Data centers are often thought of as the backbone of the internet, and for good reason. Without data centers, we would not be able to store or access the massive amounts of data that are generated every day.

They are becoming increasingly important in the Middle East as the region’s economies transform digitally. In this article, we discuss key points you need to know about data centers in the Middle East and how Agility can help data center operators grow faster in the region.

What are data centers and what services do they offer?

Data centers are facilities that house computer systems and their associated components, such as telecommunications and storage systems, including servers, etc. Data centers typically require a large amount of power to operate and need to be located near robust telecommunications infrastructure to ensure the speed of data transmission.

Data centers offer a variety of services that can help businesses with their data storage and processing needs. They can provide storage space for data, as well as the infrastructure needed to process and manage it.

Data centers can also offer tools and services to help businesses analyze their data and make decisions about how to use it. In addition, data centers can provide access to high-speed networks and computing resources that can help businesses with their data-intensive tasks. Artificial intelligence (AI) and machine learning (ML) are two examples of use cases.

Data centers are critical infrastructures for many organizations. They store and manage data, applications, and other resources that are essential to the operation of the business. Data centers are used by companies of all sizes, from small businesses to large enterprises. They play a vital role in supporting mission-critical applications and services.

There are many different types of data centers, ranging from small facilities to large hyperscale data centers. The type of data center that an organization needs depends on its specific requirements.

Small and medium-sized businesses typically use colocation data centers. In a colocation data center, the customer rents space from a service provider and uses the service provider’s infrastructure to house its servers and other IT equipment.

Large enterprises often build their own data centers. These data centers are designed to meet the specific needs of the enterprise, such as accommodating a large number of users or supporting high-performance applications.

Hyperscale data centers are the largest and most powerful type of data center. They are designed to support the massive scale of operations of hyperscale companies, such as Google, Facebook, and Amazon.

What is driving the growth of data centers in the Middle East?

There are several factors driving the growth of data centers in the Middle East, including:

- Data sovereignty laws mandate that certain categories of data – e.g. government and certain personal data of citizens and residents – be resident in the country

- Migration to the cloud for hosting data by both governments and enterprises in the region

- Rising consumption of data by consumers driven by the growth of 4G or 5G services from telecom companies and the usage of applications that leverage artificial intelligence (AI)

- Growing connectivity of subsea cables to countries in the region enables larger flows of data from the country globally

- Lower latency requirements from streaming applications like Netflix and other so-called Over-the-Top media services (OTTs).

What is the current data center market size and what are the forecasts for growth?

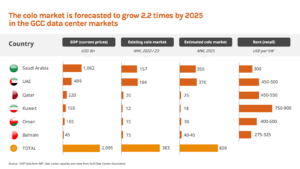

The colocation market in the six Gulf Cooperation Council (GCC) data centers in the Middle East is forecasted to grow 2.2 times by 2025 from 383 MW of IT load to an estimated 839 MW of IT load, demonstrating the large investment that is going into this sector.

Some commentary from the Gulf Data Center Association (GDCA) on the 6 GCC markets in the Middle East:

Saudi Arabia – The largest economy in the region is seeing a lot of growth in data center activity.

- The government continues to offer strong support for data centre growth. The Ministry of Communications and Information Technology (MCIT) recently called for an $18 Billion investment in hyperscale data centers and renewable energy by 2030 to take total capacity to more than 1.3GW and transform Saudi Arabia into the main data center hub for the region.

- With a population approaching 35 million, there is a large domestic demand which has been reinforced by recent data protection laws that place tight restrictions on the transfer of data outside of the country. Saudis are avid users of social media and consumers of online content. Notably, Saudi Arabia is becoming a global hub for esports and gaming.

- Saudi Arabia has 16 in-service subsea cables, which places it as one of the highest amongst other GCC countries in terms of connectivity. The 2Africa cable, which will be the longest subsea cable ever developed and is expected to come into operation by the end of next year, has four cable landing points in Saudi Arabia. Google’s Blue Raman cable, which will connect Europe to the Middle East and India without going through the Gulf of Suez, includes a future cable landing point in Duba on the Red Sea.

- Whilst Riyadh, Jeddah, and Dammam remain the three main clusters for data center development, the government is pushing ahead with the development of Neom. As an early deployment in the development of the city, Neom is building a 12MW data center facility, with Oracle announced as the first tenant.

UAE – The UAE has led the GCC region in terms of data center capacity, variety of data center operators, and future growth ambition for many years.

- The market has remained attractive with its tech-hungry and growing population, as well as Dubai’s position as a major international business and trading hub.

- The UAE has worked hard to improve its international and regional connectivity, now being served by 17 international subsea cables, whereas a decade ago, this number was significantly lower.

- Multiple hyperscale cloud providers are now present, including AWS, Microsoft, Google, and Alibaba. AWS’s recent launch of their own data centers in the UAE reflects the country’s rapid uptake of cloud services, with most Government entities, large enterprises, and SMEs using cloud services already or are in advanced stages of actioning a migration plan.

Qatar – Demand for data center requirements in Qatar received a big boost ahead of the World Cup last year, which saw massive investment into new infrastructure to support the global sporting event.

- Until recently, the market in Qatar was limited to just two operators offering colocation services, namely Meeza and Ooredoo. However, with the entry of cloud providers Microsoft and Google, the market has shifted into another phase of development, with a number of international operators now actively looking at Qatar for opportunities to offer build-to-suit facilities, which is opening up the market to potential new entrants.

- Qatar was the first country in the world to launch 5G services back in 2018. It has the cheapest power costs for businesses in the GCC and has the highest per capita levels in the region.

- Qatar is making big efforts to diversify the economy away from its past reliance on oil and natural gas as well as develop more sustainable sources of energy. Large-scale solar projects are now in operation with the 800 MW Al Kharsaah project, with a further 800MW of solar output in the pipeline to be developed by 2024.

Kuwait – The Kuwaiti data center market was limited to a handful of players offering retail colocation, but Google will be the first hyper scaler to enter the market.

- The known providers are Zain, Ooredoo (formerly Fast Telco), Kalaam (formerly Zajil), and Solutions by STC (formerly Quality Net). These are all telecom companies that have built additional colocation data center space alongside their own needs. The majority of these facilities are built in their own headquarters occupying a couple of floors in each building. Smaller hosting businesses have taken space within the Tec Building tower, which is home to Kuwait’s cable landing station.

- The rest of the market currently lies within enterprise facilities – in particular, the financial services sector, which continues to invest in enterprise facilities. ITU built a 1,200 sqm data center with over 500 servers for Kuwait Finance House in 2021.

- The market has recently seen an increase in cloud requirements as businesses look to migrate to the cloud. However, the market has struggled to expand to support new requirements and, as a result, has seen some requirements go to neighboring GCC markets. For example, Batelco has an alliance with Ooredoo, and its Global Zone data center in Bahrain is made available to support Global Zone Kuwait.

- There have been multiple attempts by the existing providers (along with a few other GCC operators) to build new facilities. However, difficulties in finding logistics space and securing sufficient power have halted most progress.

- Google is opening a cloud region in Kuwait – the first hyper scaler in the country. Google is working closely with the government as part of a strategic partnership to help promote further digital transformation in the economy and meet the goals set out in the 2035 Kuwait Vision Plan. This includes further development and availability of e-services. Mastercard, for example, has collaborated with Google to recently launch Google Pay in Kuwait.

- The new cloud region has led to a requirement for data center development which has heightened interest levels from a number of international wholesale operators. However, finding suitable sites for data centers and navigating the approval process has so far proved challenging.

- Agility Logistics Park (ALP), one of the largest real estate owners of warehousing and industrial land, has announced plans to deploy data center campuses across several Middle East and African countries, including one on a site in Kuwait next to a major substation.

Bahrain – The Bahrain data center market has managed to attract some major wins over the past few years

- Names such as AWS, Tencent, and the recent announcement of a major data center campus with STC prove that there is significant confidence in this market.

- Confidence stems from an active and supportive Government with regard to data centers, along with a geopolitical climate that is widely considered to be stable and safe

- Bahrain’s attributes include an open telco market, a reputation as an easy place to do business, and lower operating costs compared to other GCC countries.

- Taking advantage of its geographical position, the Bahraini market is working hard to position itself as a central Gulf location that can manage a wide range of requirements, including disaster recovery, regional cloud deployments such as cloud gaming, and a keen interest in financial markets and fintech.

- The government of Bahrain continues to support data center opportunities via the Economic Development Board of Bahrain (EDB Bahrain). This is in keeping with the Kingdom’s Cloud First policy, introduced in part to reduce the cost of Government I.T. infrastructure.

- Tencent Cloud announced plans that it would build its first data center in Bahrain, which could make it the second cloud player to do so after AWS established its availability zone in the Kingdom of Bahrain in 2019.

Oman – Oman has the highest number of subsea cables in the GCC with 14 currently in operation and a further 4 planned.

- Omantel is the main telecom company in the country and has a joint venture with 4Trust that operates Oman Data Park which has several facilities in Wattayah, Knowledge Oasis Muscat and Duqm. Last year, Oman Data Park announced plans to build a data centre in Zanzibar.

- Oman has set a target of 30% of all power to come from renewable sources by 2030 with a number of large-scale solar and wind projects in the pipeline.

- The capacity of the sector in Oman is undergoing a growth phase with a number of data centres under construction. In the past, many companies used their own in-house facilities but demand for colocation is rising with migration to the cloud.

- Oman has three free trade zones (Al Mazunah, Sohar and Salalah) and two special economic zones (Duqm and Knowledge Oasis Muscat). Various incentives are on offer to help attract inward investment including allowing 100% foreign ownership of companies. Last year, the Sohar Free Zone agreed to lease 25,000 sqm of land to a Chinese firm to build a cloud data centre.

- At the end of 2022, the Ministry of Transport, Communications and Information Technology (MTCIT) signed an MoU with AWS to launch a local zone for cloud hosting in Muscat. Oman is the first country in the MENA region to host an AWS local zone after its launch in the US and other cities in the world.

What are the challenges to the development and operation of data centers in the Middle East?

There are several challenges to the development of data centers in the Middle East, including:

- Land acquisition – securing sites with the appropriate land use/zoning at the right location with proximity to power and fiber connectivity

- Permitting – securing the permits for building and operating a data center

- Power – securing large amounts of power, preferably from green sources

- Talent – Given this is a rapidly growing industry, there is a dearth of talent across the value chain in the industry in this region

How Agility can help enable data center operators to grow faster

Agility Logistics Parks (ALP), the leading private owner and developer of industrial real estate in the Middle East & Africa, has a portfolio of data center campuses, which are sites with substantial power and utilities (including renewable energy), building permits, and regulatory approval, to accelerate time-to-market for data center developers.

ALP has four decades of expertise in land acquisition and development in emerging markets and is a strong institutional partner for data center developers looking to deploy capacity rapidly across the Middle East.

ALP’s value proposition is speed to market in a de-risked manner in complex, challenging emerging markets leveraging several capabilities:

- Land acquisition – Large sites with title secured. Prime locations. Master planned and tailored for hyperscale clients and operators.

- Power & utilities – All sites already have secured multi-megawatt scale power availability with expansion opportunities.

- Fiber connectivity – Fiber connectivity from two POPs to all sites. Large fiber strand count

- Authority approvals – Ability to secure permitting and approvals for large complex projects in all markets

- Regulatory approvals – Ability to help secure proper regulatory approvals to operate in the local market.

- Construction expertise – Proven local construction and project management expertise. Pre-qualified vendors and ecosystem.

- Sustainability – Renewable energy sources available for all sites. Solar is available for all sites. Hydroelectric is the main power source for Ghana.

- Security & operations – Proven security and facilities operations support expertise in all markets.

The first two data center sites that ALP has brought to market are in Kuwait and Riyadh, Saudi Arabia:

- Kuwait – More than 100,000 sqm of land with 80+ MW of power available today with under a millisecond latency connectivity to the cable landing station. Solar power is available.

- Riyadh – 82,000 sqm of land available and 25+ MW available. Solar power is available.

ALP is looking to add more sites in Saudi Arabia and the UAE in response to strong demand from data center operators.

Connect with Agility’s data center campuses team for further information.