By Agility Vice Chairman Tarek Sultan

As I head to Saudi’s FII conference, known as “Davos in the Desert” this week, I am reflecting on the pace of change I’ve personally witnessed in KSA.

Saudi Arabia’s progress in its journey to becoming a Tier 1 global logistics hub has been impressive. It’s clear the Kingdom is already ahead of many key targets and on course to meet many more, diversifying its economy and enhancing its global profile.

Agility has been investing in Saudi Arabia for 20 years. The scale, resources, resolve, and pace of reform we have seen in Saudi Arabia in recent years has been particularly exciting. In our view, Saudi Arabia is one of the most attractive markets for logistics investments in the world today.

Agility is investing in KSA around the following areas:

- Building essential infrastructure. We’re building a world-class logistics and distribution park near Jeddah. We’ve committed SAR 611 million ($163 million) to the 570,000 SQM project, an ultra-modern facility to go with the state-of-the-art Agility Logistics Parks already serving Saudi companies and multi-nationals in Riyadh and Dammam.

- Improving Air Travel. Our Menzies Aviation business is the world’s largest aviation services company. It has partnered with Saudi Logistics Services (SAL) to improve passenger services, cargo handling and warehousing, and airline hub management for Saudi-based airlines.

- Speeding the low-carbon transition. The Agility Logistics Park in Riyadh features the GCC’s first EDGE Advanced-certified warehouse (Excellence in Design for Greater Efficiencies), meaning it is zero-carbon ready and at least 40% more energy efficient than others in the market. Tristar also is building the Kingdom’s first LEED-certified green building for dangerous goods (DG), in Modon Dammam Second Industrial City.

- Investing in Saudi innovation. Through our venture capital arm, Agility Ventures, we have invested in Saudi Arabia’s entrepreneurs and digital innovators, such as e-commerce enablement innovator Zid and digital road freight platform Humoola. We are also helping bring transformational global health technologies to the Kingdom, through partnerships with companies like AiZTech Labs, which has developed breakthrough medical testing using selfies of the eyes taken with mobile phones and Bexa, a company pioneering innovative breast cancer screening technologies.

- Powering e-commerce. Our Shipa group of companies include Shipa Delivery, one of the Kingdom’s most advanced last-mile delivery providers, and Shipa E-Commerce, a leader in cross-border fulfillment. Shipa provides both domestic parcel delivery and cross-border shipping to and from the GCC and Saudi Arabia.

- Enhancing energy-sector efficiency and safety. Agility affiliate Tristar Group works with Aramco, SABIC, and others in the energy sector to modernize equipment, vehicles and storage facilities used in the handling of chemicals, cryogenic gases and hazardous goods — essential industrial feedstocks.

- Strengthening Saudi companies. United Stars, Tristar’s Saudi JV, earned the highest score among multi-nationals in Aramco’s In Kingdom Total Value Add (iktva) program. The program’s goal is to build a world-class supply chain while cultivating local business and retaining at least 70% of all procurement spend within the Kingdom. United Stars focuses on recruiting, coaching and developing strong Saudi teams.

When it comes to Saudi Arabia’s growth potential, Agility is an investor, partner, and supporter.

- When the pandemic dies down, trade protectionism will become the biggest threat to global supply chains.

- This will both drive up prices and make resiliency harder to achieve.

- Accelerated digitalization and uptake of new technologies can help firms find a balance between supply chain resiliency and efficiency.

Seven months into the COVID-19 pandemic, businesses of all kinds are devising ways to protect themselves from future shocks by making their supply chains more resilient. In doing so, they need to guard against the mistake of preparing for the last battle rather than the coming one.

At some point, hopefully soon, the unprecedented global response to COVID-19 will reduce it to a manageable threat that allows us to return to something approximating normalcy in our personal and professional lives.

When that occurs, the greatest immediate and long-term risk to supply chains won’t be a virus. It will be trade protectionism, which was resurgent even before the COVID crisis, and now threatens to choke off the lifeblood we need to speed us toward recovery.

As recently as 2016, trading nations were erecting fresh barriers – subsidies, tariffs, quotas, licensing requirements and other obstacles – at twice the rate they were adopting measures to liberalize trade, according to Global Trade Alert. By 2018, new obstacles outpaced liberalizing steps by three to one. Last year, the ratio was four to one, and the value of global merchandise trade fell by 3%, the first decline since 2015.

Since the start of the COVID-19 crisis, we have seen protectionism intensify. Some emergency moves are clearly temporary. They were put in place by governments to ensure access to the medicines, machines and protective equipment required to contain or treat the virus. In other cases, the aim was to guarantee adequate food supplies for local populations.

Yet these new measures and others have been taken against a backdrop of simmering trade tensions between the world’s two largest economies, the US and China, and a growing chorus of voices in the US, Germany and other countries calling to re-shore, nationalize or find alternative sources for key products and industries such as 5G wireless equipment, semiconductors, steel, electrical power gear, mobile cranes, rare earth minerals and other goods.

The 164-nation World Trade Organization (WTO), normally the body that would quell trade wars and bolster the global consensus for free trade, has been weakened, perhaps fatally, by a loss of faith in its dispute resolution system and the apparent withdrawal of US support.

“In the current alternate universe we’re living in, global trade is collapsing and the WTO and the liberal order itself are in a true existential crisis,” Bloomberg noted in June.

As economies around the world emerge, unevenly, from the pandemic, we can expect demand to begin to strengthen. As it does, trade flows, carrier schedules and inventory levels will start to normalize, and supply and demand will find a new equilibrium.

But normalization won’t mean a return to normal. The World Bank expects a 5.2% contraction in global GDP in 2020. Advanced economies could shrink by as much as 7%, although they are likely to recover faster than economies in emerging or developing countries, the bank says.

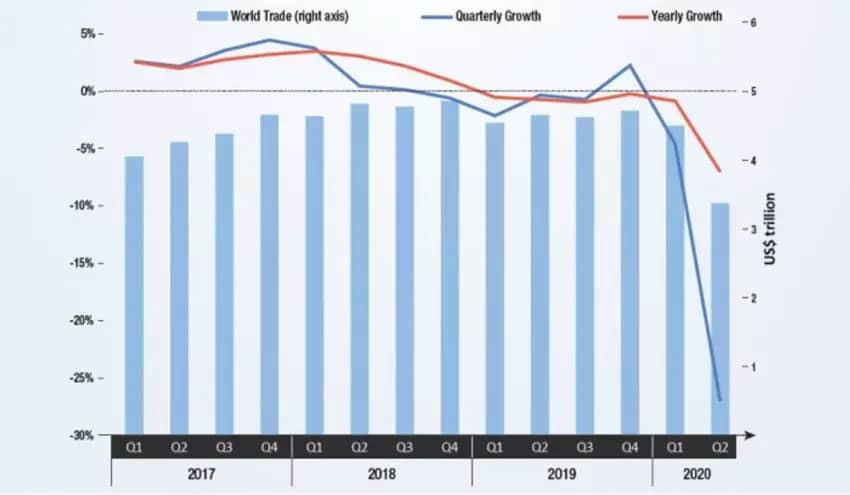

Trade, which has accounted for 54% to 60% of global economic activity in recent years, is set to retreat even further. The WTO forecasts a drop in global trade flows of 13% to 32% in 2020. UNCTAD expects trade to decline by 20%. For context, the largest quarterly decline in trade volume during the 2008 financial crisis was 5%.

Image: UNCTAD

The new wave of protectionism, which includes a sharp rise in the use of international economic sanctions and penalties, will significantly increase the cost of goods at a time when we are experiencing historic levels of joblessness, poverty, and business failures on every continent.

Protectionism is likely to make supply chain resiliency harder to attain, not to mention more costly.

The first step toward resiliency is diversification of sources and suppliers. For many, that means reducing reliance on China, which accounts for 28% of global manufacturing.

Yet the economic trauma caused by COVID-19 will shrink the universe of suppliers, not expand it. And new layers of protectionism will leave companies with even fewer choices of supply because they will rob efficient producers – in China and elsewhere – of their competitiveness and make them too expensive.

Simply uprooting from China is not as easy as it seems. Forty years after it began modernizing, China today holds advantages available nowhere else: unmatched scale; abundant skilled and unskilled labour; sophisticated automation, engineering and sciences; world-class infrastructure and logistics; closely synchronized and integrated supplier networks both in-country and across Asia. Twenty-five years ago, leaving China meant leaving a low-cost manufacturing centre. Today, it would mean giving up on the world’s largest consumer market and an economy growing at twice the rate of the US before the COVID-19 crisis.

Other attempts to build resiliency also defy easy answers. For instance, businesses that see the pandemic as a reason to beef up future inventory through the addition of “safety stock” will probably think differently when the historically low cost of capital begins climbing.

Once the COVID-19 threat recedes, businesses across virtually all industries will have to find a new balance between efficiency and resiliency, because the latter carries a cost. Rather than trying to ‘deglobalize’ or shorten the physical length of far-flung supply chains, they should consider the resiliency offered by accelerated digitalization and deeper integration of technology.

From its earliest days, the pandemic separated digital leaders from laggards. Leaders had tools that gave them accurate visibility into supplier status, orders, shipments and inventory. They could make data-driven decisions quickly because they had trusted supply chain partners – especially freight forwarders and third-party logistics providers (3PLs) – sharing fresh information in near real-time and hunting down available production and shipping capacity. Laggards floundered and continue to flounder.

One obvious lesson from the pandemic is that digital capabilities such as predictive modelling, big data and partner integration are driving business flexibility. When things are relatively stable, those digital capabilities provide a competitive advantage. In times of disruption, they give companies the ability to optimize schedules, ports, modes, vendors and other variables, adjusting on the fly to events that could otherwise prove calamitous, even ruinous.

True resiliency means being ready for any kind of disruption: political, economic, cyber, conflict-based or, yes, pandemic-related. Knowing where to find it is what will separate tomorrow’s leaders from laggards.

Originally published on the World Economic Forum’s Agenda blog