities ranging from industrial work to operating vehicles, CO2 is one of the main greenhouse gasses responsible for global warming. According to the US Environmental Protection Agency (EPA), CO2 emissions have increased by nearly 90 percent since 1970. And already, climate change has impacted diverse industries that rely on natural resources—from commercial fishing to forestry. By making the switch to more sustainable practices, businesses can do a lot to slow or stop global warming and ensure a bright future for our planet.

In addition, green supply chain practices reduce waste and conserve nonrenewable resources. For instance, when businesses choose recycled paper products instead of plastic, they keep trash out of landfills and fragile ecosystems while also reducing their reliance on petroleum-based products. When they load trucks more efficiently and institute stricter policies for driving speed and idling, they use less fuel. And when they abide by the principles of sustainable agriculture and sustainable forestry, they conserve resources for future generations. In short, implementing GSCM practices is not just important for the health of our environment. It’s critical for sustaining industries and communities into the future.

How implementing a green supply chain can save you money

A fundamental principle of green supply chains is reducing waste and overall energy use. Needless to say, this can lead to big cost savings. According to Inbound Logistics, the office supply retailer Staples saved $3 million in fuel annually, simply by asking its delivery drivers to slow down. By limiting top speed to sixty miles per hour, Staples reduced its fleet’s fuel efficiency from 8.5 miles per gallon (mpg) to 10.4 mpg, equating to 20 percent less fuel. Other ways of using GSCM practices to improve environmental performance and reduce costs include:

-

Rethinking your materials:

Using recycled materials during the manufacturing process can save money. For instance, it’s now possible to convert waste plastic into 3D printing filament, which manufacturers can use to create new products at lower costs than new plastic. While testing new materials to ensure they meet safety and performance standards takes time, the payoff could be worthwhile. -

Reusing waste or by products:

Think creatively about what your company is throwing away—whether that’s at the manufacturing stage or during distribution. It’s possible to reuse waste you’d otherwise discard or even unlock new revenue streams from recyclable materials. For instance, some food manufacturers supply local farmers with organic waste to use as fertilizer. And with closed-loop recycling, manufacturers can turn recycled products made of materials like glass or metal into the same products without sacrificing quality. So it may be possible to salvage excess materials or broken products from the manufacturing process and use them to make new goods. -

Cutting back on packaging:

Switching to streamlined packaging uses less materials and can lead to lower costs. In addition, a more efficient package design could make it possible to ship more units in the same cargo space, lowering transport costs and reducing greenhouse gas emissions. -

Reducing risk to your business:

Unsustainable practices inevitably have an end date. When businesses don’t plan for the future, they can find themselves without a cost-effective supplier if environmental or socioeconomic issues cause disruptions to the supply chain. Proactively planning to adopt supply chain practices that are both smarter and greener can help you prepare for a future in which your former practices are no longer feasible. A great example of this is how sustainable forestry helps preserve woodlands for ongoing use, as opposed to clear-cutting trees. -

Redesigning your processes:

Have you considered ways that technology could streamline your manufacturing processes or other areas of your operations? Small changes that boost efficiency can lead to big energy and cost savings down the line. For instance, Nike famously used a new kind of knitting technology to reduce labor and materials for a greener, more cost-effective sneaker. Even boosting your team’s productivity by a marginal amount could reduce equipment operation time and lead to less energy use. -

Optimizing transport:

Streamlining your transportation logistics offers many ways to save money and shrink your carbon footprint. For instance, you could use load-planning software to not only make logistics planning easier but utilize cargo space more efficiently and reduce the number of trips you must make to transport your products. In addition, making the change from primarily using air freight to shipping goods via another method, such as ocean freight, is better for the environment and easier on your bottom line.

How implementing a green supply chain can improve your public image and marketing

Today’s consumers value companies that make the effort to go green. In fact, Boston Consulting Group found that 70 percent of consumers are willing to pay a 5 percent price premium for sustainable goods. After all, green supply chain practices don’t just help to preserve the planet for future generations. They make communities better now, in part by reducing emissions that impact air quality and worker health. And as consumer values shift, demand for green products will keep growing. According to the US Small Business Association, four out of five consumers buy environmentally friendly products and services.

What does that mean for you? For one, communicating your green values could boost your public image and marketing efforts, helping you win over customers who are looking for sustainable solutions. For two, opting not to get on board with the demand for green supply chain practices could ultimately harm your brand. As we collectively seek solutions for pressing climate issues, environmental consciousness is growing. Overhauling your supply chain practices now will help ensure your company stays at the forefront of positive change.

Types of green supply chain practices

6 practices for a more sustainable supply chain

Green supply chains use ethical and environmentally sound practices at every stage, with the goal of reducing air, water, and waste pollution. Needless to say, designing a sustainable supply chain requires different practices at each leg of your product’s journey from initial concept to your customer’s home:

-

Green purchasing:

Green purchasing, which means finding suppliers with environmentally sustainable products and services, is just as important as greening your own operations. After all, sourcing your materials sustainably is the foundation on which the rest of your supply chain rests. For some brands, seeking recycled or remanufactured materials is the way to go. Others will need to find sustainably harvested raw materials, such as lumber from suppliers that take steps to conserve wildlife habitat. -

Green manufacturing:

Green manufacturing focuses on using fewer nonrenewable natural resources, reducing pollution and waste, and keeping emissions to a minimum, among other green practices. The most critical component of going green at this stage is reducing energy use. Everything from powering equipment and lighting to keeping your factory warm or cool requires significant energy output. Fortunately, alternative energy sources like hydropower, wind energy, solar energy, and biofuels can help reduce your reliance on fossil fuels. Newer manufacturing technologies and even changes as simple as installing light-emitting diode lights can also make a big difference in your energy usage. -

Green packaging:

Green packaging considers every phase of a package’s life cycle. That includes everything from how your supplier sources materials to how consumers dispose of the packaging. Using boxes and packing materials made of postconsumer recycled materials is a good start. You’ll find many varieties of recycled paper and corrugated cardboard filler on the market. Another option is biodegradable packing material. Made of everything from corn to mushrooms, this material will easily decompose in consumers’ gardens—or in a landfill, if it comes to that. Which leads to another point: it’s important to instruct consumers on how they can recycle packaging. Don’t expect your customer to know that those cornstarch packing peanuts are dissolvable in water and compostable in the backyard. -

Green warehousing:

Green warehousing focuses on ensuring warehouses run more efficiently, reducing waste and energy use. One big challenge is that warehouses grow obsolete quickly. Logistics Management reports that about 11 percent of US warehouses are over fifty years old, and just 4 percent have construction dates more recent than 2008. Older warehouses tend to be less energy efficient, leading to more CO2 emissions. Fortunately, renovations can help make warehouses greener. Installing installation, using alternative energy sources like hydro and wind power, and adding windows to maximize natural light are just a few ways to improve your facility. And today, many organizations work with a third party to take advantage of managed warehouses in strategic locations. The closer your warehouse is to key distribution hubs, the less energy you’ll need to expend when transporting goods. -

Green transportation:

According to the EPA, transportation caused 28.2 percent of 2018 greenhouse gas emissions—more than any other source. Fortunately, there are ways to make transportation greener, such as consolidating goods to minimize your total number of air freight shipments or truck trips. You can also invest in electric trucks or those that run on alternative fuels. These options have improved significantly in recent years, becoming a viable option even for longer hauls. And don’t overlook rail transportation, which offers an efficient and eco-friendly solution. Trains carry far more cargo than trucks, use less fuel per ton-mile, and tend to cost less. And finally, choose a freight forwarder that prioritizes green transportation. At Agility, we’re committed to working with our partners to make transportation greener, and we invest in solutions such as electric and double-trailer trucks that reduce overall emissions. -

Life-cycle management:

Green product design always considers the complete life cycle of the item. For example, say you design backyard playground equipment for children. If the material is sturdy enough, your customer can pass on the playground equipment to another child after the first child outgrows it. And if the playground consists of recyclable materials, such as wood, those materials can have a second (and third, and fourth) life as outdoor furniture, paper, or mulch after the original product is no longer in use.

What is the difference between green and sustainable supply chain practices?

Green supply chain management and sustainable supply chain management share many features in common, but the two fields are not interchangeable. Whereas green supply chain practices have the goal of improving environmental health, sustainable supply chains focus on reducing their impact across many areas of life to ensure industry can continue to operate into the future. Naturally, environmental concerns factor into sustainability. But organizations also have to consider areas of social responsibility that include fair trade, ethical labor practices, and the effects of industry on surrounding communities. They also need to consider economic issues, like managing sustainable growth.

Leading examples of green supply chain practices, such as actively working to switch to biofuels, incorporate recycled materials into the manufacturing process, and reduce energy use, are also sustainable. But not all sustainable supply chain practices are explicitly green. For example, instituting better labor practices and fair pay for workers helps promote a higher quality of life, overall. But these practices don’t have a direct impact on the environment.

Factors affecting green supply chain practices

Green supply chain practices are critical to the health of our planet and the continued sustainability of industry. In addition, they lead to competitiveness and economic performance in several ways: by increasing cost efficiency, reducing waste, and meeting consumer demand for green products. That said, the leading factors advancing adoption of green supply chain practices can also hinder the process of going green, if not managed properly. Let’s take a look at some of these factors and what businesses can do to develop and promote GSCM practices:

-

Leadership commitment:

When managers and executives are all fully on board, it’s much easier to develop a unified approach to creating a green supply chain strategy. On the other hand, when decision makers disagree about what practices to adopt, contradictions can arise throughout the supply chain. Potential challenges include issues with supply chain performance, quality control, and overall effectiveness of green initiatives. -

Technology:

A variety of software applications and advanced technology support green supply chain management at various steps of the process. These could range from warehouse management systems (WMS) that boost warehouse efficiency to new manufacturing technologies that use less energy to make products or reduce the quantities of hazardous materials involved in the manufacturing process. When employees learn and readily adopt technology that enables green supply chains, organizations tend to see good results. When there’s employee pushback or poor adoption, it can be harder to implement lasting changes. -

Brand image and company culture:

When going green has positive implications for your brand and your culture supports these changes, introducing new green practices throughout your supply chain tends to go smoothly. In addition, involving your human resources team in recruiting green supply chain experts drives positive results. If corporate culture is less supportive of green initiatives, and if consumer demand isn’t strong enough to drive change in your industry, that can negatively impact your success. -

Cost:

Depending on your business and industry, developing a green supply chain may initially seem cost prohibitive. The expense of investing in overhauling your infrastructure and equipment may be daunting. That said, these investments can lead to long-term savings. For example, the addition of photovoltaic solar panels to your green warehouse roof can help you generate alternative energy that reduces your reliance on fossil fuels and lowers the overall costs of powering your facility. Though the initial investment is steep, you’ll recoup your outlay and then some. -

Knowledge:

Participants’ expertise stands to have a big impact on supply chain performance at every stage. Involving green architects, consultants, and other green supply chain experts can help companies make the best use of green resources, implement sustainable solutions, and optimize results. For instance, involving Agility in planning a green logistics solution can take the guesswork out of sustainable distribution. Conversely, not involving the experts can reduce the overall effectiveness of your strategy.

Trends in green supply chain practices

Green supply chain practices are working themselves into the greater consciousness because they’ve arisen in response to pressing need. Each year, measurable human demand and activity exceed the regenerative capacity of the planet’s natural ecosystem. It’s a phenomenon known as “ecological overshoot.” In 2020, for example, overshoot occurred on August 22. For the rest of the year, human activities operated in ecological deficit, drawing on resources needed for the future. Now that most individuals and organizations recognize the detriment of overshooting nature’s capacity to support its occupants, finding sustainable solutions has gained momentum. This drive has led to a variety of green innovations in recent years, particularly when it comes to supply chains.

The latest green supply chain practices

The following supply chain trends and practices are helping organizations achieve greener operations and promote a more sustainable future for our planet:

-

Minimizing air freight:

Shipping by air is extraordinarily efficient in terms of transporting goods quickly. Unfortunately, it’s far from energy efficient. More organizations are seeing the value of using air freight to meet only immediate demand, while relying on ocean freight and rail transport to meet planned ongoing needs. Developing the right freight and transportation mix helps ensure you’re equipped to meet customer demand while minimizing your environmental impact. -

Investing in transportation infrastructure:

Improvements to ports, railways, and roads, especially in emerging markets like Southeast Asia, are enabling more efficient transportation. That, in turn, has led to fewer carbon emissions. The next step? Building more charging stations for heavy electric trucks. The West Coast Electric Highway, a network of electric vehicle fast-charging stations that crosses California, Oregon, and Washington, is a good start in North America. But experts say that this infrastructure needs to develop at a faster pace throughout the world to keep up with demand for green trucks. -

3D printing:

Every day, 3D printing gains new applications across a range of industries—from aerospace to medical device manufacturing. What’s more, 3D printing is more energy efficient and cost efficient than other equipment and processes used in the manufacturing industry. Why? For one, 3D printers are precise and lead to almost no material waste. For two, they enable manufacturers to create products on demand, reducing the chance of overproduction. By minimizing energy use and waste, 3D printers help lower carbon emissions. It’s even possible to turn recycled materials into new products using a 3D printer. -

Circular supply chains:

Circular supply chains focus on recovering and recycling waste materials to turn them into saleable products. This approach can take many forms—from refurbishing old products for resale, as Apple does with its iPhones, to reprocessing old components to make brand-new products. Needless to say, adopting the circular economy model reduces waste and helps keep valuable materials out of landfills. And it can also be quite profitable for companies. -

Carbon emissions trading:

Carbon trading is the process of exchanging carbon credits among nations to minimize CO2 emissions. Each country has a cap on the amount of CO2 it can release. Nations with higher carbon emissions can then buy carbon credits from countries with lower carbon emissions, gaining the right to release more CO2 into the atmosphere. Individual companies can also engage in trading. The idea behind this system is that using fossil fuels comes with many hidden costs—from environmental degradation to health care needs resulting from poor air quality. Putting a price tag on the right to emit carbon gives nations and corporations a financial incentive to reduce their emissions. In fact, emissions trading systems around the world are growing in number.

Technology developments that are impacting green supply chain practices

The advent of supply chain technology innovations makes it easier to achieve green results by optimizing efficiency at every leg of a product’s journey:

-

The Internet of Things (IoT):

IoT enables organizations to monitor equipment, inventory, and energy use in real time. For example, sensors can track the temperature and lighting inside a warehouse, making it possible to control these aspects from afar. Organizations gain greater awareness of energy waste, overstocking, and other missteps. That leads to a clearer picture of what needs to change throughout the supply chain. -

Digitization of the supply chain:

Improved digital tools, such as smarter WMS, make it possible to increase supply chain efficiency and automate processes—from stock reordering to optimizing warehouse picking paths. This helps supply chain leaders increase accuracy, avoid rush orders that require expedited shipping solutions like air freight, and prevent overordering. In turn, these improvements help reduce waste and energy use. -

Artificial intelligence (AI):

AI helps automate processes, boost efficiency, and prevent human error. These capabilities are useful throughout the supply chain—from streamlining manufacturing processes to using data to forecast product demand to analyzing delivery routes and planning the quickest journey. By helping people work faster and more accurately, AI leads to less wasted effort and resources. For example, say route optimization tools enabled by AI help shave an average of a few minutes off each truck haul. Over the course of a year, that could add up to a significant reduction in fuel expenditure and CO2 emissions. -

Robotics:

Robots hold great potential for streamlining operations throughout the supply chain—particularly when it comes to logistics. For example, drones could one day make small deliveries much more efficient than large vehicles. In addition, self-driving trucks could automate traffic decisions, optimizing everything from delivery route to fuel efficiency. -

Materials engineering:

In recent years, advances in materials engineering have led to greener and more efficient manufacturing and product packaging. For example, new processes make it easier to turn recycled materials into durable products or develop new materials that are lightweight but strong. In addition, life cycle planning tools help organizations optimize products for a future beyond their initial use.

Agility’s Tarek Sultan joined the London Business School’s Middle East Club for a fireside chat on the rise of successful startups.

Nearly 90% expect export growth by using tech to overcome shipping, regulatory obstacles

DUBAI – May 10, 2018 – Small and medium-size businesses that have struggled for equal footing in the global economy are increasingly looking to cross-border trade for growth, seeing technology as a way past obstacles in shipping and compliance, according to new research from Shipa Freight.

Shipa Freight’s global study of 800 SMEs from developed and emerging markets shows that smaller companies are remarkably upbeat about their ability to expand through trade.

Eighty-nine percent of exporting SMEs surveyed say their export revenue will grow over the next three years. Seventy-one percent say they are concentrating more on international markets than on their home markets. The Shipa Freight survey included exporters and importers from the UK, USA, Germany, Italy, China, India, Indonesia and UAE.

Smaller companies account for an estimated 95% of all businesses and employ two-thirds of the world’s workers. Critics of globalization have argued that decades of efforts aimed at easing the flow of goods, capital and jobs across borders has come at the expense of SMEs and disproportionately benefitted multi-nationals and other large businesses.

“Smaller businesses used to think they couldn’t compete in trade. Now many see it as their best path for growth,” says Toby Edwards, CEO of Shipa Freight, the online freight service. “SMEs are not naïve about the obstacles to unlocking new markets. They see online tools and other technology as a way to conduct transactions, get financing and gather market intelligence.”

Three-quarters of SME executives surveyed by Shipa Freight believe businesses that operate internationally are more resilient. Nearly 80% say they are already using online platforms for freight quotes and bookings.

Roadblocks

SMEs identified numerous obstacles they face in international trade. Forty-two percent say the costs of shipping abroad are too high, or that they don’t have an accurate picture of their costs. Forty percent say they find it difficult to understand documentation requirements.

A significant minority say their cargo has been held up in customs (39%) or lost in transit (27%).

Small and medium-sized businesses based in emerging markets are finding export regulations particularly challenging: 67% identify export regulations as a difficult issue, compared with just 44% of SMEs based in mature European markets. Seventy-nine percent of exporters from India, China and Indonesia say they find it challenging to penetrate markets in Europe.

SMEs that view the UK as one of their top export markets are looking elsewhere because of Brexit. Seventy-three percent say Britain’s vote to leave the European Union has prompted them to prioritize trade with other European countries. Sixty percent of UK SMEs that export and 52% of UK SMEs that import say that leaving the EU Single Market would be “disastrous” for them.

New tech boosts export prospects

Smaller companies clearly see technology as a way to close the gap with bigger competitors, cope with documentation requirements and get quick access to competitive shipping options. Eighty-six percent say that tech is “leveling the playing field” for SMEs to operate globally; 89% believe technology is transforming the logistics industry.

“The logistics industry has traditionally ignored SMEs and done far too little to help them find new markets and grow,” Edwards says. “Technology is giving them the ‘virtual’ scale that they’ve needed to lower their costs, get real-time information and compete.”

About the study

Shipa Freight’s Ship for Success research examines the trade patterns and barriers of SMEs, defined here as organizations with 10-250 employees. The opinion research was conducted in winter 2017 amongst 800 companies (400 exporters and 400 importers). There were 100 respondents from each of the following markets: UK, USA, Germany, Italy, India, Indonesia, China and UAE. Study participants included SME leaders, such as managing directors and operations directors. Participating companies were drawn from the following sectors: retail and fashion, fast-moving consumer goods (FMCG), automotive (including supply chain), industrial and manufacturing, and technology. You can explore the findings and download the full report below. Download full report

About Shipa Freight

Shipa Freight is the new online service powered by Agility that makes it easy to get air and ocean freight quotes, book, pay and track your shipments online. With our global network of logistics experts and industry-leading technology, we ensure that your goods arrive safely and reliably every time.

For more information about Shipa Freight, visit www.shipafreight.com/

Twitter: twitter.com/ShipaFreight

LinkedIn: linkedin.com/company/shipafreight/

YouTube: youtube.com/ShipaFreight

About Agility

Agility is one of the world’s leading providers of integrated logistics. It is a publicly traded company with more than $4.6 billion in revenue and more than 22,000 employees in over 500 offices across 100 countries. Agility Global Integrated Logistics (GIL) provides supply chain solutions to meet traditional and complex customer needs. GIL offers air, ocean and road freight forwarding, warehousing, distribution, and specialized services in project logistics, fairs and events, and chemicals. Agility’s Infrastructure group of companies manages industrial real estate and offers logistics-related services, including customs digitization, waste management and recycling, aviation and ground-handling services, support to governments and ministries of defense, remote infrastructure and life support

For more information:

Sabrina Mundy

Man Bites Dog

+44 1273 716 826

[email protected]

‘Emerging markets’ refers to the combined results of India, China and Indonesia. It does not include UAE figures. ‘Mature European markets’ refers to the combined results of the UK, Germany and Italy.

After a difficult year of deaths and lockdowns, hope is finally on the horizon as the first COVID-19 vaccines appear on the market. The very first doses of the COVID-19 vaccine have already been administered, but full distribution of the vaccine to the global population—which will represent the largest vaccine procurement and supply operation in history—is yet to begin in earnest.

This operation will greatly impact every aspect of the global supply chain. There are a number of expected vaccine logistics shortages from COVID-19, from shipping container availability to cold chain supplies. And that’s not counting the many COVID-19-related challenges the supply chain is already facing, such as route disruptions and skyrocketing cargo rates.

This article will discuss the impact of the global COVID-19 vaccine distribution on supply chain logistics, including anticipated COVID-19 vaccine logistics, unique distribution challenges of COVID-19 vaccines, development of the COVID-19 supply chain, and how the vaccine could impact pharmaceutical supply chain logistics.

Anticipating COVID-19 vaccine logistics

The COVID-19 vaccine distribution effort is not yet in full swing, but it’s possible to anticipate how the logistics of the effort will work. Both national and global agencies have discussed putting into place coordinated distribution initiatives on an unprecedented scale, which will require the cooperation of supply chain agents and logistics providers.

The vaccine supply chain before COVID-19

Pre-COVID-19, the vaccine supply chain was an end-to-end system that was meant to ensure effective vaccine storage and handling, as well as strict temperature control in the cold chain. It has always been essential for the vaccine supply chain to run smoothly to ensure uninterrupted vaccine delivery to populations in need.

However, even before COVID-19, the World Health Organization (WHO) reported that national supply chains were struggling to manage the volume of new vaccines and to take advantage of improved vaccine supply chain technology like updated cold chain materials.

Necessary changes to the vaccine supply chain due to the COVID-19 vaccine

Moving forward, the vaccine supply chain cannot afford to get bogged down in supply chain issues like inadequate storage, transportation, and personnel capacity. This creates bottlenecks, and in the past has led to spoilage of many vaccines. A global coordination effort will be needed to optimize the supply chain for this crucial operation. Possible steps include the following:

- Standardization of all COVID-19 vaccine packaging to ensure proper fit within containers

- Coordination of vaccine deliveries based on the two necessary doses of the COVID-19 vaccine

- Maintenance of the COVID-19 accessory supply chain for supplies such as needles and alcohol swabs

- Open communication across all agents within the supply chain

How the COVAX initiative will affect the logistics of the COVID-19 vaccine

COVAX is the vaccines pillar of the Access to COVID-19 Tools (ACT) Accelerator, launched by the WHO, the European Commission, and France in April 2020. It is leading efforts to procure vaccines and distribute them to ninety-two lower-income countries, while also supporting procurement for more than ninety-seven upper-middle-income and high-income nations.

According to UNICEF, the United Nations agency responsible for providing humanitarian and developmental aid to children worldwide, these represent more than four-fifths of the world’s population. UNICEF, a COVAX member, is responsible for the transportation and supply chain piece of the COVID-19 vaccine distribution.

COVAX will allocate vaccine doses to participating countries, proportional to their total population size. To distribute the vaccines, UNICEF is working with manufacturers and partners in procurement, freight, logistics, and storage. UNICEF is well suited to handling the distribution, because it is the single largest buyer of vaccines in the world and already has longstanding expertise in procurement and logistics.

How large a project is the COVID-19 vaccination effort expected to become?

The COVID-19 vaccination effort will be the largest vaccine procurement and supply operation in history. The World Economic Forum (WEF) expects approximately six to seven billion doses of COVID-19 vaccines to be consumed in 2021. This accounts for nearly the entire global population of 7.8 billion people.

Europe, North America, and Asia are expected to consume the largest shares of the 2021 doses. The WEF projects that the largest inflows of vaccine doses will be to Asia, excluding China and India (820 million doses), and Africa (450 million doses).

How the COVID-19 vaccination effort will affect other health care logistics

The health care and pharmaceutical industries will experience logistical challenges as a result of the COVID-19 vaccination effort, because of the vaccine effort itself and also because of disruptions to the medical and pharmaceutical supply chain due to COVID-19 and vaccine distribution.

Air shipments to Africa and parts of Asia-Pacific will lead to an imbalance in normal air freight trade and diversion of aircraft to routes leading to hubs in those regions, which may impact other supply chains, including medical and pharmaceutical supply chains.

In addition, shipping and freight prices are high and volatile due to the impact of COVID-19 on the entire shipping industry: global air cargo capacity remains about 20 percent below prepandemic levels, mainly due to reduction in passenger flights and resulting shortage of widebody belly capacity, which is down nearly 70 percent. Also putting pressure on rates is the lack of natural backhaul cargo from Africa and other southern hemisphere destinations.

To improve the COVID-19 vaccine supply chain, the pharmaceutical industry could consider combining a distributed manufacturing approach with multiple manufacturing sites in different regions in order to minimize distribution needs. Shipment in less-than-container loads for transport by ocean could be a possibility. In addition, the pharmaceutical industry may also be able to save time by shipping the vaccines in bulk.

Unique distribution challenges of COVID-19 vaccines

Vaccines are among the most difficult cargo to transport due to their very particular temperature requirements, so we can expect significant challenges in shipping the COVID-19 vaccine. In addition, associated shipping materials may become in short supply, while the unprecedented scale of the vaccine distribution effort will strain the entire global supply chain. Logistics providers will need to strategize carefully to effectively transport vaccines to their destinations.

The role of cold chain logistics in the distribution of the COVID-19 vaccine

“Cold chain logistics” refers to the process of safely transporting temperature-sensitive products in the supply chain. Vaccines are among these cold chain products: according to Supply Chain Dive, they must be shipped at a temperature between -50 degrees and -15 degrees Celsius if frozen, or 2 to 8 degrees Celsius otherwise. Temperature stabilization is tricky in shipping, and unfortunately, a quarter of all vaccines are degraded by the time they reach their destination.

Eighty-three percent of COVID-19 doses will be normal cold chain products requiring storage at 2 to 8 degrees Celsius; roughly 17 percent will be ultra cold chain products requiring storage at lower temperatures.

Temperature-sensitive shipping often relies on dry ice. One significant challenge in the COVID-19 vaccine supply chain is that different types of passenger aircraft are limited in the amount of dry ice they can carry. The range is 180 to 950 kilograms, with most aircraft types limited to the lower end of the range.

Materials in demand for the successful distribution of the COVID-19 vaccine

As discussed above, temperature-controlled shipping materials are essential in the vaccine supply chain and thus will be highly in demand.

There are two options when it comes to cold chain shipping: active containers and passive containers. An active container has active temperature control, while a passive container is an insulated container with no active temperature control. Cooling packaging must be used in passive containers, and cooling materials such as dry ice may soon be in short supply due to high demand.

In addition, requirements for related cargo could be significant: one pallet of vaccine doses requires one truckload of syringes and related equipment. Shipping space will be even more in demand because of this additional cargo.

How will the sheer size of the COVID-19 vaccination effort impact logistics?

The COVID-19 vaccination effort will make the entire logistics landscape look very different than usual. COVID-19 vaccines will represent five times the air freight volumes for all vaccines in 2019, and the vaccines will represent 12 percent of the pharmaceutical industry’s total air freight volume in 2019. Industry groups estimate that global COVID-19 vaccine distribution will require the equivalent air freight capacity of 928 Boeing 747-400 aircraft.

To prepare for the coming changes in the logistics industry, Agility’s COVID-19 Response Team & Charter Desk has done detailed analysis of carriers for capacity, frequency, scheduling, routing, cost, flow type, dry ice constraints, lead time requirements, cancellation rules, and types of agreements (HB, SB, ad hoc/spot). We are also evaluating carriers based on their performance records, flexibility, and risk, as well as the likelihood they will increase rates.

Since major shipping hubs on the ground will certainly feel the strain in the supply chain as well, we have evaluated their ground handling capabilities, airport requirements and constraints, and nearby cold storage availability and options.

Agility has expanded its network of life sciences centers to thirty-two locations worldwide. In addition, we are leveraging our parent company’s global footprint and logistics assets, which include aviation and ground handling expertise and facilities, truck fleets, and workforce, as well as international-standard logistics parks in Asia-Pacific, the Middle East, and Africa.

Developing the COVID-19 vaccine supply chain

Agencies involved with vaccine distribution are aware that developing the vaccine was just half the battle; the other half is effective distribution, a massive challenge in itself. Task forces have been appointed for just this purpose, and these groups will need to address safety precautions in the vaccine supply chain, as well as ways to streamline the process.

The role of the WHO’s COVID-19 Supply Chain Task Force

The WHO’s COVID-19 Supply Chain Task Force is addressing shortages in essential supplies, including personal protective equipment, diagnostics, and medical equipment. It is taking a three-pronged approach to this challenge in the following ways:

- Establishing a global strategy to provide access to essential supplies

- Bringing together public and private partners to help meet those needs

- Ensuring the distribution of essential supplies and cargo

The WHO is pursuing these goals through the following methods:

- Consolidating demand to avoid overlap and demand amplification

- Coordination of procurement to aggregate volumes and get better access and pricing

- Forming allocation agreements based on need, country capacity, and vulnerability levels

- Forming a singular distribution network that allows movement of deliveries through established hubs around the world and to designated ports of entry worldwide

Safety precautions in the coronavirus vaccine supply chain

The biggest vulnerability in COVID-19 vaccine distribution is the possibility of temperature excursions. Vaccine manufacturers must use only temperature-regulated shippers and containers that are certified to meet the international regulations for temperature-controlled products.

At the same time, manufacturers will need to prepare for risks that arise during the shipping process. Companies will need to have a plan for rescuing vaccine shipments that are delayed in delivery, so that temperature excursions do not occur. Companies will also need to plan for a certain inevitable level of vaccine spoilage and damage incurred in the shipping process.

How the coronavirus vaccine supply chain can be streamlined

As a logistics expert, Agility recommends the following strategies for helping the COVID-19 vaccine shipping process go more smoothly:

- Identify and evaluate key lane pairs based on value and importance

- Engage in forward planning, forecasting, and building of stock levels

- Examine possible changes to shipping solutions to reduce volume and weight

- Increase cold chain packaging availability and develop backup plans with key suppliers

- Tighten alliances with strategic partners

How the COVID-19 vaccine could change pharma supply chain logistics

The COVID-19 vaccine distribution will have an unparalleled impact on pharmaceutical supply chain logistics. The vaccine will strain the supply chain more than perhaps any other pharmaceutical product in history. Due to the COVID-19 vaccine, the pharmaceutical supply chain will face certain geopolitical issues and a changed market outlook, at least in the near future.

How will the COVID-19 vaccine rollout change supply chain logistics for pharmaceutical companies and products?

Agility has been talking to various industry stakeholders, including clients, airlines, ground handlers, and packaging providers about the market outlook for pharma supply chain logistics. In short, no one yet has a clear picture.

These stakeholders are looking closely at the following factors:

- Timeline/duration and shipping cycles

- Vaccine availability/expected shipping volumes

- Vaccine transport requirements, including variation in temperature requirements for different vaccines

- Beyond temperature control requirements, the product has a relatively low monetary value, yet a high criminal value. The aspect of product safety cannot be neglected.

- The air market situation and the COVID-19 pandemic impact on equipment and capacity

Agility foresees challenges in equipment and supplies of containers, dry ice shippers, and dry ice itself. We also anticipate imbalances and return logistics challenges for containers. On the road freight side, capacity and drivers will become an issue.

What can the pharmaceutical industry learn from the global distribution of COVID-19 vaccines?

In addition to being a challenge, the COVID-19 vaccine distribution effort can also represent an opportunity for the pharmaceutical supply chain, especially in terms of future vaccine distribution. Never has there been such an impetus for the pharma supply chain to optimize and coordinate its operations on a global scale.

After the COVID-19 pandemic, the pharma supply chain will be able to take advantage of optimized operations that were developed out of necessity for COVID-19 vaccine distribution. It can continue to coordinate pharmaceutical packaging to ensure it fits optimally within containers. It can also utilize strategies developed for COVID-19 vaccine distribution to push more pharmaceuticals to hard-to-reach areas. Finally, it can keep the lines of communication open to ensure better transparency across the supply chain, which will help keep products at the necessary temperatures, leading to less vaccine wastage overall.

How could the pharma industry prepare for future disruptions to its supply chain?

In the future, pharmaceutical manufacturers can make their supply chains more resilient by diversifying their sources and suppliers. In many cases, this will mean lessening dependence on China, which accounts for 28 percent of manufacturing worldwide. Regional supply chains will emerge, reducing the dependency on a limited number of suppliers located in one geography.

The other major way to “future-proof” pharmaceutical supply chains is to rely more on digital capabilities such as predictive modelling, big data, and partner integration. The increased information and flexibility afforded by these technologies can make all the difference in a crisis situation.

The supply chain’s role in conquering COVID-19

The COVID-19 disease and vaccine will continue to impact the entire global supply chain for the foreseeable future. The supply chain is crucial to distributing the vaccine and finally seeing an end to the pandemic. For the sake of human health and safety worldwide, it’s essential for every party involved to understand the logistics issues inherent in COVID-19 vaccine distribution and to strategize properly for an organized, effective approach.

Agility is committed to helping agents at all points of the supply chain navigate the unique logistics challenges presented by COVID-19. Receive the latest COVID-19 global shipping updates here.

This article is part of the World Economic Forum Annual Meeting

- The number of potentially disruptive technologies in logistics is daunting.

- This makes it difficult for supply chain businesses to know where to look.

- Blockchain, IoT, automation and data science should be first on their list.

Astute business leaders discipline themselves to be on constant lookout for disruptive new technologies.

They foster an internal business culture that is able to evaluate promising technologies through a continuous cycle: Watch > pilot > partner > adopt or discard.

In logistics, as in many other sectors, the number of potentially disruptive innovations is daunting. It includes everything from augmented reality and big data to autonomous vehicles and 3D printing. Even the most agile businesses can’t test or pilot everything, so what’s the right approach?

For companies with goods to move, there are several technologies that bear watching and four that every party in the supply chain should be testing at some level. These four are the BIRD technologies – blockchain, the internet of things (IoT), robotic process automation (RPA) and data science.

The BIRD technologies are inter-related and mutually reinforcing. Blockchain, or distributed ledger technology, establishes trust in data. The IoT provides a vast quantity of relevant data points. RPA improves the accuracy of data. Data science extracts value.

1) Blockchain

Blockchain has its skeptics, including many who believe the technology has already fallen short and might be too inherently problematic. Some skepticism is justified, but it’s premature for blockchain to be written off.

The idea behind blockchain is that all of the information required for completion of a transaction is stored in transparent, shared databases to prevent it from being deleted, tampered with or revised. There is a digital record of every process, task and payment involved. The authorization for any activity required at any stage is identified, validated, stored and shared with the parties who need it.

In ongoing pilots of this technology, shippers, freight forwarders, carriers, ports, insurance companies, banks, lawyers and others are sharing “milestone” information and data about their pieces of an individual shipping transaction. What’s missing today is agreement by all the relevant parties in the supply chain – including regulators – on a set of common industry standards that will govern the use of blockchain.

Absent a consensus on standardization, blockchain offers little. But with a common framework and set of rules, it could make shipping faster, cheaper and more efficient by increasing trust and reducing risk. It would shrink insurance premiums, financing costs and transit times, and eliminate supply chain intermediaries who add cost today but who would become surplus to requirements.

2) The internet of things

As a platform for sharing trusted data, blockchain is ideally suited to the internet of things. IoT devices can be attached to almost anything. As 5G technology evolves and spreads, tiny IoT chips embedded in products will enable businesses to track and monitor shipments of pharmaceuticals, high-tech goods, consumer products, industrial machinery and garments.

That data can be encrypted and shared through the blockchain so that customers and suppliers have a real-time record of the transaction. An IoT-enabled supply chain would be both leaner and less risky. It would allow for true just-in-time production by guaranteeing inventory accuracy and, in turn, reducing working capital requirements.

3) Robotic process automation

Of course, data is no good if it is not accurate. In the supply chain, the leading cause of inaccuracy is human error. Robotic process automation, or RPA, is the artificial intelligence used to allow software to handle many of the steps involved in a shipping transaction by understanding and manipulating data, triggering responses and interacting with other digital systems.

Use of RPA can ensure accuracy in customs declarations, safety certificates, bills of lading and other paperwork. It can reduce reliance on the manually entered data, emails and digital forms that produce errors, create delays and add cost all along the supply chain. RPA frees up workers to be more productive by doing what humans do best: solve problems, react to the unexpected, think creatively and deal with customers.

4) Data science

Thanks to data science, we are in the midst of seismic change in the supply chain. We are getting more data from more sources; it is the right data; and it is accurate. Tools such as artificial intelligence, machine learning and cloud computing enable us to analyze and use that data in powerful new ways.

Rather than using information to sound alarms when there are “exceptions” – problems or anomalies with an individual shipment or in the supply chain – we can use it to prevent them. Data becomes about managing the future, not the present.

The risk, of course, is that only large, well-resourced supply chain players will be able to take advantage of BIRD technologies and other advances that involve harnessing data. That would create a dangerous new digital divide between large and small, haves and have-nots.

Thankfully, data is having a democratizing effect by making the global economy fairer and more inclusive in important ways. Small businesses and emerging markets companies aspiring to go global aren’t piloting blockchain or developing their own RPA applications. But they are already the beneficiaries of new, inexpensive, data-informed tools and platforms underpinned by artificial intelligence and machine learning: online freight booking, instant financing, automated marketing, cheap cloud computing and remote advisory services.

The BIRD technologies generate trust in data, ensuring accuracy and giving users the ability to predict and act. In a data-driven world, they can help businesses of all sizes take flight.

Since the outbreak of the COVID-19 pandemic, companies across virtually every goods-based industry have been re-examining their reliance on China, which accounts for roughly 28% of global manufacturing and is a leading source of critical commodities such as rare earth minerals and ingredients for pharmaceutical products.

The China re-think didn’t start with COVID-19

Well before the pandemic, many companies relying on Chinese producers for finished goods and parts were looking to de-risk by finding alternative suppliers in other countries. Why? Geopolitical tensions, trade disputes, and rising costs in China.

Trade tensions and national security concerns have led to a wave of legislation in the United States, where there are more than 60 bills pending in Congress aimed at changing economic relations with China. In addition, U.S. brands and manufacturers comparing China’s labor costs to those in Mexico have seen China’s labor costs rising faster. That has eroded China’s competitiveness and made Mexico more attractive.

Outward migration of production was underway before the pandemic because tariffs imposed by the U.S. and China had increased supply chain costs by up to 10% for as much as 40% of companies sourcing in China, according to Kamala Raman, a senior director analyst at Gartner.

The U.S., Germany, Japan and other countries have expressed strategic concerns about overreliance on China for critical products: 5G telecommunications gear, semiconductors, steel, cranes, electrical power equipment and more. McKinsey identified 180 different products for which one country — most often China — accounts for more than 70% of the global export market. Many of the products are chemicals and pharmaceuticals.

Intel recently divested itself of a business in politically sensitive memory chips because the business was heavily dependent on China sales. Samsung and others have cited cost considerations for production moves or asset sales.

The pandemic is turning concern to action

China’s assertive response to the pandemic included lengthy, mandatory lockdowns that froze manufacturing and stranded global cargo shipments for several weeks in the spring of 2020. That caused unprecedented disruption in supply chains and led to shortages of everything from household goods and consumer electronics to industrial components and healthcare products.

The pandemic exposed the fragility of sprawling global supply chains. In one recent survey, one-quarter of businesses sourcing from China indicated plans to transition all or some of their operations to other countries over the next three years. In a Gartner survey, an even higher percentage – 33% — said they intend to pull manufacturing or sourcing out of China in the next two to three years. Sixty-four percent of North American manufacturing and industrial professional said they were likely to bring manufacturing production and sourcing back to North America, in a Thomas Publishing survey.

Look for knock-on effects

Any exodus from China will ripple around the world so expect huge and uneven consequences in other markets. The modest movement to other production and sourcing locations has already led to overheated labor markets and infrastructure bottlenecks in other Asian manufacturing countries.

In some cases, the effort to build supply chain resilience is felt most in far off warehousing and distribution hubs, where companies are adding safety stock or shifting from just-in-time inventory to beefed up “just-in-case” models.

Sourcing diversification is altering the flow of goods into U.S. ports. West Coast ports continue to have a lock on ocean traffic from China and serve as the primary gateway for Chinese goods. But now East Coast ports are receiving higher volumes of containerized ocean goods because, in addition to vessels traversing traditional routes from Europe, the Mediterranean and the Caribbean, they receive cargo from Vietnam, Thailand, Malaysia and India, which have found it economical to ship via the Indian Ocean and Suez Canal.

In turn, the shift toward the East Coast has driven up industrial real estate prices along the eastern seaboard of the U.S. as companies scramble to set up distribution hubs and e-commerce facilities.

Japan is pushing an ‘Exit China’ strategy

At least 87 Japanese companies have shuttered production in China, moving it back home to Japan or relocating to Southeast Asian countries in response to incentives offered under the Japanese government’s $2 billion Exit China program. Nikkei Asia says Japanese companies “wary of rising labor costs in China and geopolitical factors had already begun reorganizing production prior to the pandemic.”

Japanese investment in Southeast Asian manufacturing – specifically in Vietnam, the Philippines, Malaysia, Indonesia and Thailand – was already increasing at twice the rate of investment in China.

It’s not just China

Supply chain risk has been rising for years as costly disruptions become regular occurrences.

McKinsey says weather disasters alone accounted for 40 separate incidents involving damage in excess of $1 billion in 2019. Add the risk from trade disputes, retaliatory tariffs — and a doubling of cyberattacks in a single year at a time when companies are increasing their reliance on digital systems.

Geopolitical risk is unavoidable. Today, 80% of trade involves countries with declining stability scores. “Companies can now expect supply chain disruptions lasting a month or longer to occur every 3.7 years, and the most severe events take a major financial toll,” McKinsey says.

Agility’s Take

Economic trauma caused by COVID-19 will initially shrink the universe of suppliers, not expand it. And new layers of protectionism will leave companies with even fewer choices of supply because they will rob efficient producers — in China and elsewhere — of their competitiveness and make them too expensive.

Uprooting from China is not as easy as it seems. Forty years after it began modernizing, China today holds advantages available nowhere else: unmatched scale; abundant skilled and unskilled labor; sophisticated automation, engineering and sciences; world-class infrastructure and logistics; closely synchronized and integrated supplier networks both in-country and across Asia.

Twenty-five years ago, leaving China meant leaving a low-cost manufacturing center. Today, for some multi-nationals, it would mean giving up on the world’s largest consumer market and an economy growing at twice the rate of the United States before the COVID-19 crisis.

Willy Shih, a Harvard Business School professor, says: “There’s a lot of impatience about this supply chain resilience and reshoring. I like to remind people that it took 20 to 25 years for China to capture the supply chain for many products. And if you want to move the supply chain, we’re not talking about something that will happen in a year, or in a couple of years.”