How Better Warehouses Increase Trade in Africa

Kuwait-based Agility Logistics Parks customers can log-on to view contracts and make payments.

UK MOD personnel can log-in to the GRMS portal to schedule household relocation shipments.

Kuwait-based Agility Logistics Parks customers can log-on to view contracts and make payments.

UK MOD personnel can log-in to the GRMS portal to schedule household relocation shipments.

After many years in early stage venture capital funding, I’ve seen the good, the bad and the ugly of the startup world. There are a few things that almost all successful entrepreneurs have in common, and plenty of mistakes to be avoided as well.

For your best chance of success, here are five tips for establishing a startup that can really go the distance. Plus, if you’re looking for investment, look at my post below, where I share industry insight into the most common ways entrepreneurs accidentally sabotage their funding pitches.

Picking the right co-founder can be precarious and time consuming. Many venture capitalists favor startups with two strong co-founders over those with one, because they are generally considered to have more chance of succeeding. The co-founder model can mitigate risk of burnout and makes it less likely the company will collapse if a key figure leaves.

Each principal should ideally bring a unique skill set and lead a different section of the business. For example, one co-founder might guide the technological side of the company, while the other heads up finance and operations. In this scenario, each co-founder tends to be more passionate about their section of work, and brings highly specialized knowledge that complements the other’s, optimizing the efficiency of business operations.

But while there are undeniable benefits to having a co-founder by your side when the going gets tough, it’s not impossible to succeed by going it alone with a single founder or principal. It is crucial, however, to make sure the team around you has skills and passions that fit well with yours and that you have a really strong second-in-command who you trust to make decisions and lead when needed.

Being the sole founder of a company also makes it even more important to have structures in place to ensure that your wider team is incentivized to work hard – usually this is very effectively achieved through equity ownership.

Whether your team is tiny or substantial, team members must be able to work together and cover all the critical functions of your business without any gaps.

It’s important to make sure all bases are covered, but don’t hire people just to tick a box. Often entrepreneurs replicate traditional management structures, instead of searching for people who can fulfill the functions their company needs.

Staff members who are hungry, multi-skilled and willing to pitch in and fill gaps are invaluable, especially in small- and medium-sized companies. People are any startup’s most valuable asset, so make sure every hire is a great one.

When I recommend a business for investment, what I’m really putting my faith in is the people. A good team is the single most important factor in making sure a startup succeeds. You can have the best idea in the world, but if it doesn’t have good people to make it happen then it will probably fail.

It’s a good idea to diversify your investment streams as much as possible, even if your business is still in the early stages. The key here is to have multiple sources of capital because delays often need to be resolved with an injection of cash, so having a few parties pitching in additional capital is always good.

Obviously, this can be a challenge. Maybe it was hard enough to find that backer in the first place! But if one investor has faith in you and your ideas then the chances are that others will too.

Lots of new entrepreneurs get complacent once they’ve found their first financial backer, and shift their focus entirely to developing their idea and business. Obviously it’s important to do this as well, but if you stop searching for investment it can lead to problems in the future. With only one backer you might struggle to expand at the rate you’d like, and it’ll be much harder to push back against your original investor if you need to.

Having multiple investors keeps your options more open. And remember that venture capitalists have more to offer than money: each brings a unique set of assets. While some are great at strategy and hiring, others have your domain expertise and can tap into their network to help your company. So it’s worth spending some time to find a broad group of investors who can bring different value to you down the road. You’ll have to answer to more stakeholders, but it’s worth it to make sure you diversify the sources of knowledge you can draw on.

All entrepreneurs want to make money, and the prospect of financial reward is a powerful motivator. But money hardly ever provides all the motivation you need to keep going through the ups and downs of building a business from scratch.

Make sure you find something that you feel passionate about in addition to making money. You need to be interested in what you’re doing and believe that it offers benefits. If you aren’t sure, how are you going to convince anyone else to buy what you’re selling?

Figure out what motivates you. Is it finding new, more efficient ways of doing things? Is it introducing a completely new product to market? Do you have a passion for utilizing technology to solve problems? What is the purpose of your company?

You will need to care about what you’re doing to overcome the hurdles. Rather than pursuing an idea that could have the biggest profit margins but leaves you cold, pick something that’s financially viable and that you feel excited about – and then the money will follow.

You might have the most wonderful solution in the world, but if the problem it fixes only applies to a small universe of customers then you need to turn your focus to something else.

If the market for a new product or service is too small then it will be almost impossible to find investors. No one will take a risk on something with a small potential for returns, and sometimes products and services simply aren’t marketable. Restricted markets certainly aren’t the right territory for entrepreneurs in the early stages of expanding their business.

Depending on how niche the market is, it might be possible to come back to “smaller” ideas when you’ve built your reputation and revenue. If you can integrate them into your business model cost-effectively, then you can make additional profits from them. But start with a focus on ideas that are broad in scope.

It’s never easy. But if you’re on the Agility Ventures website, you’re already a passionate entrepreneur who’s doing a lot right. You’ve picked a market with so much potential – logistics is complex and full of disruption, and that’s what makes it so exciting and full of opportunity. Do your research, make informed decisions and bring the innovations you want to see to market.

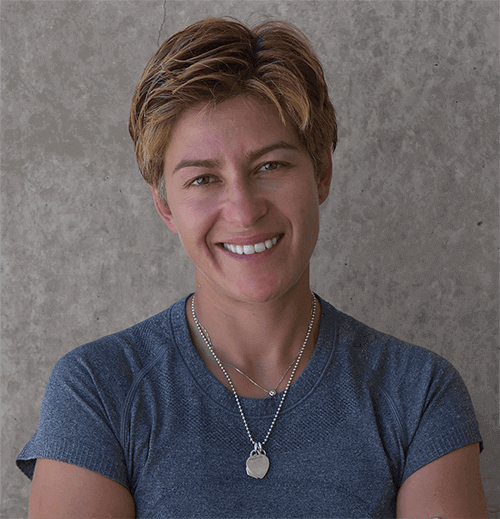

Find out more about Victoria Grace and her relationship with Agility here bio box, and keep checking the Agility Ventures site for advice and articles to help you succeed on your entrepreneurial journey.