Trade is an important aspect of Africa’s economic growth and development, helping the continent address numerous socio-economic challenges while opening up unprecedented opportunities.

Trade helps bolster economic diversification, reducing Africa’s overreliance on a few key commodities and sectors. It also encourages innovation and specialization and facilitates the exchange of goods and services both within the continent and with international partners.

Trade connects Africa’s nations to global markets, increasing their visibility and influence on the world stage.

As a result, trade has unfolded economic benefits for Africa, generating revenue for governments and businesses, creating job opportunities, reducing property, and fostering economic growth. It also helps stimulate foreign direct investment and enhances Africa’s access to technology and knowledge.

Despite these, Africa faces some logistics challenges that hinder its potential to fully benefit from its trade relations. Among these are the inadequacy of transportation infrastructure, customs and border procedures inefficiencies, and inadequate access to financial services and information.

In light of these issues, Africa is exploring initiatives for infrastructure development, including building better warehouses, to increase and facilitate trade in its region.

How Better Warehouses Can Improve Trade in Africa

Warehouses are often overlooked components of the supply chain, but they are important in facilitating global trade. Especially in Africa, where logistics challenges hinder efficient trade, better warehouses are crucial to enhance trade in Africa through:

Storage and Inventory Management

Efficient warehousing solutions can allow businesses in Africa to store their goods safely and reduce the risk of damage or spoilage. This is particularly important as Africa has a strong agricultural leg—better warehouses will allow farmers to store their produce and transport the supply to the market.

This waste reduction promotes price volatility, benefiting not only the producers but also the consumers.

Reduction in Transit Time

Transportation infrastructure is a challenge in Africa that can be solved with better warehouses. Proximity to well-equipped warehouses can reduce transit times and allow businesses to move their products to the market more efficiently. This reduces transportation costs and satisfies customer demands, making Africa more competitive in domestic and international markets.

Quality Control

Warehouses can be equipped with advanced technology to improve quality control. For example, temperature-controlled facilities can maintain the quality of perishable goods and ensure that African products meet the high standards of international buyers. This further bolsters trade opportunities and boosts Africa’s reputation in global markets.

Consolidation and Distribution

Improved warehouses can serve as consolidation points for small-scale producers. Such a setup allows these businesses, especially SMEs seeking to access broader markets, to benefit from economies of scale in transportation.

Further, warehouses located in prime destinations can act as distribution hubs to help streamline the flow of products across countries.

Recognizing these benefits, several warehouse providers have already set up their facilities in African nations, including Agility Warehouses in Africa.

Agility Logistics has a range of warehouses in various African countries, including Ghana, Mozambique, Nigeria, Cote d’Ivoire, and Egpyt. These modern facilities offer a regional distribution platform used by foreign and local companies for storage, assembly, and processing.

Our African logistics parks and warehouses deliver essential infrastructure to help companies reduce capital costs, shorten operational lead times, and de-risk entry and expansion into African markets.

Benefits of Better Warehouses in Africa

Better warehouses can boost African trade, which also brings along a range of benefits in other areas. These include:

Environmental Benefits

Better warehouses in Africa are contributing to environmental conservation through reduced food waste, efficient energy use, sustainable building practices, minimized transport emissions, and packaging optimization.

Modern warehouses in the region comply with environmental regulations and standards mainly through resource efficiency practices. As Africa continues to invest and upgrade its warehousing infrastructure, it has the potential to significantly contribute to global efforts towards sustainability and environmental improvement.

Efficiency

Better warehouses enhance logistics and trade efficiency in Africa by optimizing storage space, accelerating order processing, implementing advanced inventory management systems, improving security, maintaining product quality, integrating transportation management, and streamlining handling equipment.

As a result, these improvements are leading to faster order fulfillment and increased customer satisfaction—not to mention reduced operational costs for business operations and supply chain trading in Africa.

Costs

By optimizing space, reducing labor expenses, speeding up order fulfillment, minimizing transportation costs, improving energy efficiency, preventing product loss and damage, conducting predictive maintenance, and ultimately achieving supply chain efficiency, better warehouses are reducing costs for businesses and facilities in Africa.

These cost-saving measures contribute to the profitability and competitiveness of African businesses and supply chains.

Security

Better warehouses employ various security measures, from container security and surveillance systems to cybersecurity and security training. These help warehouses protect valuable inventory and assets, as well as contribute to safe supply chains.

The result is enhanced trust with customers and partners, providing a secure environment for business operations.

Compliance

Better warehouses maintain high compliance standards, ensuring the safety and quality of stored goods while supporting the integrity of supply chains. These enhance the reputation of African businesses in international trade and promote adherence to ethical and environmental regulations.

Access to Markets

Through efforts that include reducing transit times, ensuring product quality, facilitating trade, providing distribution solutions, and ensuring compliance with transportation and regulatory requirements, better warehouses are vital in improving Africa’s access to markets.

Better warehouses improve trade in Africa, allowing businesses to access consumers from different nations, enhancing their competitiveness and supporting Africa’s economic growth.

Learn more about Agility’s warehouses in African regions on our website.

Africa is making small strides to upgrade its logistics infrastructure. Leveraging eco-conscious technologies and innovative solutions, Africa has joined the initiative of developing sustainable logistics parks in the region, bringing about opportunities for its economy, job market, and logistics industry.

This article explores Africa’s sustainable logistics parks and its current efforts to contribute to logistics refinement.

What are sustainable logistics parks, and how many are there in Africa?

Sustainable logistics parks are infrastructure complexes designed to optimize the movement, storage, and distribution of goods in a way that is more environmentally friendly than traditional logistics operations. They use resource-efficient and sustainable practices—including renewable energy sources, waste-reduction methods, sustainable construction materials, park and warehouse design features, site selection, etc.—to reduce environmental impact.

The main goal of sustainable logistics parks is to adopt principles into their operations that meet the demands of the logistics industry while safeguarding natural resources and lowering the impact on the environment.

With power and water challenges in many places, Africa needs to put resource conservation at the forefront. That has prompted a focus on designing buildings that require less electricity to ease the burden on Africa’s electrical grids; creating parks that conserve or reuse or recycle water, which eliminates burdens on communities where clean water is scarce; prioritizing advanced waste-recycling programs to reduce the burden of landfills, etc.

Some primary characteristics of sustainable logistics parks include:

- Strategic location planning

- Green building designs

- Electric or alternative-fuel vehicles

- Waste recycling and management systems

Interest in sustainable logistics is growing in Africa. There have been recent announcements about investments of more than $50 million aimed at the growth of sustainable e-logistics operations.

Some of Africa’s newest logistics parks boast state-of-the-art features that reduce energy consumption and greenhouse emissions. They are equipped with solar panels and wind turbines that power the park’s operations, allowing it to reduce its reliance on fossil fuels.

Newer parks also have rainwater harvesting systems and waste recycling facilities. They are located near major transport routes, making them important hubs for the streamlined flow of goods.

Sustainable logistics parks contribute to the African economy and help bring about innovation. Among the benefits they provide include:

- Economic growth: Sustainable logistics parks produce employment opportunities for the African workforce and promote economic diversification.

- Regional integration: These logistics parks also improve the efficiency of logistics infrastructure, therefore enhancing intra-regional trade.

- Enhanced competitiveness: With sustainable logistics parks in their arsenal, African businesses position themselves as key players in the international market.

- Green image: Shifting from traditional logistics to sustainable logistics parks creates the impression that Africa is an eco-conscious continent.

- Attracting investments: Sustainable logistics parks in Africa attract eco-conscious investors, businesses, and consumers.

How can sustainable logistics parks enhance regional connectivity and trade in Africa?

Sustainable logistics parks are becoming catalysts of trade in Africa and beyond, creating opportunities for its regions for regional integration and economic growth. Here’s how they do that:

- Create efficient trade routes: Sustainable logistics parks in Africa are located near major transport hubs, including seaports, airports, and roads and railways. As such, they facilitate cheaper and more efficient trade routes, streamlining the movement of goods between regions.

- Improve transportation: One characteristic of a sustainable logistics park is the use of efficient transportation infrastructure. Along with the improved facilities, these parks also expand and upgrade their transport corridors to facilitate more efficient movement.

- Promote sustainable supply chains: By prioritizing eco-conscious operational practices, sustainable logistics parks reduce their environmental impact and position themselves to gain a competitive advantage in international trade.

- Boost intra-regional trade: Sustainable logistics parks are making it easier and cheaper to move goods, which gives Africa access to new markets within its regions.

- Attract foreign investments: As sustainability awareness becomes more rampant, businesses and investors seek facilities promoting eco-conscious and efficient trade practices. In this regard, sustainable logistics parks in Africa are attractive investments for foreign businesses.

- Create employment opportunities: With more advanced logistics parks comes the need to hire specialized skills. This gives the African job market more job opportunities in logistics and administrative positions.

What challenges and opportunities exist in establishing sustainable logistics parks in Africa?

While the sustainable logistics park movement in Africa is flourishing, it still needs to navigate challenges to maximize its benefits. These include:

- Infrastructure limitations: Such as inadequate transport infrastructure and underdeveloped transport corridors.

- Regulatory and policy barriers: The lack of regulatory frameworks and streamlined processes for permits, licenses, and customs procedures.

- Financing: Retrieving funding for the development of sustainable logistics parks is a challenge, especially in remote and less-developed areas in Africa.

- Energy and water resources: Plenty of countries in Africa face issues with water and energy scarcity.

- Skills and workforce development: The need to train people on modern logistics and sustainable practices.

- Environmental considerations: The intricacies of environmental conservation are vast, requiring the understanding of how to adopt waste management, carbon reduction, and green building design practices, among others.

- Stakeholder collaboration: There must be healthy collaboration between stakeholders, such as private investors, international partners, government entities, and local communities.

Despite these challenges, the future of sustainable logistics parks in Africa is bright. There are also a variety of opportunities for further growth and success.

By overcoming these challenges, Africa can position itself at the forefront of sustainable logistics and enjoy opportunities with economic growth, regional integration, enhanced trade efficiency, innovation, foreign investments, and a green reputation.

If your organization wants to tap into sustainable logistics parks in Africa for your shipping needs, visit our website to learn more about how we can help.

By Agility Vice Chairman Tarek Sultan

As I head to Saudi’s FII conference, known as “Davos in the Desert” this week, I am reflecting on the pace of change I’ve personally witnessed in KSA.

Saudi Arabia’s progress in its journey to becoming a Tier 1 global logistics hub has been impressive. It’s clear the Kingdom is already ahead of many key targets and on course to meet many more, diversifying its economy and enhancing its global profile.

Agility has been investing in Saudi Arabia for 20 years. The scale, resources, resolve, and pace of reform we have seen in Saudi Arabia in recent years has been particularly exciting. In our view, Saudi Arabia is one of the most attractive markets for logistics investments in the world today.

Agility is investing in KSA around the following areas:

- Building essential infrastructure. We’re building a world-class logistics and distribution park near Jeddah. We’ve committed SAR 611 million ($163 million) to the 570,000 SQM project, an ultra-modern facility to go with the state-of-the-art Agility Logistics Parks already serving Saudi companies and multi-nationals in Riyadh and Dammam.

- Improving Air Travel. Our Menzies Aviation business is the world’s largest aviation services company. It has partnered with Saudi Logistics Services (SAL) to improve passenger services, cargo handling and warehousing, and airline hub management for Saudi-based airlines.

- Speeding the low-carbon transition. The Agility Logistics Park in Riyadh features the GCC’s first EDGE Advanced-certified warehouse (Excellence in Design for Greater Efficiencies), meaning it is zero-carbon ready and at least 40% more energy efficient than others in the market. Tristar also is building the Kingdom’s first LEED-certified green building for dangerous goods (DG), in Modon Dammam Second Industrial City.

- Investing in Saudi innovation. Through our venture capital arm, Agility Ventures, we have invested in Saudi Arabia’s entrepreneurs and digital innovators, such as e-commerce enablement innovator Zid and digital road freight platform Humoola. We are also helping bring transformational global health technologies to the Kingdom, through partnerships with companies like AiZTech Labs, which has developed breakthrough medical testing using selfies of the eyes taken with mobile phones and Bexa, a company pioneering innovative breast cancer screening technologies.

- Powering e-commerce. Our Shipa group of companies include Shipa Delivery, one of the Kingdom’s most advanced last-mile delivery providers, and Shipa E-Commerce, a leader in cross-border fulfillment. Shipa provides both domestic parcel delivery and cross-border shipping to and from the GCC and Saudi Arabia.

- Enhancing energy-sector efficiency and safety. Agility affiliate Tristar Group works with Aramco, SABIC, and others in the energy sector to modernize equipment, vehicles and storage facilities used in the handling of chemicals, cryogenic gases and hazardous goods — essential industrial feedstocks.

- Strengthening Saudi companies. United Stars, Tristar’s Saudi JV, earned the highest score among multi-nationals in Aramco’s In Kingdom Total Value Add (iktva) program. The program’s goal is to build a world-class supply chain while cultivating local business and retaining at least 70% of all procurement spend within the Kingdom. United Stars focuses on recruiting, coaching and developing strong Saudi teams.

When it comes to Saudi Arabia’s growth potential, Agility is an investor, partner, and supporter.

Data centers are often thought of as the backbone of the internet, and for good reason. Without data centers, we would not be able to store or access the massive amounts of data that are generated every day.

They are becoming increasingly important in the Middle East as the region’s economies transform digitally. In this article, we discuss key points you need to know about data centers in the Middle East and how Agility can help data center operators grow faster in the region.

What are data centers and what services do they offer?

Data centers are facilities that house computer systems and their associated components, such as telecommunications and storage systems, including servers, etc. Data centers typically require a large amount of power to operate and need to be located near robust telecommunications infrastructure to ensure the speed of data transmission.

Data centers offer a variety of services that can help businesses with their data storage and processing needs. They can provide storage space for data, as well as the infrastructure needed to process and manage it.

Data centers can also offer tools and services to help businesses analyze their data and make decisions about how to use it. In addition, data centers can provide access to high-speed networks and computing resources that can help businesses with their data-intensive tasks. Artificial intelligence (AI) and machine learning (ML) are two examples of use cases.

Data centers are critical infrastructures for many organizations. They store and manage data, applications, and other resources that are essential to the operation of the business. Data centers are used by companies of all sizes, from small businesses to large enterprises. They play a vital role in supporting mission-critical applications and services.

There are many different types of data centers, ranging from small facilities to large hyperscale data centers. The type of data center that an organization needs depends on its specific requirements.

Small and medium-sized businesses typically use colocation data centers. In a colocation data center, the customer rents space from a service provider and uses the service provider’s infrastructure to house its servers and other IT equipment.

Large enterprises often build their own data centers. These data centers are designed to meet the specific needs of the enterprise, such as accommodating a large number of users or supporting high-performance applications.

Hyperscale data centers are the largest and most powerful type of data center. They are designed to support the massive scale of operations of hyperscale companies, such as Google, Facebook, and Amazon.

What is driving the growth of data centers in the Middle East?

There are several factors driving the growth of data centers in the Middle East, including:

- Data sovereignty laws mandate that certain categories of data – e.g. government and certain personal data of citizens and residents – be resident in the country

- Migration to the cloud for hosting data by both governments and enterprises in the region

- Rising consumption of data by consumers driven by the growth of 4G or 5G services from telecom companies and the usage of applications that leverage artificial intelligence (AI)

- Growing connectivity of subsea cables to countries in the region enables larger flows of data from the country globally

- Lower latency requirements from streaming applications like Netflix and other so-called Over-the-Top media services (OTTs).

What is the current data center market size and what are the forecasts for growth?

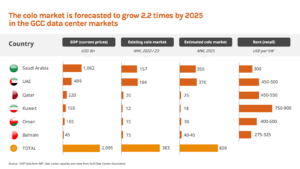

The colocation market in the six Gulf Cooperation Council (GCC) data centers in the Middle East is forecasted to grow 2.2 times by 2025 from 383 MW of IT load to an estimated 839 MW of IT load, demonstrating the large investment that is going into this sector.

Some commentary from the Gulf Data Center Association (GDCA) on the 6 GCC markets in the Middle East:

Saudi Arabia – The largest economy in the region is seeing a lot of growth in data center activity.

- The government continues to offer strong support for data centre growth. The Ministry of Communications and Information Technology (MCIT) recently called for an $18 Billion investment in hyperscale data centers and renewable energy by 2030 to take total capacity to more than 1.3GW and transform Saudi Arabia into the main data center hub for the region.

- With a population approaching 35 million, there is a large domestic demand which has been reinforced by recent data protection laws that place tight restrictions on the transfer of data outside of the country. Saudis are avid users of social media and consumers of online content. Notably, Saudi Arabia is becoming a global hub for esports and gaming.

- Saudi Arabia has 16 in-service subsea cables, which places it as one of the highest amongst other GCC countries in terms of connectivity. The 2Africa cable, which will be the longest subsea cable ever developed and is expected to come into operation by the end of next year, has four cable landing points in Saudi Arabia. Google’s Blue Raman cable, which will connect Europe to the Middle East and India without going through the Gulf of Suez, includes a future cable landing point in Duba on the Red Sea.

- Whilst Riyadh, Jeddah, and Dammam remain the three main clusters for data center development, the government is pushing ahead with the development of Neom. As an early deployment in the development of the city, Neom is building a 12MW data center facility, with Oracle announced as the first tenant.

UAE – The UAE has led the GCC region in terms of data center capacity, variety of data center operators, and future growth ambition for many years.

- The market has remained attractive with its tech-hungry and growing population, as well as Dubai’s position as a major international business and trading hub.

- The UAE has worked hard to improve its international and regional connectivity, now being served by 17 international subsea cables, whereas a decade ago, this number was significantly lower.

- Multiple hyperscale cloud providers are now present, including AWS, Microsoft, Google, and Alibaba. AWS’s recent launch of their own data centers in the UAE reflects the country’s rapid uptake of cloud services, with most Government entities, large enterprises, and SMEs using cloud services already or are in advanced stages of actioning a migration plan.

Qatar – Demand for data center requirements in Qatar received a big boost ahead of the World Cup last year, which saw massive investment into new infrastructure to support the global sporting event.

- Until recently, the market in Qatar was limited to just two operators offering colocation services, namely Meeza and Ooredoo. However, with the entry of cloud providers Microsoft and Google, the market has shifted into another phase of development, with a number of international operators now actively looking at Qatar for opportunities to offer build-to-suit facilities, which is opening up the market to potential new entrants.

- Qatar was the first country in the world to launch 5G services back in 2018. It has the cheapest power costs for businesses in the GCC and has the highest per capita levels in the region.

- Qatar is making big efforts to diversify the economy away from its past reliance on oil and natural gas as well as develop more sustainable sources of energy. Large-scale solar projects are now in operation with the 800 MW Al Kharsaah project, with a further 800MW of solar output in the pipeline to be developed by 2024.

Kuwait – The Kuwaiti data center market was limited to a handful of players offering retail colocation, but Google will be the first hyper scaler to enter the market.

- The known providers are Zain, Ooredoo (formerly Fast Telco), Kalaam (formerly Zajil), and Solutions by STC (formerly Quality Net). These are all telecom companies that have built additional colocation data center space alongside their own needs. The majority of these facilities are built in their own headquarters occupying a couple of floors in each building. Smaller hosting businesses have taken space within the Tec Building tower, which is home to Kuwait’s cable landing station.

- The rest of the market currently lies within enterprise facilities – in particular, the financial services sector, which continues to invest in enterprise facilities. ITU built a 1,200 sqm data center with over 500 servers for Kuwait Finance House in 2021.

- The market has recently seen an increase in cloud requirements as businesses look to migrate to the cloud. However, the market has struggled to expand to support new requirements and, as a result, has seen some requirements go to neighboring GCC markets. For example, Batelco has an alliance with Ooredoo, and its Global Zone data center in Bahrain is made available to support Global Zone Kuwait.

- There have been multiple attempts by the existing providers (along with a few other GCC operators) to build new facilities. However, difficulties in finding logistics space and securing sufficient power have halted most progress.

- Google is opening a cloud region in Kuwait – the first hyper scaler in the country. Google is working closely with the government as part of a strategic partnership to help promote further digital transformation in the economy and meet the goals set out in the 2035 Kuwait Vision Plan. This includes further development and availability of e-services. Mastercard, for example, has collaborated with Google to recently launch Google Pay in Kuwait.

- The new cloud region has led to a requirement for data center development which has heightened interest levels from a number of international wholesale operators. However, finding suitable sites for data centers and navigating the approval process has so far proved challenging.

- Agility Logistics Park (ALP), one of the largest real estate owners of warehousing and industrial land, has announced plans to deploy data center campuses across several Middle East and African countries, including one on a site in Kuwait next to a major substation.

Bahrain – The Bahrain data center market has managed to attract some major wins over the past few years

- Names such as AWS, Tencent, and the recent announcement of a major data center campus with STC prove that there is significant confidence in this market.

- Confidence stems from an active and supportive Government with regard to data centers, along with a geopolitical climate that is widely considered to be stable and safe

- Bahrain’s attributes include an open telco market, a reputation as an easy place to do business, and lower operating costs compared to other GCC countries.

- Taking advantage of its geographical position, the Bahraini market is working hard to position itself as a central Gulf location that can manage a wide range of requirements, including disaster recovery, regional cloud deployments such as cloud gaming, and a keen interest in financial markets and fintech.

- The government of Bahrain continues to support data center opportunities via the Economic Development Board of Bahrain (EDB Bahrain). This is in keeping with the Kingdom’s Cloud First policy, introduced in part to reduce the cost of Government I.T. infrastructure.

- Tencent Cloud announced plans that it would build its first data center in Bahrain, which could make it the second cloud player to do so after AWS established its availability zone in the Kingdom of Bahrain in 2019.

Oman – Oman has the highest number of subsea cables in the GCC with 14 currently in operation and a further 4 planned.

- Omantel is the main telecom company in the country and has a joint venture with 4Trust that operates Oman Data Park which has several facilities in Wattayah, Knowledge Oasis Muscat and Duqm. Last year, Oman Data Park announced plans to build a data centre in Zanzibar.

- Oman has set a target of 30% of all power to come from renewable sources by 2030 with a number of large-scale solar and wind projects in the pipeline.

- The capacity of the sector in Oman is undergoing a growth phase with a number of data centres under construction. In the past, many companies used their own in-house facilities but demand for colocation is rising with migration to the cloud.

- Oman has three free trade zones (Al Mazunah, Sohar and Salalah) and two special economic zones (Duqm and Knowledge Oasis Muscat). Various incentives are on offer to help attract inward investment including allowing 100% foreign ownership of companies. Last year, the Sohar Free Zone agreed to lease 25,000 sqm of land to a Chinese firm to build a cloud data centre.

- At the end of 2022, the Ministry of Transport, Communications and Information Technology (MTCIT) signed an MoU with AWS to launch a local zone for cloud hosting in Muscat. Oman is the first country in the MENA region to host an AWS local zone after its launch in the US and other cities in the world.

What are the challenges to the development and operation of data centers in the Middle East?

There are several challenges to the development of data centers in the Middle East, including:

- Land acquisition – securing sites with the appropriate land use/zoning at the right location with proximity to power and fiber connectivity

- Permitting – securing the permits for building and operating a data center

- Power – securing large amounts of power, preferably from green sources

- Talent – Given this is a rapidly growing industry, there is a dearth of talent across the value chain in the industry in this region

How Agility can help enable data center operators to grow faster

Agility Logistics Parks (ALP), the leading private owner and developer of industrial real estate in the Middle East & Africa, has a portfolio of data center campuses, which are sites with substantial power and utilities (including renewable energy), building permits, and regulatory approval, to accelerate time-to-market for data center developers.

ALP has four decades of expertise in land acquisition and development in emerging markets and is a strong institutional partner for data center developers looking to deploy capacity rapidly across the Middle East.

ALP’s value proposition is speed to market in a de-risked manner in complex, challenging emerging markets leveraging several capabilities:

- Land acquisition – Large sites with title secured. Prime locations. Master planned and tailored for hyperscale clients and operators.

- Power & utilities – All sites already have secured multi-megawatt scale power availability with expansion opportunities.

- Fiber connectivity – Fiber connectivity from two POPs to all sites. Large fiber strand count

- Authority approvals – Ability to secure permitting and approvals for large complex projects in all markets

- Regulatory approvals – Ability to help secure proper regulatory approvals to operate in the local market.

- Construction expertise – Proven local construction and project management expertise. Pre-qualified vendors and ecosystem.

- Sustainability – Renewable energy sources available for all sites. Solar is available for all sites. Hydroelectric is the main power source for Ghana.

- Security & operations – Proven security and facilities operations support expertise in all markets.

The first two data center sites that ALP has brought to market are in Kuwait and Riyadh, Saudi Arabia:

- Kuwait – More than 100,000 sqm of land with 80+ MW of power available today with under a millisecond latency connectivity to the cable landing station. Solar power is available.

- Riyadh – 82,000 sqm of land available and 25+ MW available. Solar power is available.

ALP is looking to add more sites in Saudi Arabia and the UAE in response to strong demand from data center operators.

Connect with Agility’s data center campuses team for further information.

Anyone who has shipped internationally in the past knows the customs clearance process can be time-consuming and complicated.

This is even true for the customs clearance authorities, who have to deal with outdated paper-based customs procedures. The lack of efficiency and technology in customs clearance leads to several hindrances, from shipping delays and increased costs.

It’s time to modernize the customs clearance process through innovations like digitization and single-window software solutions. Adopted into the customs process, these solutions can revolutionize international shipping and global trade.

What are the benefits of customs automation?

Customs digitization or automation transforms manual, paper-based customs clearance procedures into automated and electronic systems. It makes use of different platforms, the most prominent of which are:

- Electronic Data Interchange (EDI) – enables the electronic exchange of data and documents between traders and customs authorities.

- Automated Customs Declarations Processing – streamlines the customs declaration process by automating valuation, origin determination, duty calculation, and tariff classification.

- Risk Management Systems – assesses and manages risks involved in international trade.

- Single Window Systems – centralizes platforms for submitting and processing documents and information.

- Customs Management Information Systems (CMIS) – automates customs management, revenue collection, intelligence gathering, reporting, risk assessment, and performance monitoring.

These systems allow for electronically processing, managing, and analyzing shipment data. As a result, they help streamline the entire process, making it faster and quicker to transport goods across international borders.

Customs digitization involves the use of modern advanced technologies, including artificial intelligence, cloud computing, and data analytics, among others, that allow for the following functions:

- Electronic data submissions

- Data validation

- Risk assessment

- Customs declaration processing

- Trade facilitation and clearance

- Integration with other trade-related systems

- Data analysis and reporting

- Security and compliance

At the core of customs digitization is a single-window software solution, which is a centralized platform for all trade-related documents and information. This solution creates a single touchpoint for customs administration, eliminating multiple interactions and paperwork.

Customs digitization yields a range of benefits for the customs authorities, importing and exporting countries, carriers, and shippers worldwide, such as:

- Modernizing customs operations

- Improving transparency

- Reducing costs

- Promoting efficient trade facilitation

- Improve trade compliance and risk management

A country’s level of import and customs automation will speak volumes about its economic competitiveness, governance, and overall trade environment. It also allows them to facilitate international commerce better and develop good trade relationships with other nations.

As such, countries around the world should embrace automation in their customs clearance processes to solidify their position in the global shipping market.

What does the single window mean for businesses?

The single window aims to establish a single, centralized platform where all customs clearance processes will be conducted. It will become a business’s single point of entry where it will submit all trade-related documents and information required to ship its goods to another country.

This system will follow a streamlined process that begins with the business registering on the platform and preparing its customs documents. The business then submits those documents in the single-window platform, which will be verified and processed by the relevant customs authority. During processing, the platform will also allow the parties to collaborate and share information, as well as provide status updates and notifications on the shipment’s progress.

The customs clearance process also takes place within the single window platform, allowing authorities and relevant agencies to work together to review documents, assess compliance, profile risks, and determine the applicable fees, duties, and taxes.

The single-window concept of customs digitization offers a range of advantages for businesses, whether they act as importers, exporters, or other parties in the international trade process. Among these benefits include:

- Simplified documentation submission and processing

- Enhanced clearance efficiency and speed

- Facilitated planning and improved predictability in their trade operations

- Reduced costs associated with paperwork, manual processes, and customs clearance delays

- Assured compliance and accuracy of data, documents, and information

- Increased transparency in the trade process

How to accelerate digital trade in developing countries?

Accelerating the process of customs clearance and international trade creates a massive impact on a country’s economic growth and trade competitiveness.

To facilitate digital trade, a nation must enhance its digital infrastructure by investing in internet connectivity, broadband networks, and mobile coverage.

In line with this is the need to develop digital skills among its workforce, create regulatory frameworks for digital trade, enter into agreements with other countries, and improve the facilitation of its customs processes.

Endeavoring all these initial roadblocks will prove to be a lucrative venture for developing countries, allowing them to reap the benefits of an effective digital trade system, such as:

- Market access and global reach

- Economic growth and job creation

- Inclusive economic participation

- Access to capital

- Data-driven decision making

The WTO also has a role to play. Particularly, it can contribute by providing countries with a platform to develop rules that will govern digital trade.

The WTO can also make efforts to advance trade liberalization, foster interoperability, address data governance, facilitate collaboration with stakeholders, and promote digital trade inclusion.

What is the role of technology in enhancing international trade?

The international trade processes have, for too long, been relying on manual paper-based procedures that are proving to be inadequate and inefficient in today’s digital age. It’s time for the industry to utilize technological innovations to automate trade processes and reduce manual burdens.

Technology can enhance international trade efficiency by digitizing customs processes, logistics management, and supply chain tracking, among others, minimizing delays and reducing costly errors. This advancement helps make the industry more efficient, expands market access, promotes trade diversification, and contributes to economic growth.

The adoption of technology in international trade should also make way for facilitating the diffusion of knowledge and technologies, which will catapult a country’s integration into the global trading system.

Technology is a transformative force that is set to revolutionize international trade. It has a long journey to reshape traditional practices in the industry, but its adoption will pay off in dividends, expanding opportunities and driving economic development for countries worldwide.

Revolutionizing Trade with Customs Digitization and Single Window Software Solutions

Customs digitization and the implementation of single window software solutions have and are continuing to bring about advancements in emerging markets. They are revolutionizing the international trade process, enhancing transparency, efficiency, and competitiveness.

These solutions are helping emerging markets overcome barriers and streamline their customs procedures. They reduce paperwork, minimize bureaucratic hurdles, and speed up the clearance of goods. Businesses then enjoy faster and more predictable customs procedures, which benefits their supply chain management and financial stability.

Want to learn more about customs digitization and single-window software solutions?

Contact us today to speak to our experts.

The Suez Canal Economic Zone is a testament to Egypt’s efforts to become a key player in the global economy. It was created to serve as a hub for international commerce, innovation, and industrialization and has become attractive to both foreign and domestic investors. In turn, the Suez Canal Economic Zone has become Egypt’s catalyst for economic growth.

In this article, we uncover all the vital information about the Suez Canal and its economic zone and why it’s vital for the Egyptian economy and global commerce.

Where is the Suez Canal and Why is It So Significant?

A man-made waterway, the Suez Canal is located in Egypt’s Isthmus of Suez. It separates the continent of Africa from the Sinai Peninsula and connects the Red Sea and the Mediterranean Sea. The Suez Canal is 120 miles (193 kilometers) long.

The location of the Suez Canal makes it very significant in international shipping. It’s positioned so strategically that it proves a shorter route for maritime trade between the continents of Asia, Europe, and Africa. Before the Suez Canal, shipping vessels would need to go around Africa’s Cape of Good Hope to reach their destination, which lengthens their journey by thousands of miles and several days.

The Suez Canal, however, made passage through the Mediterranean and the Red Sea faster and more efficient. The construction of the canal reduced travel time and distance, in effect revolutionizing global trade by facilitating the fast movement of goods and resources.

Today, the Suez Canal is a vital link to get goods around the world. About 10% of global maritime trade passes through it. This, in turn, has helped boost Egypt’s economic growth and global integration, opening up new markets for global trade.

The Suez Canal is especially important for the transport of goods from the energy sector. It serves as the main gateway for transporting oil and liquefied natural gas from the Middle East to other countries worldwide. It makes tanker trips shorter, which reduces the cost of transportation and, consequently, the prices of fuel and energy resources. Without the canal, it would be difficult to achieve a steady supply of oil and LNG around the globe.

Why is the Suez Canal Important to Egypt’s Economy?

The Suez Canal has been a critical development that helped drive Egypt’s economy forward. Aside from generating revenue, the canal also opened up employment opportunities for locals. Here are key points that make the Suez Canal highly vital to the Egyptian economy:

- Generates revenue – The Suez Canal helps Egypt earn revenue through tolls and transit fees collected from vessels that pass through the canal.

- Centerpiece of the economy – The canal is Egypt’s economic centerpiece, attracting investments to the country and leading to the development of services and industries. These include ports and logistics operations.

- Facilitating trade – The canal’s primary importance is its ability to facilitate international trade, making an efficient global trade route. It gives Egypt a geographical advantage, making it a key trade hub for shippers to reduce shipping costs and transit times.

- Employment opportunities – The opening of the canal brought about an influx of job opportunities for Egypt’s labor market. It provided jobs to thousands of skilled workers to assist in the canal’s maintenance, operation, and administration. Several industries associated with the Suez Canal also opened up doors to employment, including logistics, manufacturing, shipping, and tourism.

- Economic diversification – The Suez Canal allows Egypt to diversify its economy by attracting businesses to invest in Suez Canal’s proximity. These investments come from various industries, from manufacturing and agriculture to technology and energy.

- Infrastructure development – In the vicinity of the Suez Canal grew a range of infrastructure, including logistics centers, industrial parks, and special economic zones. These make Egypt’s economy more competitive and attractive to businesses worldwide.

- Regional development – The Suez Canal benefits the Egypt economic zone, and its impact spills over to its surrounding regions. It opened doors for development in neighboring areas due to businesses investing and developing infrastructure within close proximity to the canal.

What is the Suez Canal Economic Zone?

The Suez Canal Economic Zone is the Egyptian government’s development project that aims to improve the economic potential of the Suez Canal. It was established to diversify the canal’s ecosystem in order to attract more investment, innovation, and industrialization.

The Suez Canal Economic Zone is strategically located on both sides of the Suez Canal, stretching from the Mediterranean Sea to the Red Sea. This makes it positioned optimally for global trade between Asia, Africa, and Europe. The Suez Canal Economic Zone provides access to international shipping routes.

In line with its objective to foster economic growth, the Suez Canal Economic Zone also contributes to creating job opportunities and promoting sustainable development. It’s increasing its efforts to contribute to environmental conservation, with most facilities adopting sustainable practices and green technologies.

The Suez Canal Economic Zone uses a multi-sectoral approach, putting its focus on industries like agriculture, energy, logistics, manufacturing, technology, and tourism. Its vicinity is filled with ports, logistics centers, specialized economic zones, free zones, and industrial parks, all helping it facilitate international trade and industrial activity.

It encourages foreign businesses to establish operations in Egypt using the canal’s strategic location for international shipping as leverage. In support of this, the Egyptian government has also implemented reforms and objectives to further the Suez Canal Economic Zone’s mission. Among these include enhanced infrastructure development, simplified procedures, regulations, and certain tax exemptions.

Supporting the Development of the Suez Canal Economic Zone

The Suez Canal Economic Zone is a vital development for international trade. To support its growth, the Egyptian government, international organizations, and financial institutions should endeavor to provide support in the following areas:

- Promoting investment and infrastructure – Promote investment opportunities in the Suez Canal Economic Zone through trade missions and investment forums, among others.

- Policy and regulatory support – More favorable policies from the Egyptian government to create a business-friendly environment.

- Develop skills and training – Invest in human capital development through programs to build technical skills and promote knowledge transfer.

- Research and development – Implementing research and development activities within the zone, such as innovation hubs, technology transfer programs, etc.

- Collaboration and partnerships – Partner with global governments, businesses, and organizations to share resources, expertise, and experience.

To support the development of the Suez Canal Economic Zone, governments and global businesses must work together to unlock the full potential of the development and contribute to Egypt’s economic growth and international shipping.

Want to know how Agility is helping modernize the Suez Canal Economic Zone? Click here.

Logistics industry executives are bullish about the African Continental Free Trade Agreement but concerns are rife around its implementation. Geoffrey White, CEO of Agility Africa joins CNBC Africa to discuss what the core value chains need to speed up the implementation of the trade pact.

In this episode I am joined by Ronald Philip, Senior Director Strategic Planning at Agility. Ronald shares a great insight to the data center market in the Middle East and Africa region, as well as providing an update on Agility’s recent data center campus site announcements.

First, we discuss Ronald’s career and how he made the progression to working in the data center sector.

We then discuss the recent announcement by Agility to develop data center campus sites in the Middle East & Africa regions. Ronald outlines the locations of the sites, why these locations were identified, the strategy around the developments, and the types of customers attracted to these sites.

Finally, we discuss the Middle East & Africa regions: how they are developing as data center markets, and why connectivity is so important to the people living across the region.

This is a great insight to the rapidly changing markets of the Middle East & Africa.

Learn more about Data Center Campuses by Agility.

This blog was originally published by Inside Data Center Podcast.