How Better Warehouses Increase Trade in Africa

Kuwait-based Agility Logistics Parks customers can log-on to view contracts and make payments.

UK MOD personnel can log-in to the GRMS portal to schedule household relocation shipments.

Kuwait-based Agility Logistics Parks customers can log-on to view contracts and make payments.

UK MOD personnel can log-in to the GRMS portal to schedule household relocation shipments.

The economic damage and costly business disruption brought on by the global spread of the COVID-19 virus have failed to slow the gathering momentum behind environmental sustainability and the array of efforts to battle climate change.

After decades of doubt on the part of business leaders, sustainability is delivering ROI. Businesses, investors, consumers, governments and others see it as a source of post-pandemic resiliency, efficiency and competitive advantage. Why is it proving durable now?

“A low-carbon recovery could not only significantly reduce emissions, but also create more jobs and economic growth than a high-carbon recovery would,” McKinsey says.

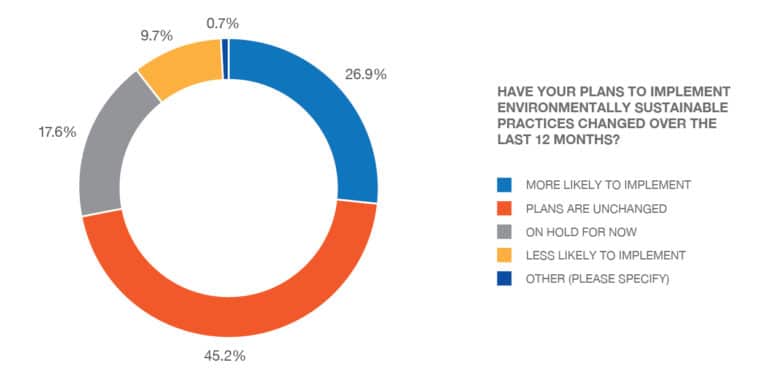

Many industries are doubling down on sustainability investments. Few are backing off. In an Agility survey of 1,200 global supply chain executives, 72% of respondents said their companies will maintain or increase their environmental sustainability commitments coming out of the pandemic.

Want more proof? In May, the International Energy Agency slashed its forecast for the amount of renewable energy capacity to be added worldwide in 2020. But by year’s end, the IEA was forced to backtrack.

“The renewables industry has adapted quickly to the challenges of the COVID crisis. We have revised the IEA forecast for global renewable capacity additions in 2020 upwards by 18% from our previous update in May. Supply chain disruptions and construction delays slowed the progress of renewable energy projects in the first six months of 2020. However, construction of plants and manufacturing activity ramped up again quickly, and logistical challenges have been mostly resolved with the easing of cross-border restrictions since mid-May,” the IEA says.

Global asset managers want in on sustainability. In 2020, they poured more than $5 billion into so-called blank-check companies created to invest in businesses that are driven by environmental, social or governance (ESG) principles or formed to bring ESG ideas to market.

“Capital markets are wide open for investment in green businesses in a way that they’ve never been before: Interest rates are at historical lows, technology costs have fallen, and financial regulators are beginning to nudge investors, so the risk-reward equation is beginning to shift,” says Dickon Pinner, who leads McKinsey’s global Sustainability practice.

There were 20 ESG-focused blank-check companies — also known as Special Purpose Acquisition Companies (SPACs) – launched last year, according to Pitchbook. (Agility said in January that it invested $35 million in Queen’s Gambit Growth Capital, a blank-check company that will target businesses offering sustainable solutions in clean energy, healthcare, financial technology, industrials, mobility and emerging technology.)

A report by SAP and media firm Which-50 indicated a “strong shift to sustainability” among the corporations tracked by consultants and research firms such as BCG, Gartner, Juniper and Forrester.

“Sustainability has shifted from a discussion largely driven by compliance to one at the centre of business strategy,” says Which-50.

Companies are taking aggressive steps to stay ahead of the pack. VF Corp., parent of Timberland, North Face and Vans brands, is one of many companies drilling deeper into their own supply chains. VF’s traceability mapping gives the company a view of its tier 1 through tier 4 suppliers. In a show of transparency, VF has posted 46 of 100 anticipated product maps online.

In a recent survey of European consumers, 57% of respondents said they had made significant changes to their lifestyles to ease the environmental impact. More than 60% said they were taking steps to recycle and buy products in environmentally friendly packaging.

“Consumer behavior and changing tastes are all moving in the direction of sustainability and adding pressure on companies and brands to do the same,” says Mohammed Esa, Agility GIL’s Senior Vice President of Global Business Development. “Social media plays a big role because it gives consumers a much bigger voice than they ever had.”

Thousands of companies have announced ambitious goals. Apple, for instance, vows to be carbon-neutral by 2030.

Fifty-three companies signed the Climate Pledge, co-founded by Amazon, committing to getting themselves to net-zero carbon emissions by 2050 – 10 years ahead of the Paris Agreement. The pledge requires them to adopt rigorous reporting, cut emissions and neutralize remaining emissions with credible offsets. Climate Pledge signatories include Microsoft, IBM, Johnson Controls, Unilever, Canary Wharf Group, Uber, Henkel, Siemens, Mercedes-Benz, Infosys, Real Betis, Daabon Group,

Another group has promised to share best practices for achieving net-zero emissions. The Transform to Net Zero initiative includes Maersk, Danone, Mercedes-Benz, Microsoft, Natura & Co., Nike, Starbucks, Unilever, and Wipro. The initiative makes business plans and other resources available online.

TextileGenesis, based in Hong Kong and India, is one of many apparel companies adopting blockchain so it can track the sourcing of raw materials through to production and shipment of finished garments.

The fashion and apparel industry is moving to introduce sustainable materials such as recycled cotton, lyocell (made from wood pulp) and viscose (made from wood) in place of less environmentally friendly fibers like polyester and nylon, which contain petroleum, coal and chemicals. Blockchain would help apparel manufacturers source, track and certify their use of the new materials.

Piramal Glass, an Indian company that makes bottles and glass packaging for the pharma, cosmetics and perfume industries, is using blockchain to get supply chain transparency and auditability.

Another important advance is the use of digital or virtual twinning.

The flood of data available from the Internet of Things (IoT) and cloud computing makes it possible and cost effective to create digital “twins” that model and simulate processes with potential to deliver environmental benefits.

“This pairing of the virtual and physical worlds allows analysis of data and monitoring of systems to head off problems before they even occur, prevent downtime, develop new opportunities and even plan for the future by using simulations,” says Forbes.

The Port of Rotterdam is using digital twinning to model automation, design and sustainability features that are part of its push to become “the world’s smartest port.” Twinning gives port planners the ability to virtually test use of autonomous ships, “digital handshakes” for documentation exchanged between vessels and the port, and emissions-lowering port call practices.

Without digital twinning, port officials would have no way to test the transformational processes without disrupting operations at a sprawling port that handles 8.8 million containers and 15 million twenty-foot equivalent units a year.

“In a virtual environment, we can verify and validate solutions before the real tests begin, maturing solutions much faster. We also don’t have the safety risks or hazards we would in real-life tests and that’s why this digital environment is better and faster for development and validation work,” says Karno Tenovuo, CEO of Awake.AI, the Finnish company that is Rotterdam’s smart-port development partner.

Tenovuo says ports will able to lower CO2 emissions 10% by adopting the features and optimization methods that will be harnessed in Rotterdam.

Slow to embrace sustainability, the maritime logistics industry is now an area to watch.

Leading container lines and ports are working on standards for a just-in-time port call process that would eliminate wasteful delays and dwell times. JIT port calls would allow ships to optimize steaming speed, lower fuel use, cut CO2 emissions, and avoid getting stranded outside ports waiting for berthing slots.

Singapore’s futuristic Tuas port is being built to handle 65 million TEUs a year. By consolidating existing container-handling facilities at a single location, Singapore will cut inter-terminal trucking hauls and emissions. Reused and recycled materials make up half of the land reclamation work, and the port is moving sensitive coral colonies that would have been damaged by the construction.

Maersk, the world’s largest container line, is accelerating development and deployment of the world’s first carbon-neutral container ship. Maersk says the vessel, a smaller ship known as a feeder, will run on biomethanol, made from paper-mill waste and other byproducts. It will join the Maersk fleet in 2023.

RightShip, a maritime risk-management company, created a ratings system to compare the efficiency of different cargo ships, along with operational performance used to score ships on safety. RightShip ratings allow shippers to choose vessels with lower CO2 footprints, better fuel efficiency, and higher safety ratings.

European Union companies that rely on imports from South Asia are promising broader market access, training and gap assessments for Sri Lankan exporters whose products can meet international sustainability standards.

The initial group of Sri Lankan companies are providers of rubber, apparel and food products, but a German and EU business delegation has agreed to help Sri Lanka extend the project to its critical tourism sector.

Banks and venture capital firms are offering preferential terms to companies that agree to meet environmental criteria, such as reporting CO2 emissions and implementing emissions-reduction strategies.

In early 2020, BlackRock, the world’s largest asset manager, notified hundreds of listed companies in its portfolio that it had started to factor environmental issues and performance into its investment decisions.

A year later, BlackRock told its own investors that it had voted against the management of 53 companies – including some of the biggest global names in manufacturing and industrial supply – because those companies failed to “make sufficient progress regarding climate risk disclosure or management.”

Too many companies still rely strictly on internal data to get a picture of their supply chains. To strengthen their post-pandemic supply chains and drive sustainability, many realize they need to exchange data with suppliers and customers.

Seventy-percent of shippers look at sustainability as part of RFPs, and more are requiring their vendors to report on sustainability metrics on a regular basis. They want to know about fuel efficiency; CO2 emissions; alternative fuel use; personnel & staffing devoted to sustainability; and fleet age.

Climate TRACE, an alliance of climate research groups, is close to launch of an initiative that will track and publish greenhouse gas emissions traceable to individual factories and ships.

“Our work will be extremely granular in focus – down to specific power plants, ships, factories, and more. Our goal is to actively track and verify all significant human-caused GHG emissions worldwide with unprecedented levels of detail and speed,” the alliance founders say.

Climate TRACE will give business leaders, investors, NGOs and climate activists a powerful tool “while ensuring that no one – corporation, country, or otherwise – will ever again have the ability to hide or fake their emissions data.”