- The center in Jebel Ali Free Zone South is being established in a new partnership with Agility and will serve customers in the United Arab Emirates, Bahrain, Kuwait, Yemen and Libya, among others

- Increasing speed of product availability, the Center will reduce time-to-market by 58 percent

- The center will facilitate the delivery of more than 3400 tons to the region.

Dubai, November 17, 2020 – Bayer Middle East FZE has announced the launch of its regional distribution center that will reduce time-to-market by as much as 58 percent. The center will facilitate the delivery of more than 3400 tons annually, while ensuring greater network flexibility, increased frequency and dedicated stock for customers in the Middle East.

Supporting network optimization and streamlining supply, the warehouse is located in the Jebel Ali Free zone, close to the Jebel Ali Sea Port with easy connections to Al Maktoum International (DWC) and Dubai International (DXB) airports and major road arteries.

Equipped with the latest warehousing and cold chain technologies, the facility operated by Agility, one of the world’s leading logistics companies, is spread over 60,000 m² with multiple storage temperature options. Accommodating over 100,000 pallet positions, 56 loading docks and 83 material handling equipment, the center is fully compliant with Ministry of Health, EU Guidelines on Good Distribution Practice and World Health Organization standards.

Thomas Panzer, SVP – Head Supply Chain Management Pharmaceuticals at Bayer AG said, “Customer focus is among Bayer’s core values and is embedded deeply in our overall supply chain strategy. With a presence in the Middle East for more than 85 years, we have been providing important healthcare and crop protection products to customers in the region. Within the last decade we have successfully launched various innovative products that advance the unmet health and nutritional needs of the region, which as the next step required us to invest in logistics infrastructure to ensure greater flexibility and reduce lead times.”

Henrik Wulff, Senior Bayer Representative – Middle East & Head of Bayer Pharmaceuticals Middle East added, “Advancing health and nutrition remains a priority for us. We want to ensure increased and closer product availability especially amidst COVID-19 through this center. Benefitting from Dubai’s strategic geographic location and logistics infrastructure and Agility’s experience, scale, operational capability and regional track record, the Center improves our distribution model in the Middle East and optimizes our last mile processes.”

Integrating fully with Agility’s warehouse management systems, Bayer will maintain visibility and traceability of inventory employing the latest technologies. The center will be supported by another facility that will be implemented in Germany in mid-2021 as part of Bayer’s long-term commitment to Middle East customers.

Albert Asool, CEO, Agility Dubai said, “Through this partnership we aim to support Bayer with world-class warehousing that incorporates multiple temperature-zone storage and cold-chain solutions. Our strategically positioned regional logistics hub, pharma supply chain expertise and distribution network incorporate a comprehensive suite of services, technologies and tools that provide visibility and traceability down to the unit level.”

The center is a key milestone for Bayer Middle East which as a legal entity was established in 2012 in the United Arab Emirates to cater the business of its leading divisions, Bayer Pharma, Bayer Consumer Health and Bayer Crop Science in the region including GCC countries and Egypt. Prior to the launch of the center, Bayer products were previously being directly imported into the local markets and sold to pharmacies, end consumers and patients through a distributor network.

| Q3 2020 (Million KD) | Q3 2019 (Million KD) | Variance (%) | 9 Months 2020 (Million KD) | 9 months 2019 (Million KD) | Variance (%) | |

| Revenue | 403.0 | 400.7 | 0.6% | 1,168.0 | 1,175.8 | -0.7% |

| Net Revenue | 120.4 | 133.3 | -9.7% | 364.0 | 386.4 | -5.8% |

| EBITDA | 46.5 | 47.4 | -1.9% | 122.4 | 142.4 | -14.1% |

| Net Profit | 15.3 | 21.7 | -29.4% | 31.5 | 63.6 | -50.4% |

| EPS (fils) | 8.00 | 11.33 | -29.4% | 16.47 | 33.22 | -50.4% |

Numbers above are rounded

KUWAIT – November 8, 2020 – Agility, a leading global logistics provider, today reported Q3 earnings of 8 fils per share on a net profit of KD 15.3 million, a decrease of 29.4% compared with the same period a year earlier. EBITDA declined 1.9% to KD 46.5 million, and revenue was flat at KD 403 million.

Nine-month earnings stood at 16.47 fils per share on net profit of KD 31.5 million, a decrease of 50.4% over the same period in 2019. EBITDA declined 14.1% to KD 122.4 million, and revenue declined 0.7% to KD 1,168 million.

Tarek Sultan, Agility Vice Chairman and CEO, said: “While we – like many businesses – are still feeling the impact of COVID-19 we are also seeing recovery across most of our business lines, albeit with each business recovering at a different pace. Agility benefited from early and decisive measures taken to contain costs and preserve cash, and is well poised to navigate what is likely to continue to be a volatile market for some time. Agility remains committed to investing in technology that will transform our industry, expanding our digital logistics offerings, and bringing world-class warehousing infrastructure to fast-growing emerging markets.”

Agility Global Integrated Logistics (GIL)

Global Integrated Logistics Q3 EBITDA was KD 18.5 million, a 35.2% increase from the same period in 2019. The improvement was primarily driven by significant cost reductions across the business.

GIL’s Q3 net revenue was KD 71.4 million, 5.1% higher than the same period in 2019. Along with net revenue increases in Air Freight and Contract Logistics, there were net revenue declines in Ocean Freight, Fairs & Events and Project Logistics. GIL gross revenue was KD 305.7 million, a 7.3% increase from same period in 2019.

The Q3 Air Freight NR increase of 39.1% was driven by continued demand for exceptional shipments related to the Life Sciences vertical. Ocean Freight NR declined 14.5% when compared with Q3 2019, as a result of volume and yield compression. Air Freight and Ocean Freight volumes decreased in Q3 vs. same period in 2019, as a result of customers’ demand and production disruption arising from COVID-19 as well as capacity constraints.

Contract Logistics continues to experience strong growth (12.7% net revenue growth), mainly in the MEA Region (Kuwait, Saudi Arabia, UAE), where there was strong performance at new facilities, along with increased efficiencies. Fairs & Events (F&E) has been hurt significantly by Coronavirus-related event postponements and cancellations.

Starting in Q1, GIL introduced a range of cost reduction measures intended to ensure continued strength of EBITDA performance in anticipation of falling global trade volumes. This positions GIL well for operating in the current environment. GIL continues to focus on operational productivity as well as customer solutions to respond to the changing market environment.

Agility’s Infrastructure Companies

Agility’s Infrastructure group EBITDA declined 16.5% to KD 31.6 million during the third quarter. UPAC, NAS and GCS were primarily responsible for the decrease, each reporting significant declines as a result of the pandemic. In contrast, Agility Logistics Parks (ALP) and Tristar proved resilient during this pandemic. Infrastructure group net revenue fell 24.4%, and gross revenue declined 15%.

ALP experienced revenue growth of 5.6% in the third quarter. ALP continues to see increased demand for warehousing spaces from customers that are mainly suppliers of necessity goods. ALP is moving ahead with the developments in Kuwait, Saudi and Africa to meet customers demand.

Tristar, a fully integrated liquid logistics company, posted a 15.9% revenue decline mainly due to commercial fuel sales. Maritime segment has shown a healthy growth due to the deployment of new vessels on long term contract. Fuel Farm segment also reported an increase in revenue as compared to same period last year. At the profitability level, Tristar have achieved improvement in earnings mainly due to contribution from Maritime segment. Tristar contractual business model helped them to be resilient during this crisis and achieve a profitability growth compared to last year.

National Aviation Services (NAS) reported a Q3 revenue decrease of 46.1% but is beginning to see improvements in passenger traffic and flights. NAS Kuwait continues to suffer from the cap imposed by the government on the number of passengers/flights into/out of Kuwait International Airport. Other geographies NAS operate in performed well, and are experiencing a rebound. NAS VIP services and airport lounges have been mostly impacted, where, in most cases, lounges remain closed. Cargo remains a positive subsector for NAS.

The pandemic also has affected performance at United Projects for Aviation Services Company (UPAC), which saw revenues decline in the third quarter compared to last year; primarily due to the cessation of operations at the Kuwait International Airport during the lockdown period and subsequent resumption of traffic at a lower capacity. Business is starting to show signs of gradual recovery as UPAC continues taking measures to reduce the negative impact on its business.

At GCS, Agility’s customs modernization company, revenue fell 30.2% in this quarter compared to the third quarter of 2019 due to the decline in trade movement, though the negative impact of COVID-19 eased during Q3.

Recap of Agility 3rd quarter 2020 Financial Performance

- Agility’s net profit decreased 29.4% to KD 15.3 million. EPS was 8 fils vs. 11.33 fils a year earlier.

- Agility’s EBITDA decreased 1.9% to KD 46.5 million.

- Agility’s revenue increased by 0.6%, to KD 403 million and net revenue decreased 9.7%.

- GIL revenue increased by 7.3% to KD 305.7 million.

- Infrastructure’s revenue declined 15% to KD 101.7 million.

- Agility enjoys a healthy balance sheet with KD 2.2 billion in assets. Net debt was KD 173.9 million (excluding lease liabilities) as of September 30, 2020. Reported operating cash flow was KD 115.2 million for the first nine months of 2020, an increase of 17.5%.

Agility will hold its Third Quarter Earnings Webcast on Thursday November 12, 2020 at 2:00 pm (Kuwait), 6:00 am (New York) and 11:00 am (London).

Please connect to the following web session at least 10 minutes before the beginning of the event:

Webcast Connection details:

Please note that a presentation will be displayed on the PC.

To view the presentation, please click the above link and join the web meeting.

Participants joining by webcast will be able to send questions via a chat box within the webcast player.

In the case you would like to submit your questions ahead of the scheduled webcast, please contact [email protected].

Sincerely,

Investor Relations Department

Agility Public Warehousing Company

Vehicle configuration means significant environmental, and operational benefits

ABU DHABI – November 4, 2020 – Agility, a leading global logistics provider, is the first logistics company in Abu Dhabi to operate double-trailer trucks, which will improve operational efficiencies for its customers and reduce emissions by cutting the number of trips made.

Agility operates an extensive fleet of trailers in Abu Dhabi. About 50 of those are now double-trailer trucks. Double trailers significantly reduce the number of trips required to haul cargo, decreasing overall wear and tear on tires and vehicles. In the first six months of operation, Agility’s fleet management data demonstrates that double trailers reduce fuel use by 26% per container, eliminating about 2,500 metric tons of CO2 emissions per year.

Houssam Mahmoud, Chief Executive Officer for Agility Abu Dhabi, said: “In addition to being environmentally friendly, the double trailers will positively impact productivity – and that’s good for both Agility and our customers. We are able to pass a lot of this benefits to our customer by providing greater flexibility and a significant reduction in the number of required trips.”

Acquiring the permit to operate double-trailer trucks took six months of proposals, trials, accident simulations, and safety demonstrations. Agility worked together with a local automotive distributor to develop the safest possible solution for the market, including Active Brake Assist 4, proximity control, and lane assist. Agility conducted a transport route survey to identify any routes that might be risky or challenging for drivers. Agility insisted on lane assist capability for the vehicles, and proposed it to the supplier after determining that drivers would need help to navigate sharp round-a-bouts. In the United Arab Emirates, Agility has an industry-leading safety record, linking driver incentive pay to safety, rather than speed of operations, and has voluntarily provided extensive third-party training on double trailers to ensure it maintains its excellent record.

Completed Phase 3 clinical study paves way for approval request

DUBAI — September 23, 2020 – Healthcare solutions provider Global Response Aid (GRA) and Dr. Reddy’s Laboratories (NYSE: RDY) announced that the anti-viral drug Avigan® produced promising results in a single-blinded, placebo-controlled Phase 3 clinical study conducted in Japan with the sponsorship of FujiFilm Toyama Chemical.

Patients who received Avigan® recovered from COVID-19 symptoms 2.8 days earlier, on average, compared with the control group. Analysis showed patients had a statistically significant higher probability to recover when administered Avigan® compared with the patients not receiving the drug.

The study involved 156 hospitalized patients showing COVID-19 induced pneumonia, and divided in two groups or “arms.” Patients in the first arm received Avigan®. Patients in the second arm received a placebo looking identical to the drug. A statistically significant percentage of the patients in the group receiving Avigan® had a rapid reduction in viral loads.

The study aimed to measure recovery from pneumonia and COVID-19 symptoms. It monitored patients’ temperature, oxygen saturation and CT scan imaging of the lungs. Time-to-alleviation of the symptoms was measured between the first administration of the drug (or placebo) and the moment when SARS-COV-2 induced symptoms became undetectable.

Shortening recovery time lowers the risk of complications in patients and, importantly, significantly reduces the risk that a patient will spread the virus. The latest results open the possibility of treating patients with mild or moderate cases of COVID-19 in outpatient settings, which also could help slow the spread of the pandemic.

Avigan®, which contains the active ingredient Favipiravir, was developed by FujiFilm Toyama Chemical in the 1990s as an anti-influenza drug. GRA, Dr. Reddy’s Laboratories, and FujiFilm Toyama recently entered a global licensing agreement covering the production, marketing and distribution of Avigan®.

Results of the Japan trial suggest the effectiveness of Avigan® as a treatment to prevent COVID-19 patients from progressing from mild to more severe or critical clinical stages of the disease, and to accelerate recovery from COVID-19 symptoms.

GRA CEO Mitch Wilson said the FujiFilm Toyama study represents a breakthrough in the fight against COVID-19, and opens the way for approval of Avigan® as a COVID-19 treatment in Japan. The drug is already approved in India, Russia, Indonesia and other countries around the world.

“The findings from this university-led study are the proof we all need to tackle this pandemic,” Wilson said. “We are actively working with regulators in order to speed up the approval in major markets. Because Avigan® is manufactured in pill form the drug can be self-administered from home, which reduces patient load in hospitals and on medical staff. Furthermore Avigan® does not require refrigerated transport or storage making it much easier to quickly distribute the drug to countries and markets with limited cold storage infrastructure”

Avigan® is the subject of clinical trials in COVID-19 patients in several countries. It was used to treat COVID-19 patients in studies in China’s Hubei province, led by the China-Japan Friendship Hospital. It is undergoing testing in the United States in a multi-site Phase 2 study involving initially hospitalized patients, a trial sponsored by FujiFilm Toyama Chemical. It also is the subject of an investigator-initiated Phase 2 study in subjects with mild or asymptomatic COVID-19 being conducted by the Stanford University School of Medicine.

Avigan® Tablet was approved for manufacture and sale in Japan in 2014 as an influenza anti-viral drug. The drug is to be considered for use only when there is an outbreak of novel or re-emerging influenza virus infections in which other influenza anti-viral drugs are either not effective or insufficiently effective, and the Japanese government decides to use the drug as a countermeasure against such influenza viruses. GRA is a Dubai-based company established by global logistics leader Agility (KSE: AGLTY) and AiPHARMA a biotechnology company to procure and develop certified diagnostic, testing and protective products and services used in the detection, treatment and prevention of COVID-19 and other public health threats.

By Chris Price, Chief Executive Officer, Agility Global Integrated Logistics

- When the pandemic dies down, trade protectionism will become the biggest threat to global supply chains.

- This will both drive up prices and make resiliency harder to achieve.

- Accelerated digitalization and uptake of new technologies can help firms find a balance between supply chain resiliency and efficiency.

Seven months into the COVID-19 pandemic, businesses of all kinds are devising ways to protect themselves from future shocks by making their supply chains more resilient. In doing so, they need to guard against the mistake of preparing for the last battle rather than the coming one.

At some point, hopefully soon, the unprecedented global response to COVID-19 will reduce it to a manageable threat that allows us to return to something approximating normalcy in our personal and professional lives.

When that occurs, the greatest immediate and long-term risk to supply chains won’t be a virus. It will be trade protectionism, which was resurgent even before the COVID crisis, and now threatens to choke off the lifeblood we need to speed us toward recovery.

As recently as 2016, trading nations were erecting fresh barriers – subsidies, tariffs, quotas, licensing requirements and other obstacles – at twice the rate they were adopting measures to liberalize trade, according to Global Trade Alert. By 2018, new obstacles outpaced liberalizing steps by three to one. Last year, the ratio was four to one, and the value of global merchandise trade fell by 3%, the first decline since 2015.

Since the start of the COVID-19 crisis, we have seen protectionism intensify. Some emergency moves are clearly temporary. They were put in place by governments to ensure access to the medicines, machines and protective equipment required to contain or treat the virus. In other cases, the aim was to guarantee adequate food supplies for local populations.

Yet these new measures and others have been taken against a backdrop of simmering trade tensions between the world’s two largest economies, the US and China, and a growing chorus of voices in the US, Germany and other countries calling to re-shore, nationalize or find alternative sources for key products and industries such as 5G wireless equipment, semiconductors, steel, electrical power gear, mobile cranes, rare earth minerals and other goods.

The 164-nation World Trade Organization (WTO), normally the body that would quell trade wars and bolster the global consensus for free trade, has been weakened, perhaps fatally, by a loss of faith in its dispute resolution system and the apparent withdrawal of US support.

“In the current alternate universe we’re living in, global trade is collapsing and the WTO and the liberal order itself are in a true existential crisis,” Bloomberg noted in June.

As economies around the world emerge, unevenly, from the pandemic, we can expect demand to begin to strengthen. As it does, trade flows, carrier schedules and inventory levels will start to normalize, and supply and demand will find a new equilibrium.

But normalization won’t mean a return to normal. The World Bank expects a 5.2% contraction in global GDP in 2020. Advanced economies could shrink by as much as 7%, although they are likely to recover faster than economies in emerging or developing countries, the bank says.

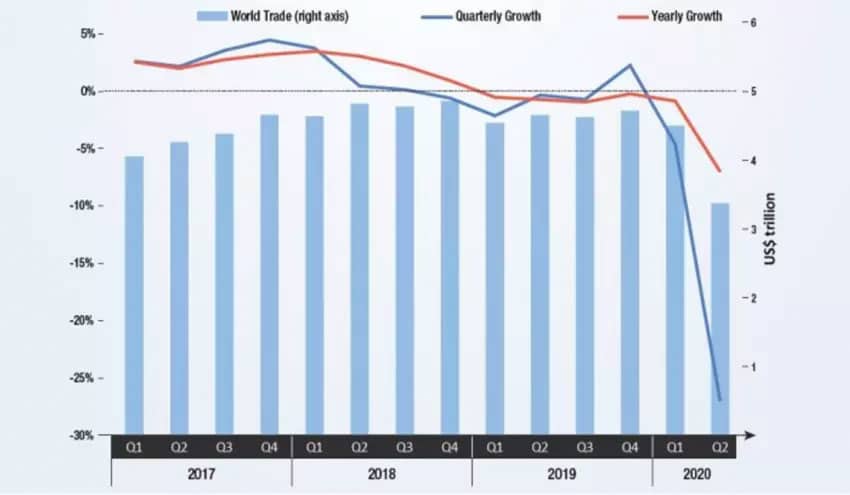

Trade, which has accounted for 54% to 60% of global economic activity in recent years, is set to retreat even further. The WTO forecasts a drop in global trade flows of 13% to 32% in 2020. UNCTAD expects trade to decline by 20%. For context, the largest quarterly decline in trade volume during the 2008 financial crisis was 5%.

The new wave of protectionism, which includes a sharp rise in the use of international economic sanctions and penalties, will significantly increase the cost of goods at a time when we are experiencing historic levels of joblessness, poverty, and business failures on every continent.

Protectionism is likely to make supply chain resiliency harder to attain, not to mention more costly.

The first step toward resiliency is diversification of sources and suppliers. For many, that means reducing reliance on China, which accounts for 28% of global manufacturing.

Yet the economic trauma caused by COVID-19 will shrink the universe of suppliers, not expand it. And new layers of protectionism will leave companies with even fewer choices of supply because they will rob efficient producers – in China and elsewhere – of their competitiveness and make them too expensive.

Simply uprooting from China is not as easy as it seems. Forty years after it began modernizing, China today holds advantages available nowhere else: unmatched scale; abundant skilled and unskilled labour; sophisticated automation, engineering and sciences; world-class infrastructure and logistics; closely synchronized and integrated supplier networks both in-country and across Asia. Twenty-five years ago, leaving China meant leaving a low-cost manufacturing centre. Today, it would mean giving up on the world’s largest consumer market and an economy growing at twice the rate of the US before the COVID-19 crisis.

Other attempts to build resiliency also defy easy answers. For instance, businesses that see the pandemic as a reason to beef up future inventory through the addition of “safety stock” will probably think differently when the historically low cost of capital begins climbing.

Once the COVID-19 threat recedes, businesses across virtually all industries will have to find a new balance between efficiency and resiliency, because the latter carries a cost. Rather than trying to ‘deglobalize’ or shorten the physical length of far-flung supply chains, they should consider the resiliency offered by accelerated digitalization and deeper integration of technology.

From its earliest days, the pandemic separated digital leaders from laggards. Leaders had tools that gave them accurate visibility into supplier status, orders, shipments and inventory. They could make data-driven decisions quickly because they had trusted supply chain partners – especially freight forwarders and third-party logistics providers (3PLs) – sharing fresh information in near real-time and hunting down available production and shipping capacity. Laggards floundered and continue to flounder.

One obvious lesson from the pandemic is that digital capabilities such as predictive modelling, big data and partner integration are driving business flexibility. When things are relatively stable, those digital capabilities provide a competitive advantage. In times of disruption, they give companies the ability to optimize schedules, ports, modes, vendors and other variables, adjusting on the fly to events that could otherwise prove calamitous, even ruinous.

True resiliency means being ready for any kind of disruption: political, economic, cyber, conflict-based or, yes, pandemic-related. Knowing where to find it is what will separate tomorrow’s leaders from laggards.

Originally published on the World Economic Forum’s Agenda blog.

Global Response Aid and Dr. Reddy’s to sell premium original version of anti-viral drug

DUBAI – September 10, 2020 – Global Response Aid (GRA) and Dr. Reddy’s Laboratories will begin selling the anti-viral drug Avigan® in Indonesia following a recent decision by the country’s National Agency of Drug and Food Control (NA-DFC) to approve the drug’s active ingredient, Favipiravir, for treatment of patients infected with COVID-19.

The approval by Indonesia’s national medicines regulator follows a similar decision in August by the medicines regulatory body of India, the Central Drugs Standard Control Organization (CDSCO), which approved Avigan® as a treatment for patients infected with Coronavirus.

Avigan® was developed as an influenza anti-viral by FujiFilm, which has licensed GRA and Dr. Reddy’s to manufacture, distribute and commercialize the drug globally. Clinical trials of the drug have been conducted and are underway in the United States, Japan, China, the Middle East and other countries, where it is being used to reduce fevers and shorten recovery time in patients who receive Avigan® in the early stages of infection with COVID-19.

Throughout the pandemic, the governments of Indonesia and Japan have been collaborating on the search for effective treatments and other challenges. In May, the Japanese government delivered more than 12,000 Avigan® tablets to Indonesia for use in fighting COVID-19.

With the drug now approved for use, GRA and Dr. Reddy’s will distribute Avigan® in Indonesia through private healthcare providers opting for a premium quality drug.

“Generic versions of Favipiravir are or will be available in Indonesia, India and other markets as it gets addditional regulatory approval and becomes accepted as a safe, effective treatment for COVID patients,” said Eric ten Kate, Head of Life Science at GRA. “GRA’s focus is getting branded Avigan®, the premium version of the drug, to providers and patients who want the original formulation, which has a higher potency, fewer impurities and five times the shelf life. Our goal is to provide the safest, most effective version of Favipiravir available anywhere.”

Mitch Wilson, CEO of GRA, said: “Approval by Indonesia means that Avigan®/Favipiravir is now being used to treat patients in the three most populous Asian countries – China, India and Indonesia. We expect further approvals in the near future and will be announcing multiple manufacturing locations globally to meet the growing demand.”

“The diligent and efficient work GRA and Dr. Reddy’s are conducting is the reason we chose them as our partners,” said Junji Okada, President, FUJIFILM Toyama Co., Ltd.

Avigan® was approved for manufacture and sale in Japan in 2014 as an influenza anti-viral drug. It has generally been used only when there is an outbreak of novel or re-emerging influenza virus infections in which other influenza anti-viral drugs are either not effective or insufficiently effective.

Working with government agencies, non-governmental organizations and local regulatory authorities, GRA is providing Avigan® to qualified patients with COVID-19 on a compassionate-use basis for emergency treatment outside of ongoing clinical studies.

The pandemic has disrupted supply chains around the world. It presents vast logistics challenges everywhere. But there are solutions. And at their heart are technology and people – and the tools, communications and data that link them.

The essential nature of logistics has been highlighted by the Coronavirus crisis, from getting personal protective equipment (PPE) to healthcare workers, to replenishing stocks in supermarkets.

The challenges are imposing. From much-reduced air and ocean cargo capacity and a rapid shift from in-store buying to e-commerce to the COVID-19 “bullwhip effect” on inventories and supplies, never have so many businesses and consumers had to adjust, improvise and innovate so rapidly.

Here are four key logistics challenges that spurred the search for new solutions.

- Capacity

Capacity evaporated. In normal times, ocean freight is typically around 90% of global trade volume. But the pandemic initially curtailed the supply of manufactured goods out of Asia, then rippled across the world and sent demand for goods shipped by ocean freight plummeting. Ocean carriers responded by removing shipping capacity from the market: cancelling sailings and eliminating “strings” where vessels call on several ports before reaching a final destination. Air freight capacity also dropped, in large part because a significant portion of air cargo flies in the bellies of passenger flights, many of which were cancelled as passenger traffic dried up. Meanwhile, driver shortages and cross-border restrictions shrank road freight capacity in certain places and led to long backups and delays.

Ocean freight capacity is starting to bottom out and stabilize. In the meantime, a number of other answers have emerged, including:

- Shift of ocean cargo to air, despite higher shipping rates and a scramble for space. Makers of tech products – laptops and headsets – saw demand soar as millions around the world left the office and began working from home for extended periods;

- Use of air charters for urgent, high-value cargo that would otherwise go aboard freighter aircraft or in the belly of widebody passenger flights;

- Conversion of empty passenger aircraft to “passenger-freighters” that can carry cargo in specially packed passenger cabins, in addition to belly cargo;

- Charter sharing and freight consolidation among forwarders or shippers that might normally be competitors;

- Alternative modes such as rail from China to Europe, then long-haul trucking across borders;

- Alternative airports, ports, and trucking routes where there is extra capacity.

- Fluctuating demand

COVID-19 has turbocharged the consumer shift to online buying. In Italy, e-commerce sales of consumer products rose by 81% in a single week; McKinsey forecasts that 55% of consumers in China will continue shopping online as the crisis eases – for example, buying cars without ever visiting a showroom. Businesses weathering the storm include those with omni-channel inventory strategies that have pivoted to BOPIS (buy online, pick up in store) models, and smaller firms such as restaurants that transformed their websites into points-of-sale and converted themselves into delivery-led operations.

The retail-to-go approach presents logistics hurdles. E-commerce demands rapid fulfillment and delivery that is also inexpensive for the consumer. Among the solutions is alternative inventory storage: more warehousing close to point-of-origin or destination, conversion of stores into storage as distribution and fulfillment hubs, or strategic use of ocean freight as “floating storage” through careful timing of orders and deliveries.

- Geographic risk

The crisis also provides an opportunity to re-evaluate supply chain locations. At the start of the pandemic, when China shuttered production, some US fashion retailers said more than 70% of their stock was sourced from the country. Disruption to its industries have left electronics retailers facing delays of 10 weeks on shipments. The same is true for brands producing in other nations.

Will the crisis alter global production and sourcing patterns? Will it prompt companies producing or sourcing in Asia to diversify by spreading production, or to adopt near-shoring or reshoring strategies? There are signs some US manufacturers are looking at bringing production closer to home, mainly in Mexico.

For many, it will be hard to cut or loosen ties to China. Supply chains there are highly efficient, the labor force large and skilled, the market vast and growing. Chinese production is deeply integrated with inputs from and production in other Asian markets. China, for instance, is a major source of fabric for garment manufacturers in the region, making it hard to remove from the equation altogether. And a “China+1” strategy to spread supply chain risk is also potentially expensive.

Many companies with the flexibility to move have already done so, as the result of US-China trade friction that began in 2016, or because labor costs in China were rising. Pre-COVID-19, the Agility Emerging Markets Logistics Index 2020 found 70% of those with operations in China were planning to stay put, despite global trade tensions and other headwinds. This sentiment may endure after the pandemic, suggesting a logistics-led solution, smoothing supply and demand issues, is the best approach.

- Inventory management

Consider the COVID-19 “bullwhip effect” – the changes in consumer demand that ripple through the supply chain at ever greater magnitudes, creating long-term problems for production and supply. This can be seen in the one-off surges in demand for toilet paper – stockouts one week, then excess inventory buildup the next. From goods delayed to goods unwanted, the pandemic has created inventory chaos.

Some solutions exist in creative logistics:

- Improving visibility tools and using advanced data analytics for better modeling;

- Moving stock closer to key markets;

- Working out whether smaller volumes of inventory are needed in order to be more responsive to fast-paced trends;

- Demand planning and ordering in shortened, more frequent cycles.

One lesson of this crisis is that without people, technology is of little value. Companies that reacted quickly to the supply chain disruption caused by the pandemic typically did so because, as Biju Kewalram, Chief Digital Officer of Agility GIL, says, “Technology doesn’t make itself useful. People make technology useful.”

“We’ve found that the customers that have a high degree of digital supply chain already built in were able to flex a lot better and more quickly with us. But they also had agile organizations where internal collaboration and collaboration with customers and suppliers were already part of the culture, data and visibility were shared, and people were empowered to be nimble in how they responded.”