By Tarek Sultan

Vice-Chairman of the Board, Agility

- Investment is pouring into Gulf startups from domestic and foreign sources.

- Start-up friendly policies, access to funding and the multiplier effect are just a few of the reasons for this growth in investment.

- Powerful local and global economic currents are benefitting the Gulf states.

This is a golden age for startups and entrepreneurs in the six countries of the Gulf Cooperation Council (GCC). Geopolitics, technology, climate urgency and daring national agendas across the region have combined to create what might be the most favourable conditions that small businesses anywhere have ever enjoyed.

Private-sector expansion is the key to national ambitions in all six countries. Increasingly, Gulf leaders will be looking to small business and entrepreneurs as engines of job creation and innovation.

The time is right. The ecosystems that Gulf countries established to nurture, fund and scale digital startups are maturing. Gulf funders — from sovereign wealth funds to venture capitalists to family offices — are looking to write checks to entrepreneurs closer to home. Regulatory fine-tuning is creating new openings for smaller companies that have struggled to compete. Massive infrastructure, energy and technology projects are having a spinoff effect for local businesses and specialized service providers. Finally, powerful currents in Gulf trade, foreign investment, research and e-commerce are all working in favour of SMEs.

Five reasons the time is now for startups and small businesses in the Gulf

1. Funding

Simply put, there’s more money from local and international sources looking to invest in young, innovative Gulf companies.

The Gulf’s sovereign wealth funds have more than $4 trillion in assets under management, a record. They account for more than 40% of global SWF wealth, and their investments comprised 40% of the global sovereign investment total through the first nine months of 2024. Increasingly, Gulf fund managers are looking to invest more at home so that they can drive private-sector growth at the heart of the region’s national strategies.

Saudi Arabia’s Public Investment Fund (PIF) is shifting the balance of its portfolio to focus less on international holdings and more on investment in new industries and projects in the Kingdom. PIF Governor Yasir Al-Rumayyan said in October that the fund will trim its global holdings to 18% of its portfolio, down from 30% in 2020.

In other cases, Gulf sovereign funds are putting money into young companies with innovative ideas that can aid home-country economic diversification. Abu Dhabi’s Mubadala recently invested in Odoo, a Belgian company that offers single-platform software for small and medium-sized companies.

Venture capital investment in the GCC quadrupled from 2017 to 2022 and continues to outpace growth in most other geographies, increasing at a 24% compound annual growth rate. Investment is pouring into Gulf startups in AI, specialized online marketplaces, climate tech, delivery apps, fintech, edtech and investment platforms.

At the same time, overseas funds such as US-based ScienceWerx are putting down new roots in Saudi Arabia and neighboring countries so they can be first movers in AI, biotech, healthtech and other emerging fields. Similarly, Brookfield Asset Management says it is raising at least $2 billion for a new Middle East-focused private equity fund with PIF and other partners.

2. Multiplier effects

The vast majority of small businesses in the Gulf aren’t the kind to attract direct investment from sovereign funds and venture capitalists. But most can expect to be lifted by the “agglomeration” or multiplier effect that flows from the staggering amount of investment and spending across the region, particularly in mega-projects, logistics infrastructure, AI, clean energy and climate adaptation.

In the US, where most of the research on multiplier effects has been done, there is a clear correlation between investment and increased demand for local goods and services; increased productivity; and job creation. The addition of one highly skilled job in an urban area creates 2.5 jobs in other sectors dominated by smaller businesses: construction, food service and other localized roles.

3. Regulatory incentives

Gulf governments are using their policy levers to create new jobs, expand private-sector growth and boost investment. Among all the carrots and sticks being deployed by policymakers are loads of advantages and opportunities that benefit smaller businesses. Some examples:

— In the UAE, where there are nearly 50 economic free zones, operators are competing to create the most business-friendly conditions. The Ajman NuVentures Centre Free Zone, the newest in the Emirates, promises to grant business licenses online in 15 minutes and issue two-year visas for investors within 48 hours.

— In Saudi Arabia, one of the main drivers of growth in the small business sector has been the Kingdom’s sweeping push to make it easier and more attractive for women to join the workforce. Since 2017, the Kingdom has lifted the ban on women driving, introduced anti-harassment laws, expanded female legal autonomy, introduced childcare and transportation subsidies for working women, mandated equal pay and prohibited termination of pregnant women. Today, women own 45% of small and medium-sized businesses in Saudi Arabia. The rate of female participation in the labour force roughly doubled to 35% between 2017 and 2023.

— To create jobs for their citizens, Gulf countries are requiring private companies to meet hiring quotas and maintain a certain percentage of nationals in their workforce. In the UAE, small businesses can qualify for grants, subsidies and reduced fees by taking part in labour force Emiratization.

— Saudi Arabia’s Regional Headquarters Programme, intended to get multinationals to establish their regional head offices in the Kingdom, will add to the multiplier effect by sending global companies in search of Saudi partners for everything from local recruiting to branding, advertising and marketing.

4. Promotion and skills development

Gulf countries are getting better at figuring out what startups and small businesses need. Where non-energy exports used to be negligible, they are now aggressively promoted by the Saudis, Emiratis and other GCC governments.

In Kuwait, which licensed 6,700 new companies through the first three quarters of 2024, the National Fund for SME Development recently launched its Mubader Plus programme, offering workshops, counseling and other assistance to budding entrepreneurs.

Dubai’s Expand North Star, with 70,000 in attendance in 2024, is the world’s largest tech startup and investment event.

5. Powerful tailwinds

Gulf leaders are embracing the post-World War II US innovation model, which uses government money to fund university research that can produce ideas later scaled and commercialized by the private sector. GCC countries are establishing or expanding universities and pushing them to innovate through partnerships with leading international research institutions or alongside Gulf counterparts through platforms such as the Qatar-led My Gulf University.

Trade trends are also working in favour of SMEs. The UK and six GCC countries are nearing completion of a new free trade agreement valued at $73 billion annually. A new FTA with the UK is likely to accelerate economic integration among the six countries, as will Gulf e-commerce, which continues to outpace other regions in annual growth.

Not to be overlooked is the China factor. Chinese companies are looking to the Gulf as the place where they can diversify their manufacturing base, invest in renewable energy and hydrogen production and become EV market share leaders. Chinese investment in Gulf-based AI and tech development is making the GCC a hub for digital transformation and commerce.

For entrepreneurs, startups and small business in the GCC, it’s never been a better time.

This blog was originally published by the World Economic Forum.

By Henadi Al-Saleh

Chairperson, Agility

- Female-founded companies received only 2% of all venture capital (VC) investment in 2022.

- Gender bias and a scarcity of female investors are thought to hamper VC investment in female-owned businesses.

- By expanding female-led VC communities, highlighting successful VC funding for female businesses and confronting stereotypes, more VC funding should flow to female-founded companies.

By most measures, women are making steady gains in professional opportunity, pay and status and decision-making power at work. Their progress, while slow and uneven, is reflected in economic empowerment indexes put out by the OECD, World Health Organization, UN agencies and others.

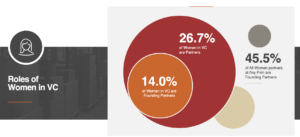

One area where women are advancing little, however, is venture capital (VC). Companies founded solely by women received only 2% of all VC investment in 2022, and only about 15% of all VC ‘cheque-writers’ are women.

In the Middle East, where my company is based, venture capital investment is increasingly seen as a critical component of national economic competitiveness and a source of innovation. The region’s VC funds and corporate VCs are competing with sovereign wealth funds, among the world’s largest and most active VC investors. Yet, startups founded by women in the Middle East and North Africa (MENA) received only 1.2% of funding in 2021 and about 2% last year.

What’s behind the disparity?

The glaring imbalance has sparked lively debate about what’s causing it.

Venture capital is a male-dominated industry and bias, whether conscious or subconscious, is clearly a factor. A Harvard study showed that 70% of VC investors preferred pitches presented by male entrepreneurs over those presented by female entrepreneurs, even though the pitches were identical.

Another analysis has shown that VC investments in enterprises founded or co-founded by women average less than half the amount invested in companies founded by male entrepreneurs.

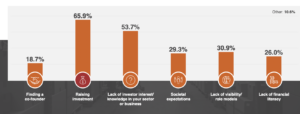

In Inc.’s Women Entrepreneurship Report, 62% of female entrepreneurs said they experienced some form of gender bias during the funding process. Feelings of bias are especially acute among women entrepreneurs in MENA. In a survey of 125 female founders in the region, 58% said MENA investors were less likely to invest in women-led startups than global investors.

The scarcity of female investors – those who sit on fund boards, lead deals, and make investment decisions – is also an issue. However, the authors of a Harvard Business Review article on the VC gender gap caution women founders against focusing solely on pitching to female investors.

“There are still very few female investors, and they tend to be concentrated in funds that focus on earlier-stage investments, where risk is higher and funds invested are smaller. Today, female VCs simply do not control sufficient assets to continue investing in female-led firms as they scale. This means that female founders will ultimately need to attract male investors to grow — and if you’re a woman, our research shows that’s a lot easier to do if you raise at least some capital from men from the start,” they wrote.

Another hard reality is the lack of a pipeline; here I speak from experience. Our corporate VC arm, Agility Ventures, received about 1,000 pitch decks last year. How many came from women-founded or women-led businesses? I can count them on one hand.

The lopsided numbers in MENA are especially perplexing because of the inroads women in the region have made in the educational fields that generate most of the innovation and ideas sought by venture investors. Women now account for 57% of STEM students at MENA universities, according to UNESCO.

Image: Data Source: Wamda, TiE Dubai – survey of 125 female founders in MENA, published in collaboration with TiE Dubai and TiE Women

Why address the VC gender gap?

Apart from the need to address basic inequity, there are plenty of reasons to tackle the gender chasm in venture capital. The biggest is the chance to unlock economic gains.

Venture funding de-risks the innovation process through bets on promising ideas from smart people who need resources to get their ideas to market. It’s a wellspring of new technology, business growth and economic development, which makes the diversity of entrepreneurship and VC leadership economic imperatives. A widely cited BCG report says global GDP would rise 3% to 6%, boosting the global economy by up to $5 trillion annually if women entrepreneurs received the same investment as male entrepreneurs.

What’s the answer?

Expand women-led VC communities

That means networking, mentorship, technical assistance and other support. It means building on the work of investment community participants, such as Women in VC, the world’s largest global community for women in VC to connect and collaborate; AllRaise, an organization dedicated to accelerating the success of women founders and funders; and the Female Founders Fund, an early-stage fund that offers pitching resources and technical help in addition to investing in women-led tech startups.

It also means more non-profit and public-sector programmes, such as empowerME, an initiative aimed at female entrepreneurs in the Middle East; Monsha’at, a Saudi government small business authority with an entrepreneurship programme targeted at women; She Innovates, the global UN Women programme that connects female innovators via app and platform; and Global Invest in Her, a platform for women entrepreneurs seeking funding.

Celebrate success

We need to elevate the visibility of female role models who have raised capital and successfully brought products and services to market. Stories of success act as inspiration and provide models for females in business to emulate. Mona Ataya, CEO of Mumzworld, is a good example.

Confront stereotypes

The Global Entrepreneurship Monitor (GEM) highlights one damaging stereotype: that businesses started by women typically aren’t the kind that are right for outside investment because they’re low-tech enterprises in sectors with little potential to scale, trade across borders and go public through stock offerings.

“More attention needs to be given to women who are starting and growing high growth, high innovation and large market businesses. Stereotypes that frame women entrepreneurs as a disadvantaged group feed a false narrative that women lack the same competency as men regarding business leadership,” the GEM team says.

The views expressed in this article are those of the author alone and not the World Economic Forum.

This blog was originally published by the World Economic Forum.

The challenges businesses face today demand courageous leadership and a new model of collaboration. What are the winning strategies, technologies, and business-models that can keep companies competitive while also building better, greener, and fairer economies? Hear from the speakers of Agility’s Tandem Talks breakfast series at the World Economic Forum’s Annual Meeting 2023.

WEF Tandem Talks: Macro Pairing | Money Pairing | Movement Pairing | Mindset Pairing

Agility Tandem Talks: Hassan El-Houry | Paul Baldassari | Sarah Chen-Spellings | Claude Letourneau | Beth Ann Lopez | Nadir Salar Qureshi

WEF Tandem Talks – Macro Pairing

WEF Tandem Talks – Money Pairing

WEF Tandem Talks – Movement Pairing

WEF Tandem Talks – Mindset Pairing

Agility Tandem Talks – Hassan El-Houry

Agility Tandem Talks – Paul Baldassari

Agility Tandem Talks – Sarah Chen-Spellings

Agility Tandem Talks – Claude Letourneau

Agility Tandem Talks – Beth Ann Lopez

Agility Tandem Talks – Nadir Salar Qureshi

By Tarek Sultan

CEO, Agility

There are plenty of flashing lights warning us of the possibility of a sharp economic slowdown in 2023.

We know that COVID-19 has reversed years of progress in global development. It has widened gaps in education, health, income and access to opportunity. It brought on the steepest economic decline since World War II and, by World Bank estimates, pushed 97 million people into extreme poverty.

Today, the global economy is slowing amid a flood of risks: depleted national budgets, war in Ukraine, high inflation, traumatized labor markets, tightening credit, disruptive climate events, a COVID-challenged China, and unprecedented supply chain instability.

As we look ahead, we face three key questions:

- How can we limit, repair and reverse the damage done by the pandemic and its aftermath?

- How can we create a system that’s more open, transparent and fair for the poor, developing countries, women, and small businesses?

- How do we ensure shared prosperity as we speed our transition to a low-carbon future?

It seems obvious, right? We should work to make sure the next phase of global growth includes geographies, businesses and people who’ve traditionally been left out. “The idea of inclusive growth has emerged as a central theme animating discussions on recovery and growth in the post-COVID world,” the World Bank says.

Not everyone agrees. Growth-first advocates view inclusion as a dangerous diversion that could sidetrack economic revival. They want us to focus on growth because they see any recovery as a rising tide that lifts all boats.

That’s a hard sell to those demanding inclusion. They warn that we could see a massive economic divergence between rich and poor, haves and have-nots. And they note that even before the pandemic, we were witnessing the highest levels of income and wealth inequality on record.

“This inequality has disproportionately affected communities of color, women, those less physically abled, and certain geographies,” McKinsey says.

Growth or inclusion is a false choice. Insufficient economic inclusion is — in itself — “a threat to prosperity,” as McKinsey says.

The consulting firm cites research showing that economies grow faster, more vigorously and for longer periods of time when the fruits of that growth are shared and distributed more equally across the population. Up to 40% of the GDP growth in the U.S. economy from 1960 to 2010 can be attributed to the increased participation of women and people of color in the labor force, McKinsey says.

At the same time, you can’t have inclusion and sustainability without growth as the foundation. So where will it come from?

There are four areas where technology can clearly be a powerful force for both inclusion and growth.

1. For small businesses.

Small businesses provide 70% of jobs worldwide and contribute 50% of GDP in developing countries, according to the International Labor Organization.

In the supply chain industry, a host of inexpensive new digital tools are bringing efficiency to smaller shippers and carriers. Among them:

- AI-driven load matching (Frete, Flock Freight) – that allow shippers to pool goods on trucks and bypass freight hubs

- Digital payments for carriers and other stakeholders (Relay Payments, FreightPay)

- Credit, working capital and payments platforms (PayCargo)

- Customs and security digitization products (MDM)

- Online logistics platforms that combine a lot of these features (Shipa)

All of these tools improve cash flow and streamline financial operations by digitizing payments, reconciliations and discrepancies between shippers and carriers, dramatically reducing Accounts Receivable/Accounts Payable errors and processing time.

Digital tools also make sustainability viable for smaller businesses and startups, allowing them to take climate action and build more resilient businesses.

- Free or inexpensive measurement tools

- Resources such as playbooks, and matchmaking platforms that link them with potential partners and vendors (SME Climate Hub, SME360X)

- Supply chain mapping tools that help small businesses do due diligence, customs compliance, environmental and social sustainability tracking, in addition to operations and business continuity planning (Sourcemap)

2. For women.

How can we do more to draw on the talents of women in the workforce, particularly in emerging markets countries, where they are most underrepresented?

One way is by making it safer, faster and more affordable to get to work. That’s what Swvl is doing in Egypt, Pakistan and other emerging markets countries with tech-oriented transportation.

3. For the unconnected poor.

Thirty-seven percent of the world’s population – about 2.9 billion people – has never used the Internet, the International Telecommunications Union says. Most live in developing countries. Nearly all are poor.

Poverty, illiteracy, and lack of connectivity and electricity contribute to this alarming digital divide. In Afghanistan, Yemen, Niger, Mozambique and the poorest countries, nearly 75% of people have never connected. That means remote learning was out of the question during the pandemic – and a major threat to a whole a generation of school children. Connectivity is the only way to address the dangerous “learning loss” that we experienced during COVID.

4. For those whose jobs are at risk from automation & digitization.

So-called frontier technologies are here. Many take advantage of digitalization and connectivity: artificial intelligence (AI), the Internet of Things, big data, blockchain, 5G, 3D printing, robotics, drones, gene editing, nanotechnology and solar photovoltaic.

While they offer incredible promise and productivity gains, these technologies will eliminate jobs. And without massive, targeted, well-resourced upskilling and retraining programs, the adoption of next-generation technologies could profoundly deepen inequality by shutting large numbers of people out of meaningful employment.

The World Bank’s Gallina Vincelette identifies four pillars for inclusive growth. They are life-long learning, removal of barriers to firm entry, trade that fosters competition, and a faster green transition.

Technology can supercharge all four, while bringing down costs, improving productivity and creating good new jobs.

IBM CFO Jim Kavanagh calls technology “the only true deflationary” force in a global economy where companies are struggling to cope with inflation driven by higher human capital costs – salaries, recruiting, retention, churn, overall cost of talent acquisition – plus higher materials costs, fuels costs, transportation costs, borrowing costs, currency volatility costs and other factors.

Growth and inclusion aren’t in conflict. They’re the essential ingredients of a better world.

This blog was originally published by the World Economic Forum

By Tarek Sultan

CEO, Agility

The global supply chain continues to sputter and break down more than two years into the pandemic. Each day comes news of choked ports, out-of-place shipping containers, record freight rates, and other problems that cause disruption and defy easy answers.

Unless you’re the one waging the day-to-day battle to move cargo for your organization, you should find a moment to take a deep breath. Step back and look at the larger picture because when ports eventually clear and rates come down, the way we manage and think about the supply chain will be very different.

How? Let’s look at the changes in the supply chain brought about by the COVID-19 pandemic.

1. Supply chain is on the front-burner for good

The supply chain finally has the C-suite’s attention, and chief supply chain officers are its new stars. In October, for the first time, corporate CEOs in a McKinsey survey identified supply chain turmoil as the greatest threat to growth for both their companies and their countries’ economies. Bigger than the COVID-19 pandemic, labor shortages, geopolitical instability, war, and domestic conflict.

At about the same time, Bank of America noted that mentions of “supply chain” in Q3 earnings calls by Fortune 500 companies had risen an astonishing 412% from Q3 2020 and 123% from Q2 2021 earnings calls, when the boardroom focused on the issue was already red hot. Fifty-nine percent of companies say they have adopted new supply-chain risk management practices over the past 12 months, including diversifying to reduce overreliance on China.

“We’re seeing a supply chain that is being tested on a daily basis,” Kraft Heinz CEO Miguel Patricio said recently.

2. Flexibility + resiliency + business continuity > cost

Before the pandemic-driven supply chain disruption, cost reduction and productivity enhancement were driving supply chain process improvements, digitization, and investment. Those drivers remain essential, but the unprecedented chaos triggered by COVID threatened the competitive position — even the survival — of many businesses that found they could no longer meet customer expectations.

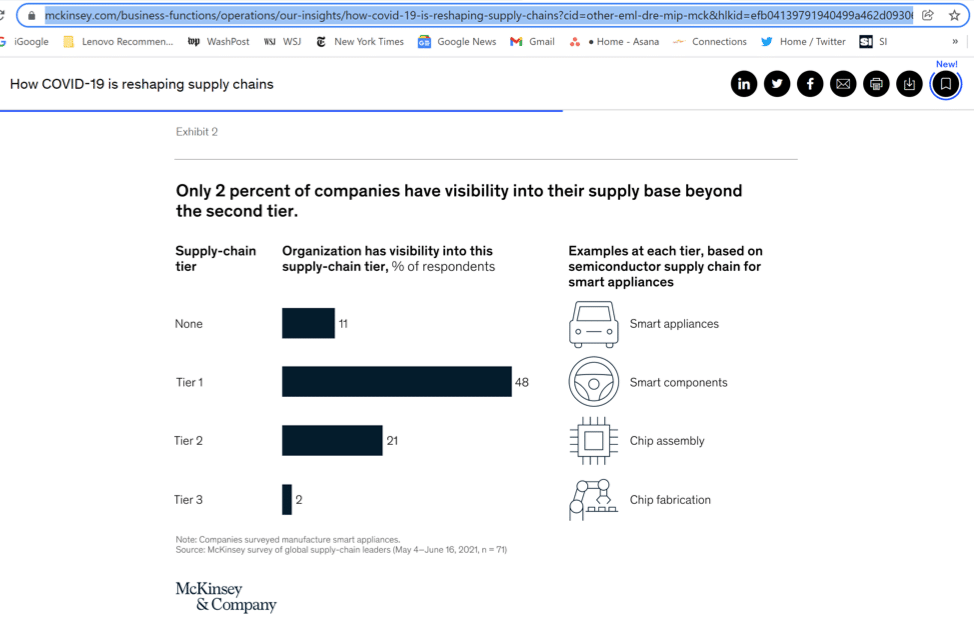

The existential crisis brought on by the pandemic has forced companies to shift the focus of innovation and restructuring efforts to ensure business continuity by building resiliency and flexibility. McKinsey highlighted the vulnerability of manufacturers by showing how few had any visibility into their supplier networks beyond Tier 1 suppliers.

Clorox is one of many companies taking action. It is investing $500 million to upgrade its digital capabilities, citing the need for real-time visibility and better demand planning.

“Supply chain and operations teams must develop new capabilities―and quickly. Playing to a more balanced scorecard will require many changes: reducing the carbon footprint, building greater resilience in the supply chain, creating more transparency, and ensuring accountability,” says Bain & Co. in a new report.

3. Buyer-supplier relations have been altered

In certain industries, the failure of critical links in the supply chain has led to new alliances and co-development ventures between OEMs and suppliers. Alarmed by the shortage of semiconductors, for instance, Ford and General Motors have formed strategic agreements with chipmakers.

More broadly, there is a recognition that resiliency is impossible unless buyers, suppliers, and other parties along a value chain are willing to share data and collaborate. A new Reuters report, Where’s My Stuff? suggests that businesses could share sensitive, closely held data with partners by creating “cleanrooms” where joint teams can perform analysis without fear that competitive information will leak. Blockchain technology, which enables secure, access-controlled data exchange, also could be valuable in data sharing. It allows data storage and distribution through a decentralized network where there are no owners.

“With the benefits of increasing collaboration through data sharing and visibility into deeper tiers becoming more obvious, addressing mistrust becomes a key objective and will require concerted and directed efforts. … (O)rganizations will need to move closer to their suppliers and build relationships and trust, but they can also use smart approaches to data sharing to make progress,” the Reuters report says.

4. Business lines are blurred and ‘workarounds’ are SOPs

Bold companies are not waiting for supply lines to untangle themselves. Retailers short on storage space are buying warehouses. Shippers that can’t find containers are making their own. Companies unable to book with ocean carriers are chartering vessels themselves. Those unhappy with their online sales are buying e-commerce fulfillment operators.

Amazon and ocean giants Maersk and CMA CGM are placing orders for aircraft and moving into air freight. Maersk and CMA CGM, in fact, appear to be on a collision course with Amazon and Alibaba in logistics, forwarding, and delivery.

Nimble shippers and manufacturers know they have to keep adjusting. They are using alternative ports, reformulating products, shifting to air freight, boosting in-house trucking, taking advantage of off-peak port hours, and diverting resources from low-margin products to bigger moneymakers.

In its healthcare unit, GE is redesigning products, using dual sources, and expanding factory capacity as it struggles to cope with semiconductor shortages and other supply chain changes and challenges that have caused turmoil in the medical technology industry.

GE and Stanley Tools are among the many companies that have sought to secure goods by shifting production, using forward contracting, turning to contract manufacturers, fast-tracking plant expansion, building new contract manufacturing hubs, using dual-source manufacturing, and nearshoring, or making hard-to-get parts with 3D printing.

5. The inventory playbook has been ripped up

Companies know that disappointed customers might not come back. That’s why some consumer product brands are desperate to conceal stockouts and disguise low inventory, even reconfiguring in-store displays and using decoys to hide shortages.

More fundamentally, others are questioning the supply chain models they have worked so hard to make hyper-efficient. Automakers that spent decades fine-tuning and perfecting just-in-time systems have started to break with JIT practices because they don’t work when there are shortages of critical components. Toyota, Volkswagen, Tesla, and others are stockpiling batteries, chips, and other key parts and racing to lock up future deliveries.

“The just-in-time model is designed for supply-chain efficiencies and economies of scale,” said Ashwani Gupta, Nissan Motor Co.’s chief operating officer. “The repercussions of an unprecedented crisis like COVID highlight the fragility of our supply-chain model.”

To ensure they have enough to sell, retailers Nordstrom, PVH, and Gap have tried “pack-and-hold” strategies — over-ordering to prevent stockouts with the gamble that they can stash away unsold inventory and sell it as new next year rather than having to discount deeply.

In other industries built on lean inventories, there is a debate about whether we are seeing a permanent change in strategy – toward larger inventory and more safety stock – or a temporary one necessary because of higher demand.

The Reuters report suggests that more companies are prepared to implement aggressive Continuous Replenishment Programs and automate more of their ordering to avoid getting caught flatfooted without sufficient stocks.

What’s clear is that nearly two years after the world first learned of COVID, the supply chain is still experiencing an unfortunate series of firsts. A historic level of carrier unreliability. Record-high freight rates. Record-low warehouse vacancies. And more.

It will pass. When it does, look for more intelligent options that offer supply chain resilience for both the short and long term.

Agility’s Tarek Sultan joined the London Business School’s Middle East Club for a fireside chat on the rise of successful startups.

Nearly 90% expect export growth by using tech to overcome shipping, regulatory obstacles

DUBAI – May 10, 2018 – Small and medium-size businesses that have struggled for equal footing in the global economy are increasingly looking to cross-border trade for growth, seeing technology as a way past obstacles in shipping and compliance, according to new research from Shipa Freight.

Shipa Freight’s global study of 800 SMEs from developed and emerging markets shows that smaller companies are remarkably upbeat about their ability to expand through trade.

Eighty-nine percent of exporting SMEs surveyed say their export revenue will grow over the next three years. Seventy-one percent say they are concentrating more on international markets than on their home markets. The Shipa Freight survey included exporters and importers from the UK, USA, Germany, Italy, China, India, Indonesia and UAE.

Smaller companies account for an estimated 95% of all businesses and employ two-thirds of the world’s workers. Critics of globalization have argued that decades of efforts aimed at easing the flow of goods, capital and jobs across borders has come at the expense of SMEs and disproportionately benefitted multi-nationals and other large businesses.

“Smaller businesses used to think they couldn’t compete in trade. Now many see it as their best path for growth,” says Toby Edwards, CEO of Shipa Freight, the online freight service. “SMEs are not naïve about the obstacles to unlocking new markets. They see online tools and other technology as a way to conduct transactions, get financing and gather market intelligence.”

Three-quarters of SME executives surveyed by Shipa Freight believe businesses that operate internationally are more resilient. Nearly 80% say they are already using online platforms for freight quotes and bookings.

Roadblocks

SMEs identified numerous obstacles they face in international trade. Forty-two percent say the costs of shipping abroad are too high, or that they don’t have an accurate picture of their costs. Forty percent say they find it difficult to understand documentation requirements.

A significant minority say their cargo has been held up in customs (39%) or lost in transit (27%).

Small and medium-sized businesses based in emerging markets are finding export regulations particularly challenging: 67% identify export regulations as a difficult issue, compared with just 44% of SMEs based in mature European markets. Seventy-nine percent of exporters from India, China and Indonesia say they find it challenging to penetrate markets in Europe.

SMEs that view the UK as one of their top export markets are looking elsewhere because of Brexit. Seventy-three percent say Britain’s vote to leave the European Union has prompted them to prioritize trade with other European countries. Sixty percent of UK SMEs that export and 52% of UK SMEs that import say that leaving the EU Single Market would be “disastrous” for them.

New tech boosts export prospects

Smaller companies clearly see technology as a way to close the gap with bigger competitors, cope with documentation requirements and get quick access to competitive shipping options. Eighty-six percent say that tech is “leveling the playing field” for SMEs to operate globally; 89% believe technology is transforming the logistics industry.

“The logistics industry has traditionally ignored SMEs and done far too little to help them find new markets and grow,” Edwards says. “Technology is giving them the ‘virtual’ scale that they’ve needed to lower their costs, get real-time information and compete.”

About the study

Shipa Freight’s Ship for Success research examines the trade patterns and barriers of SMEs, defined here as organizations with 10-250 employees. The opinion research was conducted in winter 2017 amongst 800 companies (400 exporters and 400 importers). There were 100 respondents from each of the following markets: UK, USA, Germany, Italy, India, Indonesia, China and UAE. Study participants included SME leaders, such as managing directors and operations directors. Participating companies were drawn from the following sectors: retail and fashion, fast-moving consumer goods (FMCG), automotive (including supply chain), industrial and manufacturing, and technology. You can explore the findings and download the full report below. Download full report

About Shipa Freight

Shipa Freight is the new online service powered by Agility that makes it easy to get air and ocean freight quotes, book, pay and track your shipments online. With our global network of logistics experts and industry-leading technology, we ensure that your goods arrive safely and reliably every time.

For more information about Shipa Freight, visit www.shipafreight.com/

Twitter: twitter.com/ShipaFreight

LinkedIn: linkedin.com/company/shipafreight/

YouTube: youtube.com/ShipaFreight

About Agility

Agility is one of the world’s leading providers of integrated logistics. It is a publicly traded company with more than $4.6 billion in revenue and more than 22,000 employees in over 500 offices across 100 countries. Agility Global Integrated Logistics (GIL) provides supply chain solutions to meet traditional and complex customer needs. GIL offers air, ocean and road freight forwarding, warehousing, distribution, and specialized services in project logistics, fairs and events, and chemicals. Agility’s Infrastructure group of companies manages industrial real estate and offers logistics-related services, including customs digitization, waste management and recycling, aviation and ground-handling services, support to governments and ministries of defense, remote infrastructure and life support

For more information:

Sabrina Mundy

Man Bites Dog

+44 1273 716 826

[email protected]

‘Emerging markets’ refers to the combined results of India, China and Indonesia. It does not include UAE figures. ‘Mature European markets’ refers to the combined results of the UK, Germany and Italy.

This article is part of the World Economic Forum Annual Meeting

- The number of potentially disruptive technologies in logistics is daunting.

- This makes it difficult for supply chain businesses to know where to look.

- Blockchain, IoT, automation and data science should be first on their list.

Astute business leaders discipline themselves to be on constant lookout for disruptive new technologies.

They foster an internal business culture that is able to evaluate promising technologies through a continuous cycle: Watch > pilot > partner > adopt or discard.

In logistics, as in many other sectors, the number of potentially disruptive innovations is daunting. It includes everything from augmented reality and big data to autonomous vehicles and 3D printing. Even the most agile businesses can’t test or pilot everything, so what’s the right approach?

For companies with goods to move, there are several technologies that bear watching and four that every party in the supply chain should be testing at some level. These four are the BIRD technologies – blockchain, the internet of things (IoT), robotic process automation (RPA) and data science.

The BIRD technologies are inter-related and mutually reinforcing. Blockchain, or distributed ledger technology, establishes trust in data. The IoT provides a vast quantity of relevant data points. RPA improves the accuracy of data. Data science extracts value.

1) Blockchain

Blockchain has its skeptics, including many who believe the technology has already fallen short and might be too inherently problematic. Some skepticism is justified, but it’s premature for blockchain to be written off.

The idea behind blockchain is that all of the information required for completion of a transaction is stored in transparent, shared databases to prevent it from being deleted, tampered with or revised. There is a digital record of every process, task and payment involved. The authorization for any activity required at any stage is identified, validated, stored and shared with the parties who need it.

In ongoing pilots of this technology, shippers, freight forwarders, carriers, ports, insurance companies, banks, lawyers and others are sharing “milestone” information and data about their pieces of an individual shipping transaction. What’s missing today is agreement by all the relevant parties in the supply chain – including regulators – on a set of common industry standards that will govern the use of blockchain.

Absent a consensus on standardization, blockchain offers little. But with a common framework and set of rules, it could make shipping faster, cheaper and more efficient by increasing trust and reducing risk. It would shrink insurance premiums, financing costs and transit times, and eliminate supply chain intermediaries who add cost today but who would become surplus to requirements.

2) The internet of things

As a platform for sharing trusted data, blockchain is ideally suited to the internet of things. IoT devices can be attached to almost anything. As 5G technology evolves and spreads, tiny IoT chips embedded in products will enable businesses to track and monitor shipments of pharmaceuticals, high-tech goods, consumer products, industrial machinery and garments.

That data can be encrypted and shared through the blockchain so that customers and suppliers have a real-time record of the transaction. An IoT-enabled supply chain would be both leaner and less risky. It would allow for true just-in-time production by guaranteeing inventory accuracy and, in turn, reducing working capital requirements.

3) Robotic process automation

Of course, data is no good if it is not accurate. In the supply chain, the leading cause of inaccuracy is human error. Robotic process automation, or RPA, is the artificial intelligence used to allow software to handle many of the steps involved in a shipping transaction by understanding and manipulating data, triggering responses and interacting with other digital systems.

Use of RPA can ensure accuracy in customs declarations, safety certificates, bills of lading and other paperwork. It can reduce reliance on the manually entered data, emails and digital forms that produce errors, create delays and add cost all along the supply chain. RPA frees up workers to be more productive by doing what humans do best: solve problems, react to the unexpected, think creatively and deal with customers.

4) Data science

Thanks to data science, we are in the midst of seismic change in the supply chain. We are getting more data from more sources; it is the right data; and it is accurate. Tools such as artificial intelligence, machine learning and cloud computing enable us to analyze and use that data in powerful new ways.

Rather than using information to sound alarms when there are “exceptions” – problems or anomalies with an individual shipment or in the supply chain – we can use it to prevent them. Data becomes about managing the future, not the present.

The risk, of course, is that only large, well-resourced supply chain players will be able to take advantage of BIRD technologies and other advances that involve harnessing data. That would create a dangerous new digital divide between large and small, haves and have-nots.

Thankfully, data is having a democratizing effect by making the global economy fairer and more inclusive in important ways. Small businesses and emerging markets companies aspiring to go global aren’t piloting blockchain or developing their own RPA applications. But they are already the beneficiaries of new, inexpensive, data-informed tools and platforms underpinned by artificial intelligence and machine learning: online freight booking, instant financing, automated marketing, cheap cloud computing and remote advisory services.

The BIRD technologies generate trust in data, ensuring accuracy and giving users the ability to predict and act. In a data-driven world, they can help businesses of all sizes take flight.