By Tarek Sultan

Vice-Chairman of the Board, Agility

- Investment is pouring into Gulf startups from domestic and foreign sources.

- Start-up friendly policies, access to funding and the multiplier effect are just a few of the reasons for this growth in investment.

- Powerful local and global economic currents are benefitting the Gulf states.

This is a golden age for startups and entrepreneurs in the six countries of the Gulf Cooperation Council (GCC). Geopolitics, technology, climate urgency and daring national agendas across the region have combined to create what might be the most favourable conditions that small businesses anywhere have ever enjoyed.

Private-sector expansion is the key to national ambitions in all six countries. Increasingly, Gulf leaders will be looking to small business and entrepreneurs as engines of job creation and innovation.

The time is right. The ecosystems that Gulf countries established to nurture, fund and scale digital startups are maturing. Gulf funders — from sovereign wealth funds to venture capitalists to family offices — are looking to write checks to entrepreneurs closer to home. Regulatory fine-tuning is creating new openings for smaller companies that have struggled to compete. Massive infrastructure, energy and technology projects are having a spinoff effect for local businesses and specialized service providers. Finally, powerful currents in Gulf trade, foreign investment, research and e-commerce are all working in favour of SMEs.

Five reasons the time is now for startups and small businesses in the Gulf

1. Funding

Simply put, there’s more money from local and international sources looking to invest in young, innovative Gulf companies.

The Gulf’s sovereign wealth funds have more than $4 trillion in assets under management, a record. They account for more than 40% of global SWF wealth, and their investments comprised 40% of the global sovereign investment total through the first nine months of 2024. Increasingly, Gulf fund managers are looking to invest more at home so that they can drive private-sector growth at the heart of the region’s national strategies.

Saudi Arabia’s Public Investment Fund (PIF) is shifting the balance of its portfolio to focus less on international holdings and more on investment in new industries and projects in the Kingdom. PIF Governor Yasir Al-Rumayyan said in October that the fund will trim its global holdings to 18% of its portfolio, down from 30% in 2020.

In other cases, Gulf sovereign funds are putting money into young companies with innovative ideas that can aid home-country economic diversification. Abu Dhabi’s Mubadala recently invested in Odoo, a Belgian company that offers single-platform software for small and medium-sized companies.

Venture capital investment in the GCC quadrupled from 2017 to 2022 and continues to outpace growth in most other geographies, increasing at a 24% compound annual growth rate. Investment is pouring into Gulf startups in AI, specialized online marketplaces, climate tech, delivery apps, fintech, edtech and investment platforms.

At the same time, overseas funds such as US-based ScienceWerx are putting down new roots in Saudi Arabia and neighboring countries so they can be first movers in AI, biotech, healthtech and other emerging fields. Similarly, Brookfield Asset Management says it is raising at least $2 billion for a new Middle East-focused private equity fund with PIF and other partners.

2. Multiplier effects

The vast majority of small businesses in the Gulf aren’t the kind to attract direct investment from sovereign funds and venture capitalists. But most can expect to be lifted by the “agglomeration” or multiplier effect that flows from the staggering amount of investment and spending across the region, particularly in mega-projects, logistics infrastructure, AI, clean energy and climate adaptation.

In the US, where most of the research on multiplier effects has been done, there is a clear correlation between investment and increased demand for local goods and services; increased productivity; and job creation. The addition of one highly skilled job in an urban area creates 2.5 jobs in other sectors dominated by smaller businesses: construction, food service and other localized roles.

3. Regulatory incentives

Gulf governments are using their policy levers to create new jobs, expand private-sector growth and boost investment. Among all the carrots and sticks being deployed by policymakers are loads of advantages and opportunities that benefit smaller businesses. Some examples:

— In the UAE, where there are nearly 50 economic free zones, operators are competing to create the most business-friendly conditions. The Ajman NuVentures Centre Free Zone, the newest in the Emirates, promises to grant business licenses online in 15 minutes and issue two-year visas for investors within 48 hours.

— In Saudi Arabia, one of the main drivers of growth in the small business sector has been the Kingdom’s sweeping push to make it easier and more attractive for women to join the workforce. Since 2017, the Kingdom has lifted the ban on women driving, introduced anti-harassment laws, expanded female legal autonomy, introduced childcare and transportation subsidies for working women, mandated equal pay and prohibited termination of pregnant women. Today, women own 45% of small and medium-sized businesses in Saudi Arabia. The rate of female participation in the labour force roughly doubled to 35% between 2017 and 2023.

— To create jobs for their citizens, Gulf countries are requiring private companies to meet hiring quotas and maintain a certain percentage of nationals in their workforce. In the UAE, small businesses can qualify for grants, subsidies and reduced fees by taking part in labour force Emiratization.

— Saudi Arabia’s Regional Headquarters Programme, intended to get multinationals to establish their regional head offices in the Kingdom, will add to the multiplier effect by sending global companies in search of Saudi partners for everything from local recruiting to branding, advertising and marketing.

4. Promotion and skills development

Gulf countries are getting better at figuring out what startups and small businesses need. Where non-energy exports used to be negligible, they are now aggressively promoted by the Saudis, Emiratis and other GCC governments.

In Kuwait, which licensed 6,700 new companies through the first three quarters of 2024, the National Fund for SME Development recently launched its Mubader Plus programme, offering workshops, counseling and other assistance to budding entrepreneurs.

Dubai’s Expand North Star, with 70,000 in attendance in 2024, is the world’s largest tech startup and investment event.

5. Powerful tailwinds

Gulf leaders are embracing the post-World War II US innovation model, which uses government money to fund university research that can produce ideas later scaled and commercialized by the private sector. GCC countries are establishing or expanding universities and pushing them to innovate through partnerships with leading international research institutions or alongside Gulf counterparts through platforms such as the Qatar-led My Gulf University.

Trade trends are also working in favour of SMEs. The UK and six GCC countries are nearing completion of a new free trade agreement valued at $73 billion annually. A new FTA with the UK is likely to accelerate economic integration among the six countries, as will Gulf e-commerce, which continues to outpace other regions in annual growth.

Not to be overlooked is the China factor. Chinese companies are looking to the Gulf as the place where they can diversify their manufacturing base, invest in renewable energy and hydrogen production and become EV market share leaders. Chinese investment in Gulf-based AI and tech development is making the GCC a hub for digital transformation and commerce.

For entrepreneurs, startups and small business in the GCC, it’s never been a better time.

This blog was originally published by the World Economic Forum.

By Henadi Al-Saleh

Chairperson, Agility

- Female-founded companies received only 2% of all venture capital (VC) investment in 2022.

- Gender bias and a scarcity of female investors are thought to hamper VC investment in female-owned businesses.

- By expanding female-led VC communities, highlighting successful VC funding for female businesses and confronting stereotypes, more VC funding should flow to female-founded companies.

By most measures, women are making steady gains in professional opportunity, pay and status and decision-making power at work. Their progress, while slow and uneven, is reflected in economic empowerment indexes put out by the OECD, World Health Organization, UN agencies and others.

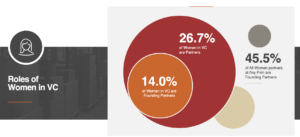

One area where women are advancing little, however, is venture capital (VC). Companies founded solely by women received only 2% of all VC investment in 2022, and only about 15% of all VC ‘cheque-writers’ are women.

In the Middle East, where my company is based, venture capital investment is increasingly seen as a critical component of national economic competitiveness and a source of innovation. The region’s VC funds and corporate VCs are competing with sovereign wealth funds, among the world’s largest and most active VC investors. Yet, startups founded by women in the Middle East and North Africa (MENA) received only 1.2% of funding in 2021 and about 2% last year.

What’s behind the disparity?

The glaring imbalance has sparked lively debate about what’s causing it.

Venture capital is a male-dominated industry and bias, whether conscious or subconscious, is clearly a factor. A Harvard study showed that 70% of VC investors preferred pitches presented by male entrepreneurs over those presented by female entrepreneurs, even though the pitches were identical.

Another analysis has shown that VC investments in enterprises founded or co-founded by women average less than half the amount invested in companies founded by male entrepreneurs.

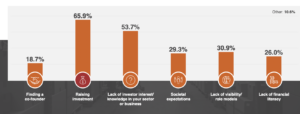

In Inc.’s Women Entrepreneurship Report, 62% of female entrepreneurs said they experienced some form of gender bias during the funding process. Feelings of bias are especially acute among women entrepreneurs in MENA. In a survey of 125 female founders in the region, 58% said MENA investors were less likely to invest in women-led startups than global investors.

The scarcity of female investors – those who sit on fund boards, lead deals, and make investment decisions – is also an issue. However, the authors of a Harvard Business Review article on the VC gender gap caution women founders against focusing solely on pitching to female investors.

“There are still very few female investors, and they tend to be concentrated in funds that focus on earlier-stage investments, where risk is higher and funds invested are smaller. Today, female VCs simply do not control sufficient assets to continue investing in female-led firms as they scale. This means that female founders will ultimately need to attract male investors to grow — and if you’re a woman, our research shows that’s a lot easier to do if you raise at least some capital from men from the start,” they wrote.

Another hard reality is the lack of a pipeline; here I speak from experience. Our corporate VC arm, Agility Ventures, received about 1,000 pitch decks last year. How many came from women-founded or women-led businesses? I can count them on one hand.

The lopsided numbers in MENA are especially perplexing because of the inroads women in the region have made in the educational fields that generate most of the innovation and ideas sought by venture investors. Women now account for 57% of STEM students at MENA universities, according to UNESCO.

Image: Data Source: Wamda, TiE Dubai – survey of 125 female founders in MENA, published in collaboration with TiE Dubai and TiE Women

Why address the VC gender gap?

Apart from the need to address basic inequity, there are plenty of reasons to tackle the gender chasm in venture capital. The biggest is the chance to unlock economic gains.

Venture funding de-risks the innovation process through bets on promising ideas from smart people who need resources to get their ideas to market. It’s a wellspring of new technology, business growth and economic development, which makes the diversity of entrepreneurship and VC leadership economic imperatives. A widely cited BCG report says global GDP would rise 3% to 6%, boosting the global economy by up to $5 trillion annually if women entrepreneurs received the same investment as male entrepreneurs.

What’s the answer?

Expand women-led VC communities

That means networking, mentorship, technical assistance and other support. It means building on the work of investment community participants, such as Women in VC, the world’s largest global community for women in VC to connect and collaborate; AllRaise, an organization dedicated to accelerating the success of women founders and funders; and the Female Founders Fund, an early-stage fund that offers pitching resources and technical help in addition to investing in women-led tech startups.

It also means more non-profit and public-sector programmes, such as empowerME, an initiative aimed at female entrepreneurs in the Middle East; Monsha’at, a Saudi government small business authority with an entrepreneurship programme targeted at women; She Innovates, the global UN Women programme that connects female innovators via app and platform; and Global Invest in Her, a platform for women entrepreneurs seeking funding.

Celebrate success

We need to elevate the visibility of female role models who have raised capital and successfully brought products and services to market. Stories of success act as inspiration and provide models for females in business to emulate. Mona Ataya, CEO of Mumzworld, is a good example.

Confront stereotypes

The Global Entrepreneurship Monitor (GEM) highlights one damaging stereotype: that businesses started by women typically aren’t the kind that are right for outside investment because they’re low-tech enterprises in sectors with little potential to scale, trade across borders and go public through stock offerings.

“More attention needs to be given to women who are starting and growing high growth, high innovation and large market businesses. Stereotypes that frame women entrepreneurs as a disadvantaged group feed a false narrative that women lack the same competency as men regarding business leadership,” the GEM team says.

The views expressed in this article are those of the author alone and not the World Economic Forum.

This blog was originally published by the World Economic Forum.

The Suez Canal is a vital hub for international trade, connecting the East and West by linking the Mediterranean and Red Seas. This strategic positioning ultimately shortens routes for cargo ships and enables them to transport goods to and from Europe, Asia, and Africa more efficiently.

As more and more vessels began to take advantage of the Suez Canal, processes and maritime activities were put in place to ensure optimal operations. One of these is stevedoring.

What is stevedoring?

Stevedoring refers to the process of loading and unloading cargo from ships. Although it sounds simple at first glance, many tasks and activities go into the process to ensure the smooth transition of goods between the vessel and the port.

It does not only refer to the physical act of moving cargo itself but also involves the whole gamut of tasks, from planning the arrangement of cargo in ships to loading and unloading them. Stevedoring also includes handling various types of cargo, including bulk goods, vehicles, hazardous materials, and containers. Each type will have its own set of processes and protocols.

The process of stevedoring is done by a stevedoring company that specializes in providing labor, equipment, and expertise requirements for cargo handling. They work with cargo owners, port authorities, and shipping carriers to ensure a seamless process that adheres to international regulations. Some offer value-added services like cargo handling, inspection, warehousing, and customs clearance.

These companies hire stevedores or specialized laborers who possess the skills and knowledge of cargo securing, stowage methods, and operating equipment involved in the job. Their responsibilities include supervising loading and unloading operations, operating heavy machinery, securing cargo, and ensuring proper goods documentation and labeling.

What is the role of stevedoring companies in the Suez Canal Economic Zone?

The Suez Canal is administered by the Suez Canal Authority, an entity created by the Egyptian government to manage and oversee the canal’s operation, maintenance, and development. As part of these efforts, stevedoring is playing a crucial role in ensuring the operational efficiency and affordability of the Suez Canal by streamlining the flow of goods and loading and unloading of cargo.

In essence, stevedoring ensures the seamless flow of goods between vessels and port facilities. It does this by carrying out tasks involved in loading and unloading cargo from ships through specialized equipment such as cranes and forklifts. Ultimately, the goal is to minimize turnaround times and optimize the shipping process.

The importance of stevedoring to the Suez Canal was highlighted after the Suez Canal blockage in 2021, when the canal was blocked for six days after the giant Ever Given container ship ran aground. The canal was impassable, effectively halting the movement of hundreds of ships carrying billions of dollars in cargo.

Disruptions like this must be avoided, considering the canal’s massive impact on international trade. The narrow waterway shortens maritime routes, minimizes hazards, and helps vessels save on fuel costs when transporting goods between Europe and Asia.

On the whole, stevedoring ensures the operational efficiency of the Suez Canal. By assisting in streamlining the flow of goods, it can help prevent blockages that disrupt supply chain operations.

How do stevedoring services contribute to the efficiency of cargo handling in the Suez Canal Economic Zone?

Stevedoring companies and services facilitate efficient cargo handling, which is the foundation of port operations. They ensure the systematic and efficient movement of goods between ships and port facilities. As such, professionals handling stevedoring services must be skilled in ensuring that each piece of cargo is loaded and unloaded accordingly.

All in all, stevedoring transforms cargo operations in the Suez Canal Economic Zone, improving the speed and accuracy with which cargo is loaded and unloaded. As a result, stevedoring services help reduce turnaround time, prevent port congestion, and ensure the swift passage of ships. These efforts make the Suez Canal more efficient and boost its capacity to handle more vessels.

Stevedoring services can make such a significant impact by delivering the following:

- Expertise and skill: Stevedores are skilled, knowledgeable, and trained on cargo types, safety protocols, and vessel configurations.

- Precision machinery: Stevedoring companies use state-of-the-art machinery to handle various cargo types.

- Workflow management: These companies have proven cargo handling processes in place to ensure the seamless flow of goods.

- Cargo securing: They prioritize safe and secure stowing and fastening of cargo to minimize the risk of damage.

- Documentation and compliance: Stevedores also document the movement of cargo to streamline customs procedures.

Through these, stevedoring services can optimize loading and unloading operations in the Suez Canal Economic Zone, thereby minimizing turnaround time, reducing congestion, and enhancing the canal’s efficiency.

What challenges do stevedoring companies face in the Suez Canal Economic Zone?

The role of stevedoring companies in improving efficiency in the Suez Canal Economic Zone is not without its challenges. They face logistical, operational, and labor-related challenges as they carry out their operations.

Logistical challenges faced by stevedoring companies include:

- Congestion: With a high volume of vessels passing through the Suez Canal Economic Zone, the area is prone to congestion, particularly in berthing and anchorage areas.

- Labor shortages: The lack of skilled labor to carry out stevedoring services is causing overload during peak seasons when the demand for their services is the highest.

- Labor-related challenges are also present, which include:

- Skill development: Stevedoring companies are constantly under pressure to create training programs geared toward addressing labor shortages and ensuring a skilled workforce.

- Workforce management: Workforce management can be a challenge, which is why stevedoring companies need to implement strategies such as competitive wages, incentive programs, and flexible scheduling to increase job satisfaction and productivity.

- Partnerships: Stevedoring companies must collaborate with educational institutions and vocational training centers to develop skilled workers.

Operational challenges

- Berthing and anchorage: The Suez Canal sometimes receives more traffic than its berthing and anchorage spaces can handle.

- Environmental factors: Weather conditions like sandstorms and strong winds can hamper stevedoring operations in the Suez Canal Economic Zone.

If not managed properly, these challenges can lead to delays and blockages in the Suez Canal Economic Zone. Take, for instance, the blockage in 2021 that caused a whole gamut of supply chain disruptions and vessel backlogs that ultimately resulted in cargo delivery delays and increased costs.

Agility Logistics has signed a contract with the Suez Canal Economic Zone to develop and operate customs and logistics centers. This will allow Agility to implement services, logistics, and industrial zone efforts. Read more here.

Egypt has undergone serious development in the past couple of years, especially concerning its historical and cultural structures. But at the heart of these, Egypt also faces pressing challenges, especially in the ever-competing 21st century, namely pursuing sustainable industrial development.

Egypt is undertaking efforts to undergo economic transformation. Mainly, it’s striving to modernize and diversify its economy, and one of the ways it’s doing that is through industrialization. This strategy is gearing Egypt to drive growth, create jobs, and foster innovation.

The challenge lies in achieving sustainability, especially with growing environmental concerns and more awareness of responsible resource management globally—Egypt is under pressure to rethink its approach to industrial development.

In this article, we explore the prioritization of sustainable industrial development in Egypt, its risks and benefits, and its main challenges.

The Need for Sustainability in Industrial Development in Egypt

Before anything else, let’s define sustainable industrial development and cover why sustainability is important.

Sustainable industrial development is an effort to balance economic growth activities with environmental protection. It includes efforts that further resource efficiency, environmental responsibility, social inclusivity, and local perspective.

The most compelling element of sustainability in industrial development is environmental preservation.

Sustainable practices ensure that necessary industrial activities minimize harm to the environment. These practices should prioritize minimizing pollution, reducing resource depletion, and protecting ecosystems. This is especially important in a country like Egypt, where natural resources are limited, especially fresh water and arable land.

Second, sustainable industrial development is essential for economic stability and resilience. It diversifies the industrial base and reduces dependency on a single sector, thus reducing the Egyptian economy’s susceptibility to shocks. A diversified landscape in Egypt can be valuable in breeding employment opportunities and stabilizing income streams.

Finally, sustainable industrial development protects both current and future generations. It ensures that the benefits of industrial growth are more evenly distributed among different segments of society, which is crucial in Egypt, where the government is trying to address income inequality and disparities in access to basic services.

In addition to environmental protection, sustainable industrial development can also be important for economic growth and enhancing Egypt’s competitiveness in the global market.

Risk and Benefits of Sustainable Industrial Development for Egypt

While it’s clear that sustainable industrial development is a prospect that Egypt needs to tackle, doing so may not be as easy considering the risks that may be associated with it. Specifically, Egypt faces concerns in the following areas:

- Initial Costs: The transition towards sustainable industrial practices may require upfront investments in technology, infrastructure, and training.

- Concerns on Competitiveness: Companies that adopt sustainable industrial practices face higher production costs compared to those that remain using traditional methods.

- Regulatory Challenges: Implementing sustainable industrial practices requires compliance with complex environmental regulations.

- Technological Gaps: Advanced technologies and expertise are needed to support sustainable industrial development practices.

- Workforce Skills: Sustainable industrial practices demand new skills and competencies from the workforce.

These risks, however, are manageable. By addressing them, Egypt can expect the following benefits:

- Resource Conservation: Sustainable industrial development, by reducing resource consumption, can help Egypt address its challenges related to water scarcity and land degradation.

- Environmental Health: Sustainable industrial development’s clean technologies and practices allow Egypt to reduce pollution levels and minimize environmental degradation.

- Economic Growth: Egypt can count on sustainable industrial development as a source of economic growth. They can create more jobs in green sectors and attract investments.

- Global Competitiveness: Sustainability efforts will make Egypt’s industrial sector more competitive with the global market, especially among consumers who prefer eco-friendly products and services.

- Energy Independence: With sustainable industrial development, Egypt can reduce its reliance on fossil fuels and instead look to renewable energy sources like solar and wind power.

- Climate Change Resiliency: Adopting sustainability in industrial development will decrease Egypt’s vulnerability to the impacts of climate change.

- Enhanced Reputation: With a commitment to sustainability, Egypt will be well on its way to improving its global image and attracting environmentally responsible tourists and investors.

What are the Main Challenges to Sustainable Industrial Development in Egypt?

While the benefits of sustainable industrial development for Egypt are significant, the country has to weigh the costs.

Financial Barriers

There are high costs associated with implementing sustainable practices, which poses a significant barrier for Egypt and other countries. They will have to invest in green technologies, renewable energy, and resource-efficient processes.

However, this challenge can be overcome with financial support and incentives from the government and international organizations. These can come in the form of subsidies, grants, and low-interest loans for businesses.

Regulatory Gaps

Egpyt faces challenges with inconsistent or inadequate environmental regulations. This can greatly hinder its adoption of sustainable practices due to the lack of clear guidelines and monitoring that can lead to compliance.

Egypt can overcome this challenge by strengthening environmental regulations and ensuring regular monitoring and penalties for non-compliance.

Lack of Expertise

Until now, there has been little priority on sustainable industrial practices among Egypt’s businesses and workforce. To speed up the country’s transition, it will have to work to create a sustainability culture.

Egypt should make efforts to facilitate sustainability education and training programs for businesses and its workforce.

Access to Technology

Unlike other nations, Egypt does not have easy access to advanced sustainable technologies and innovation. As sustainable industrial development is highly dependent on these, the lack of such technologies can be a significant bottleneck.

However, Egypt may be able to overcome this barrier by creating technology transfer agreements and countries that possess the required advanced technologies.

Infrastructure and Logistics

There is also the challenge concerning Egypt’s outdated infrastructure and waste management systems, which limit recycling and circular economy initiatives.

To overcome this, the Egyptian government plans to invest in modern infrastructure, such as renewable energy grids, waste management facilities, and efficient transportation systems.

Why Should Companies Operating in Egypt Prioritize Sustainable Industrial Development?

Aside from cost-savings, enhanced reputation, risk mitigation, and improved resilience, there are several reasons why operating sustainable industrial facilities in Egypt is important for businesses and their stakeholders.

Firstly, it helps them achieve energy efficiency by reducing consumption and emissions.

Aiming for sustainability also helps reduce waste generation through efforts such as recycling and waste-to-energy programs.

Another prime benefit is better water management. By treating wastewater, harvesting rainwater, and ensuring responsible water sources, companies can contribute to reducing water consumption and pollution.

Not to mention, operating industrial facilities gives them access to new markets and, more importantly, allows them to play their roles in environmental responsibility and promoting public health in Egypt.

Overall, these benefits contribute to supply chain sustainability and green product development.

Agility Logistics is at the forefront of sustainable industrial development in Egypt. Read more about our efforts in our latest sustainability report.

What is EDGE Certification?

The International Finance Corporation (IFC), a member of the World Bank Group, developed the Excellence in Design for Greater Efficiencies (EDGE) certification system to encourage and reward builders and developers who adopt energy- and water-efficient designs in new construction.

EDGE-certified buildings adopt practices for sustainable industrial use and warehousing. They use at least 20% less energy or water than conventionally built buildings, making them more affordable to operate and reducing their environmental impact.

EDGE is the first green building certification system of its kind that is available globally, covering both residential and commercial building types. The EDGE certification is designed to be flexible to adapt to local conditions and regulations.

The EDGE software tool makes it easy for builders and developers to compare the costs and benefits of different design options and choose the most efficient option for their project.

To get certified for EDGE, builders need to pay a certain fee based on the floor area of their facility.

| Floor area | Price per square meter | Minimum fee |

| 0-25,000 m2 | $0.29 | $2,900 |

| 25,000-50,000 m2 | $0.24 | $7,250 |

There are a few things to consider when determining an EDGE lead certification fee:

- Size: A smaller project will generally have a lower fee, while a larger project will have a higher fee.

- Location: A project in a more rural area will generally have a lower fee, while a project in a more urban area will have a higher fee.

- Type: A more complex project will generally have a higher fee, while a less complex project will have a lower fee.

An EDGE-certified, resource-efficient building is more efficient than traditional buildings and uses less energy, water, and other resources. It also generates fewer greenhouse gas emissions than similar buildings. As a result, EDGE-certified facilities can help reduce the built environment’s environmental impact.

The benefits of becoming EDGE certified include:

- Access to financing: IFC provides financing for EDGE-certified buildings, which can help to cover the costs of making a building more energy and resource-efficient.

- Increased market value: EDGE-certified buildings are more marketable and tend to be valued higher than non-certified buildings.

- Enhanced reputation: EDGE certification can help improve a company’s or developer’s reputation, as it demonstrates a commitment to sustainable construction.

What is the EDGE Certification Process?

The EDGE Certification Process is a voluntary certification system that recognizes buildings designed to be more energy and resource efficient than standard practice. The certification process is administered by the International Finance Corporation (IFC), a member of the World Bank Group.

To receive EDGE certification and become an EDGE expert, a building must first be designed using the EDGE software tool. The EDGE software tool is a free online tool that helps architects and engineers design more efficient buildings.

Once the building has been designed using the EDGE software tool, a certified assessor will review the design to ensure that it meets the requirements for EDGE certification.

A project owner must undergo an energy and resource efficiency assessment using the EDGE software. The assessment examines several factors, including the building’s envelope (walls, windows, and roof), heating and cooling systems, lighting, and water use. Once the assessment is complete, the results are used to generate an EDGE certificate.

The EDGE certification process can take anywhere from a few weeks to several months, depending on the size and complexity of the project.

The resources required from the organization to undergo the Excellence in Design for Greater Efficiencies (EDGE) Certification are as follows:

- The organization must have a minimum of 10 employees.

- The organization must have been in operation for at least 2 years.

- The organization must have a project or initiative ready to be certified.

- The organization must have the financial resources to cover the certification cost, the application fee, review fees, green mortgages, and other associated costs.

- The organization must be willing to commit the time and resources necessary to complete the certification process. This includes providing data and documentation as required, participating in interviews and site visits, and making any necessary changes to the project or initiative as required by the certification process.

- The organization must be willing to commit to the principles of excellence in design and continuous improvement, which includes making ongoing improvements to the project or initiative and sharing lessons learned with other organizations.

The EDGE Certification is issued by the International Finance Corporation (IFC), a member of the World Bank Group. The IFC is the largest global development institution focused exclusively on the private sector in developing countries.

The EDGE certification is a great way to ensure your building is designed for maximum efficiency. If you want to make your building more efficient, the EDGE certification is a great option.

How Hard Is It to Achieve EDGE Certification?

Getting EDGE certification involves a rigorous process. However, it has been designed to be accessible to all types of projects and builders. There are several factors that can affect the difficulty of achieving EDGE certification, such as the complexity of the project and the builder’s commitment to sustainable design.

It may also be harder to achieve EDGE Advanced Certification compared to EDGE certification, as the name suggests. While the latter has minimum benchmarks for energy, water, and materials efficiency, the former is more ambitious in its targets and requires greater resource efficiency.

Builders who want to receive an EDGE Advanced Certification should ensure that their projects have a higher level of performance than the baseline requirements. These include a greater improvement in resource efficiency and a higher percentage reduction in energy, water, and materials use.

There are three levels of EDGE certification:

- EDGE Assess– Requires the organization to commit to an action plan. It’s best for organizations thinking about their commitment to change, and adopting baselines and benchmarks to track theory progress.

- EDGE Move– Documents how a company accelerates its progress across the EDGE global standards. It is for companies that have already committed to change.

- EDGE Lead– The highest certification level, EDGE lead shows that a company has achieved the standards of EDGE certification. It shows that the company has a robust commitment to sustainability.

The EDGE global standards focus on three areas of sustainability: energy efficiency, water efficiency, and materials efficiency. These are assessed by EDGE experts and auditors.

An EDGE expert has in-depth knowledge and expertise in the EDGE certification system and sustainable design. Typically engineers, architects, or sustainability consultants who have received specialized training, these experts help guide teams through the certification process and provide technical advice and guidance on EDGE requirements.

On the other hand, an EDGE auditor is an independent third-party professional who verifies and audits the EDGE certification process. They are the ones who assess the project’s compliance with global standards.

Companies opt to get EDGE certified and favor it over other certifications because of its cost-effectiveness, simplicity, global recognition, focus on essential green building elements, and alignment with their sustainable development goals. It is also adaptable and customizable, flexible across building types and climatic zones.

Future of Sustainable Buildings with EDGE

How long before a company receives EDGE certification will depend on several factors, including the complexity of their project, the readiness and completeness of their documentation, the availability of resources, etc.

However, it is a worthy investment that contributes to the advancement of green construction thanks to its scalability, accessibility, standardized framework, and alignment with global goals. The certification helps achieve a sustainable built environment, focusing on minimizing the negative environmental impact of critical construction areas and promoting long-term sustainability.

Companies that invest in achieving EDGE certification enjoy the following benefits:

- Reduced environmental impact– Allows them to contribute to mitigating climate change and conserving natural resources.

- Energy and cost savings– Reduce costs over the lifespan of the building and enhance financial performance through efficient systems and technologies.

- Increase market demand and value– Attract higher rental and occupancy rates and achieve a greater resale value by appealing to environmentally-conscious buyers and investors.

- Regulatory compliance– Ensure compliance with current and future regulations, future-proofing the building.

- Corporate social responsibility– Shows commitment to sustainable practices and environmental responsibility.

The future of sustainable buildings with EDGE certification is promising. Trends show its continuous evolution and expansion in terms of global impact. We can expect EDGE to continue increasing market adoption, expanding the scope of technological integration, regional adaptations, and global collaboration.

EDGE will continue to drive the construction industry forward and help foster a more sustainable and environmentally-responsible future.

What Is Sustainable Aviation Fuel (SAF)?

Sustainable aviation fuel (SAF) is an alternative fuel for aircraft. Unlike conventional jet fuel, SAF is produced from renewable feedstocks, such as used cooking oil or animal fats. It significantly reduces carbon dioxide emissions and presents an opportunity to reduce aviation’s environmental impact.

The production of SAF starts with collecting raw materials, such as used cooking oil or animal fats. The raw materials are then processed to create a renewable feedstock suitable for use as aviation fuel. This involves several steps, including removing impurities and filtering out contaminants before the resulting product can be blended with conventional jet fuel to create SAF.

There are a number of airlines around the world that use SAF to power their aircraft. These include major airlines such as American Airlines, United Airlines, Delta Air Lines, British Airways, and Lufthansa. Additionally, smaller regional carriers such as Alaska Air Group and Southwest Airlines have also committed to using sustainable aviation fuel.

One way to increase sustainable aviation fuel usage is to replace traditional jet A fuels with more sustainable alternatives. Jet A fuel is a kerosene-type jet fuel used for commercial and military aviation. It has higher flash point requirements than its predecessor, jet A-1, and is used for all jet aircraft operating within the U.S. and Canada.

A jet fuel blend with sustainable alternative jet fuel (SAJF) can help reduce the carbon footprint of jet engines without sacrificing engine performance. Additionally, jet engines powered by SAJF emit fewer nitrogen oxides than those fueled by jet A, resulting in better air quality and improved health outcomes.

Why Is SAF Important?

Sustainable aviation fuel (SAF) is a sustainable and renewable fuel alternative to traditional jet fuel, and it holds the potential to reduce greenhouse gas emissions from commercial flights significantly. SAFs are made from sustainable, renewable sources such as vegetable oils, animal fats, municipal solid waste, and recycled cooking oils. Using sustainable fuels, the airline industry can reduce emissions and take a step toward carbon neutrality.

SAF also is more sustainable than traditional jet fuel because it uses sustainable energy sources, such as solar power or wind turbines, to create the fuel. By using renewable energy sources, SAF reduces reliance on fossil fuels that produce harmful greenhouse gasses when burned. Additionally, sustainable aviation fuels are less likely to contribute to air pollution and ozone depletion since they burn cleaner than traditional jet fuels.

SAFs are also sustainable because their production process is much less energy intensive than traditional jet fuel. This means that the production of sustainable aviation fuel requires fewer resources and causes less environmental damage. As sustainable fuels become increasingly popular and more widely adopted, they will help the airline industry move towards a sustainable and carbon-neutral future.

Sustainable aviation fuel can potentially be a major contributor to the bioeconomy. Aircraft flights are responsible for 2-3% of global human-induced greenhouse gas emissions, and SAF provides an opportunity to reduce these emissions through its production with sustainable, renewable resources while still providing the same power output as traditional jet fuel.

The production of sustainable aviation fuel is part of a larger movement to create an economy powered by renewable energy. By transitioning from fossil fuels, the bioeconomy provides a much-needed shift toward sustainability. This shift can help reduce global greenhouse gas emissions and improve air quality while providing economic opportunities for new green industries.

One way to contribute to sustainable aviation fuel is by engaging in public policy advocacy. By speaking up for stronger environmental regulations and policies, you can help create a landscape that encourages more investment in the development of alternative fuels and incentivizes airlines to transition away from traditional fossil fuels.

Additionally, support research into less carbon-intensive energy sources and explore ways to reduce the environmental impacts of aviation. Lastly, support efforts to increase efficiency and reduce emissions through investments in new technology, improved operational processes, and better infrastructure.

Doing these things can help ensure a sustainable future for air travel that is more eco-friendly and resilient to climate change.

The Cost of SAF Compared to Traditional Jet Fuel

Traditional jet fuel, also known as jet A-1 aviation turbine fuel, is a petroleum distillate used for international aviation. It is the most common jet fuel due to its availability and stability in extreme temperatures, from -47°C to 40°C.

Sustainable Aviation Fuel (SAF) is an alternative jet fuel made from renewable sources such as vegetable oils, animal fats, and woody biomass. It has similar chemical properties to jet A-1 fuel but with lower carbon emissions. SAF is approved for commercial use by the International Air Transport Association (IATA) and can be blended with jet A-1 fuel up to a maximum of 50%, depending on the jet engine manufacturer.

In addition, SAF has a higher energy content than jet A-1 fuel which means it provides more thrust power and greater efficiency, resulting in lower costs for commercial airlines. It also produces fewer emissions of carbon dioxide (CO2) and other pollutants such as sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter.

The cost of SAF compared to traditional jet fuel depends on several factors, including availability, production cost, transportation costs, and government incentives.

Availability is a key factor that affects cost. Currently, SAF is only available in limited locations, and production levels are still relatively low. This means that the price of SAF can be significantly higher than jet fuel due to limited supply and high demand from airlines.

The production cost of SAF also plays a role in pricing. Depending on the feedstock used to produce SAF, production costs can range from one-third to two-thirds higher than traditional jet fuel. For producers to remain profitable, this added cost must be passed along to consumers.

Transportation costs also play a role in the price of SAF. The cost of transporting SAF from its production site to the end user can be several times higher than transporting traditional jet fuel. This is due to a need for more infrastructure and specialized equipment needed for transport.

Finally, government incentives and subsidies can play a role in the cost of SAF. In some countries, governments provide financial support to producers or users of SAF to encourage its use. These incentives can reduce the cost of SAF, making it more competitive with traditional jet fuel.

Sustainable alternative fuels (SAF) are becoming increasingly important in international aviation, offering numerous benefits compared to traditional fossil jet fuel. SAF has a much lower carbon intensity than fossil jet fuel, which can significantly reduce emissions released into the atmosphere during international flights.

SAF also generates fewer harmful particulate emissions while burning more cleanly and with less noise pollution than traditional fuels. Additionally, SAF is often more cost-effective than fossil jet fuel, allowing international airlines to reduce operational costs and pass on savings to customers.

As international aviation continues to grow, it’s increasingly important that sustainable alternative fuels become the new standard to protect the environment while continuing to support international travel and commerce.

How Much Carbon Does SAF Save?

Sustainable aviation fuel (SAF) offers international aviation a viable option to reduce its carbon footprint by lowering carbon dioxide emissions and energy consumption.

According to the International Air Transport Association, SAF can offer up to 80% lower lifecycle greenhouse gas emissions than traditional jet fuel. This is partly due to the use of renewable energy sources and waste products such as vegetable oil, animal fats, and recycled cooking oil for its production.

Is SAF Suitable for All Aircraft?

Despite the potential environmental benefits of using SAF, it may only be suitable for some aircraft. This is because SAF has different properties from traditional aviation fuel. Some aircraft may not be able to use SAF due to the amount of energy it provides and its resistance to pre-ignition, which can cause engine damage if not managed correctly.

If you are using your aircraft for recreational purposes, it is important to understand that SAF may offer some performance benefits over traditional jet fuels. Due to its lower carbon content and higher energy density, SAF can reduce the fuel needed for a flight, resulting in cost savings. It may also offer improved engine efficiency and smoother operation.

However, SAF may not be a suitable option if you are using your aircraft for business or another purpose requiring higher performance and speed. For example, this type of fuel is not recommended for use in engines designed for high-performance engine operations such as air racing.

GE and CFM commercial jet engines can use SAF. Synthetic aviation fuel (SAF) is renewable energy produced from waste and other non-fossil sources. It has the same chemical makeup as regular aviation fuel and offers several benefits to airlines, including improved efficiency and lower emissions.

Several helicopter manufacturers and operators are also already utilizing SAF in their aircraft. While some additional considerations must be considered when using this fuel, it has been proven reliable for helicopters.

Many airlines around the world are transitioning to more sustainable fuels. In 2020, Alaska Airlines began using a blend of traditional and sustainable aviation fuel (SAF) on flights out of Seattle Tacoma International Airport. This makes it the first airline in North America to use SAF on regularly scheduled commercial flights.

Other global airlines that have made commitments to reduce emissions through SAF usage include Lufthansa, KLM, Air France-KLM, British Airways, Cathay Pacific, Avianca, and American Airlines.

United Airlines is currently researching the impact using SAF would have on their fleet and how it would affect the performance of their aircraft. The research is ongoing, but if successful, it could be a significant step towards reducing the airline’s carbon footprint and helping to fight climate change.

What Is the Greenhouse Gas (GHG) Protocol?

The Greenhouse Gas (GHG) Protocol is an internationally recognized accounting tool designed to help businesses, governments, and other organizations understand their GHG emissions. It provides a consistent framework for measuring and reporting greenhouse gas emissions that organizations of all sizes can use.

The GHG Protocol defines four scopes of emissions: Scope 1 (direct emissions), Scope 2 (indirect emissions from the generation of purchased electricity, heat, and cooling consumed by the organization), Scope 3 (other indirect emissions resulting from activities of the organization but occurring at sources owned or controlled by another entity) and GHG removals (activities that permanently remove GHGs from the atmosphere).

The Greenhouse Gas Protocol (GHGP) covers six key greenhouse gases: carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbon (PFCs) and sulphur hexafluoride (SF6).

Carbon dioxide is the most common of these gases and has been produced in large amounts due to human activities such as burning fossil fuels. Methane is released through natural processes like agriculture, waste management, and landfills, while fertilizers and other industrial processes can emit nitrous oxide.

Hydrofluorocarbons are synthetic compounds used in refrigerants and aerosol cans, while perfluorocarbons and sulfur hexafluoride are produced by industrial processes. All six of these gases have been identified as having an impact on climate change, so organizations need to track their emissions to reduce their environmental impact.

The Protocol was developed by the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD), with sector guidance from partner organizations. The Protocol is now accepted as a global standard, adopted by governments, businesses, civil society, international organizations, and financial institutions worldwide.

Scope 1: Direct Emissions

The first among 3 emissions, Scope 1 emissions, are direct greenhouse gas (GHG) emissions that arise from sources owned and operated by the organization, such as fuel combustion in vehicles or machinery. These emissions can be reduced through initiatives such as more efficient engines, renewable energy use, and improved fuel switching.

Natural gas is a Scope 1 emission. This means that it is an emissions source directly released by an organization or facility. Natural gas combustion releases carbon dioxide, methane, nitrous oxide, and other air pollutants into the atmosphere.

Therefore, organizations must track their Scope 1 emissions from natural gas use to accurately report their total emissions. Additionally, organizations should strive to reduce their natural gas use to reduce greenhouse gas emissions released into the atmosphere.

By implementing efficiency measures and transitioning to renewable energy sources when possible, organizations can take meaningful steps towards reducing their Scope 1 emissions from natural gas use.

Organizations can also work with suppliers to reduce Scope 1 emissions along their value chain. To measure these emissions, organizations need to understand their energy consumption and the sources of their fuels.

They should also consider monitoring air pollutants such as nitrogen oxides (NOx) or particulate matter (PM). Verifying Scope 1 emissions requires organizations to collect high-quality data from all relevant sources and develop detailed records.

Organizations need to track scope 1 emission factors over time to measure the progress of their efforts and understand the impact of any changes implemented. This will help inform strategies for further reducing Scope 1 emissions. Organizations should also consider engaging stakeholders (such as employees or members of the public) to gain additional insights and feedback on the success of their GHG reduction initiatives.

Scope 2: Indirect Emissions – Owned

Scope 2 covers emissions from the consumption of energy purchased by an organization for its own use. This includes electricity, heat, and steam from sources owned by another entity (such as power plants, natural gas processors, and water boilers). It can also include other non-electrical purchased energy, such as fuel for transportation and other activities. It’s important to note that Scope 2 only covers emissions from energy purchased by an organization and does not include any of the company’s production activities, which are considered Scope 3 emissions.

To track a company’s emissions under Scope 2, it is essential to map out the energy sources used. This includes understanding where the energy comes from and what fuels produce it.

It also requires collecting data on how much energy is purchased and information about the various emissions factors associated with each source (e.g., the amount of CO2 emitted per unit of electricity consumed). The emissions from each source can then be combined to get a total Scope 2 emissions figure.

Organizations can also take steps to reduce their Scope 2 emissions by switching to renewable energy sources or purchasing more efficient equipment and technologies that use less energy. Other strategies, such as joining a green power program or participating in carbon offset projects, are also available. Ultimately, by understanding and managing their Scope 2 emissions, organizations can make progress toward achieving their sustainability goals.

Companies must report their Scope 1 and 2 emissions under the Global Reporting Initiative (GRI) Standards. The GRI is a set of voluntary sustainability reporting guidelines that guide companies on how to disclose information about their environmental, social, and economic performance.

Companies must report all direct and indirect greenhouse gas emissions to meet the requirements of the GRI Standards. Companies may also need to report additional indirect emissions, known as Scope 3 emissions, depending on their business activities and operations.

Scope 3: Indirect Emissions – Not Owned

Scope 3 emissions, also known as indirect emissions, are those resulting from activities related to the production of a company’s goods and services. This includes the emissions arising from the use of purchased electricity and heat, upstream transport of materials and fuels by suppliers, business travel, and employee commuting.

These indirect emissions account for up to 80% of total greenhouse gas emissions for many organizations. Net zero targets include Scope 3 emissions and Scopes 1 and 2. To effectively manage Scope 3 emissions, companies must assess the sources of their indirect emissions and develop strategies to reduce them.

Organizations can take numerous approaches to reduce their Scope 3 greenhouse gas emissions. These strategies range from switching to renewable electricity and fuels, improving energy efficiency in buildings and equipment, cutting down on travel, and reducing waste and packaging.

Companies can also work with their suppliers to reduce the GHG emissions associated with the transportation of goods and materials or take steps to encourage employee commuting by public transport, cycling, car share programs, and other green alternatives. Furthermore, they can offset their Scope 3 emissions through carbon credits or other approaches.

Scope 3 emissions are not mandatory to report, though there are many benefits in doing so. By tracking and reporting Scope 3 emissions, businesses can better understand their company’s carbon footprint and overall impact on the environment and identify potential areas for improvement. Additionally, by reducing Scope 3 emissions, organizations can set an example for other businesses and demonstrate their commitment to sustainable practices.

However, reporting Scope 3 emissions may also be a requirement in certain jurisdictions and sectors, such as those involved in government contracting or international agreements. Ultimately, the decision to report on Scope 3 emissions should involve careful consideration of the potential benefits and costs associated with doing so.

The question of whether companies should be responsible for Scope 3 emissions is a contentious one. On the one hand, some believe that companies should take responsibility and commit to reducing their overall carbon footprints.

This view is based on the notion that corporate social responsibility entails taking action to mitigate environmental and climate impacts through various strategies like green energy investment, process improvements, and sustainable supply chain management.

On the other hand, some argue that companies should not be held responsible for Scope 3 emissions. They point to factors such as the distance of suppliers from production sites, varying levels of corporate influence on suppliers’ emissions, and uncertainties about the cost-effectiveness of interventions at a local level as reasons why companies should not be held financially responsible for Scope 3 emissions.

Ultimately, it is up to companies and stakeholders alike to understand the implications of Scope 3 emissions and determine how best to address them. Companies can take proactive steps, such as setting climate-related targets and investing in renewable energy projects. At the same time, stakeholders can encourage businesses to reduce their carbon footprints by voting with their wallets and supporting companies that practice sustainability. By taking collective responsibility, we can create a more sustainable future for all.

What the GHG Protocol Requires Your Company To Do

The GHGP covers all aspects of handling, packaging, labeling, transport, storage, and disposal of hazardous materials that are traded internationally. It also provides specific risk assessment and management guidance for safely handling hazardous materials.

Additionally, it provides guidance on emissions reduction, waste minimization, and recycling to minimize the environmental impact of hazardous materials. By providing these standards and protocols, the GHGP helps ensure that global trade is conducted ethically while protecting people and the environment.

The GHG Protocol requires your company to conduct an inventory of its GHG emissions, measure progress towards reducing those emissions, and set improvement targets. Companies must also create a plan to offset any remaining emissions that cannot be reduced. This involves identifying which activities emit the most carbon and setting goals for reducing them.

To conduct an inventory of GHG emissions, your company must first calculate its baseline emissions. This involves collecting data from various sources, such as fuel consumption, electricity usage, and waste disposal. Baseline calculations must include data from the past three years to be considered complete.

Scope 1 GHG Protocol is a set of standardized guidelines for measuring and reporting organizational greenhouse gas (GHG) emissions. The protocol provides guidance on calculating, verifying, reporting, and managing Scope 1 emissions — the direct GHG emissions associated with an organization’s operations.

Once your company has calculated its baseline emissions, it can begin setting reduction targets. These goals should be based on the company’s specific circumstances and can be informed by prior carbon reduction experience or best practices in the industry. Companies should also set reporting goals to ensure that progress is being made toward achieving the targets.

In addition to reducing their GHG emissions, companies may consider offsetting any remaining emissions that cannot be reduced. Offsetting involves investing in projects that reduce GHG emissions elsewhere. Examples of offsetting activities include the installation of solar panels and the planting of trees.

The GHG Protocol Corporate Standard requires organizations to consistently measure, report, and manage their greenhouse gas (GHG) emissions. The standard covers both direct and indirect emissions, which include Scope 1 (direct), Scope 2 (indirect electricity), and Scope 3 (other indirect).

By complying with the GHG Protocol, your company can demonstrate its commitment to sustainability and help create positive change in the world. The process requires careful planning and implementation but can ultimately lead to a more sustainable future for everyone.

- Climate change is accelerating the transition away from fossil fuels to clean energy.

- Innovative technologies are being harnessed to help reduce or eliminate emissions.

- Across shipping, aviation, mobility, agriculture, manufacturing and construction, change is happening.

More than 20 years ago, author Malcolm Gladwell wrote a best-seller called The Tipping Point. He was fascinated by “the moment of critical mass, the threshold, the boiling point” when trends in business, marketing and human behaviour catch fire and begin to spread furiously.

We’re clearly at, or nearing, tipping point moments in the transition to clean energy. The signs are everywhere.

In the boardroom

Climate-related activity by companies and investors has shifted from risk mitigation to opportunity capture. “We are at an energy inflection point,” according to Boston Consulting Group.

McKinsey says the momentum behind projects designed to limit or eliminate greenhouse gas emissions (GHGs) “may create the largest reallocation of capital in history.” Indeed, companies and financial institutions responsible for more than $130 trillion are committed to the fight and determined to bring down emissions.

On the seas

Shipbuilders’ order books show where the maritime shipping industry is heading. Maersk, HMM, Danaos, COSCO, CMA CGM and other carriers are placing orders for dual-fuelled vessels that can run on liquid or gas fuels and will be powered by methanol. Conventional methanol is made from fossil sources – natural gas, coal, oil – but ocean carriers are betting on e-methanol, which is made with renewables: biogas, biomass, waste, sludge, and recycled carbon dioxide.

That’s important because ocean shipping generates about 3% of GHG gases. The industry has been slow to clean up its act, despite 2020 International Maritime Organization rules that limit vessels’ sulphur oxide emissions.

Cargo carriers initially responded to the IMO 2020 requirements with short-term fixes. They mothballed some older, dirtier ships and equipped others with emissions-eating scrubbers. Newer ships were fuelled with – or retrofitted to run on – cleaner-burning LNG.

Ikea, Unilever, Amazon and Inditex are among the companies that have committed to 100% zero-carbon fuel shipping by 2040. Already, customers of freight forwarder DB Schenker can select a biofuels option, agreeing to pay a surcharge to make sure their cargo moves on vessels powered by sustainable fuels.

Meanwhile, port operators and politicians are exploring creation of green, digital shipping “corridors.” One corridor would link Singapore with US West Coast ports. Ports at both ends would add storage and infrastructure for low- and zero-carbon fuels along with digital systems and tools to serve ships running on cleaner fuels.

To date, clean hydrogen lacks viability as a widely used marine fuel. That is expected to change in the next few years, but the Port of Rotterdam has decided not to wait: it is making huge investments to transform itself into an international hub for production, storage and transport of hydrogen.

There’s also hope for older ships that run on fossil fuels. Several carriers are experimenting with carbon-capture systems that can be installed on existing ships. The systems collect carbon in liquefied form, allowing it to later be offloaded and repurposed to make dry ice and other products.

There is no consensus about the dominant ocean fuel or fuels after 2030. Green ammonia, biodiesel, fuel oil, blue ammonia, LNG, e-methanol, biomethanol, biomethane, and e-methane were among the sources cited by respondents in a recent industry survey. However, there is a clear desire by operators to have the capability to power vessels with fuel “families” – multiple types of oils or gases, for example – that can be used interchangeably.

In the air

As Menzies Aviation CEO, Philipp Joenig points out, the aviation industry’s path to sustainability is cloudier. In the short run, the industry is looking to lower emissions by increasing efficiency through aircraft design tweaks and improvements in ground operations, air-traffic management, and route planning.

To scale for sustainable fuels and full decarbonization, the industry is ultimately likely to need look at redesign of airframes and the introduction of new storage technology.

Researchers are looking at an array of potential aviation fuel sources, including algae, hydrogen, biowaste and synthetic fuels made with so-called Power-to-Liquid (PtL technology). Meanwhile, United Airlines has launched a fund to invest in sustainable fuels and is asking the flying public to help make sustainable aviation fuel a reality. United wants passengers to consider contributing to the fund – from $1 to $7 – whenever they book a flight.

On the road

Electric vehicle (EV) adoption continued to grow in 2022 (80% in China year-over-year; 40% in the US). The pace of future growth is likely to be dependent on the availability of incentives such as government subsidies and tax breaks, on the one hand, and the expansion of EV infrastructure such as battery cell production and charging networks, on the other hand.

In trucking, battery-powered EVs are already on the road for drayage, last-mile, and short-haul routes. Range limitations have been the obstacle in long-haul trucking, but some in the industry expect EV freight haulers to be on the road covering the same distances as diesel trucks by 2027.

Enthusiasm for mobility and power generation that rely on lithium-ion batteries has been tempered by worry about the supply of lithium ore and the social and environmental effects of lithium mining. That explains the exuberance at recent international auto shows where carmakers have unveiled EVs using sodium-ion batteries, a cheaper source of potential electrification using a more abundant raw material.

On the farm

Ultra-efficient energy use, water conservation and emissions reduction have turned tiny Holland into the world’s second largest exporter of agricultural products (by value) after the US. The Netherlands, worried a generation ago that it couldn’t feed itself, is feeding Europe today. It is a pioneer in vertical farming, seed technology, robotics for harvesting and milking, lab-grown meat, and conventional livestock production.

Revolution upon revolution

The energy transformation is also a materials and construction revolution. Buildings consume roughly 40% of the energy we generate. Transparent aerogels made from abundant cellulose biopolymers are going into windows and skylights that can now outperform other thermal barriers when it comes to reducing heat and cooling loss. Non-transparent versions provide powerful insulation for pipes and building facades.

Micropyramid technology, which involves precise stacks of small lenses, is enhancing solar panels, increasing the amount of light they can capture each day and boosting capture on dreary days.

Developers building in some cities face mandates to reduce emissions. Some are doing so by creating buildings that are airtight envelopes with triple-pane glass, 4-inch wall insulation, and advanced ventilation systems. They say they can do more if they can obtain affordable steel made at foundries powered by green hydrogen and cement that is used to store captured carbon. In one experiment, carbon emissions from two large gas boilers in a Manhattan apartment tower are captured, liquefied and trucked to a concrete plan to be mixed with cement and sealed in blocks.

More plastics are coming from sustainable sources such as sugarcane, while Zara, H&M, Gucci and others are scaling the use of recycled fibres in apparel. SkyNano is using carbon emissions as a feedstock for low-cost, sustainable manufacturing of advanced carbon materials for batteries, tyres, and plastics.

Technology is helping us make huge improvements in stubborn areas that generate lots of waste. One example is in made-to-fit packaging, where e-commerce giants such as Walmart and Amazon are on the threshold of a major breakthrough thanks to new technology that allows them to essentially customise the size of parcels to slash packaging waste and shipping costs. Elsewhere, AI-powered robots are being deployed to address the biggest hurdle to recycling: trash sorting.

Signs of progress

In less than two years, renewables will overtake coal as the world’s number one source of power, according to the International Energy Agency (IEA). And over the next five years, the world will add more renewable energy than it has in the past two decades, equal to the entire power capacity of China. Renewables have already surpassed coal in the US.

More than 90% of the new electricity capacity added between now and 2027 will be from renewable sources. Growth in renewables is accelerating at rates that outstrip even recent forecasts by the IEA and others.

It feels like a tipping point.

This blog was originally published by the World Economic Forum.