- Climate change is accelerating the transition away from fossil fuels to clean energy.

- Innovative technologies are being harnessed to help reduce or eliminate emissions.

- Across shipping, aviation, mobility, agriculture, manufacturing and construction, change is happening.

More than 20 years ago, author Malcolm Gladwell wrote a best-seller called The Tipping Point. He was fascinated by “the moment of critical mass, the threshold, the boiling point” when trends in business, marketing and human behaviour catch fire and begin to spread furiously.

We’re clearly at, or nearing, tipping point moments in the transition to clean energy. The signs are everywhere.

In the boardroom

Climate-related activity by companies and investors has shifted from risk mitigation to opportunity capture. “We are at an energy inflection point,” according to Boston Consulting Group.

McKinsey says the momentum behind projects designed to limit or eliminate greenhouse gas emissions (GHGs) “may create the largest reallocation of capital in history.” Indeed, companies and financial institutions responsible for more than $130 trillion are committed to the fight and determined to bring down emissions.

On the seas

Shipbuilders’ order books show where the maritime shipping industry is heading. Maersk, HMM, Danaos, COSCO, CMA CGM and other carriers are placing orders for dual-fuelled vessels that can run on liquid or gas fuels and will be powered by methanol. Conventional methanol is made from fossil sources – natural gas, coal, oil – but ocean carriers are betting on e-methanol, which is made with renewables: biogas, biomass, waste, sludge, and recycled carbon dioxide.

That’s important because ocean shipping generates about 3% of GHG gases. The industry has been slow to clean up its act, despite 2020 International Maritime Organization rules that limit vessels’ sulphur oxide emissions.

Cargo carriers initially responded to the IMO 2020 requirements with short-term fixes. They mothballed some older, dirtier ships and equipped others with emissions-eating scrubbers. Newer ships were fuelled with – or retrofitted to run on – cleaner-burning LNG.

Ikea, Unilever, Amazon and Inditex are among the companies that have committed to 100% zero-carbon fuel shipping by 2040. Already, customers of freight forwarder DB Schenker can select a biofuels option, agreeing to pay a surcharge to make sure their cargo moves on vessels powered by sustainable fuels.

Meanwhile, port operators and politicians are exploring creation of green, digital shipping “corridors.” One corridor would link Singapore with US West Coast ports. Ports at both ends would add storage and infrastructure for low- and zero-carbon fuels along with digital systems and tools to serve ships running on cleaner fuels.

To date, clean hydrogen lacks viability as a widely used marine fuel. That is expected to change in the next few years, but the Port of Rotterdam has decided not to wait: it is making huge investments to transform itself into an international hub for production, storage and transport of hydrogen.

There’s also hope for older ships that run on fossil fuels. Several carriers are experimenting with carbon-capture systems that can be installed on existing ships. The systems collect carbon in liquefied form, allowing it to later be offloaded and repurposed to make dry ice and other products.

There is no consensus about the dominant ocean fuel or fuels after 2030. Green ammonia, biodiesel, fuel oil, blue ammonia, LNG, e-methanol, biomethanol, biomethane, and e-methane were among the sources cited by respondents in a recent industry survey. However, there is a clear desire by operators to have the capability to power vessels with fuel “families” – multiple types of oils or gases, for example – that can be used interchangeably.

In the air

As Menzies Aviation CEO, Philipp Joenig points out, the aviation industry’s path to sustainability is cloudier. In the short run, the industry is looking to lower emissions by increasing efficiency through aircraft design tweaks and improvements in ground operations, air-traffic management, and route planning.

To scale for sustainable fuels and full decarbonization, the industry is ultimately likely to need look at redesign of airframes and the introduction of new storage technology.

Researchers are looking at an array of potential aviation fuel sources, including algae, hydrogen, biowaste and synthetic fuels made with so-called Power-to-Liquid (PtL technology). Meanwhile, United Airlines has launched a fund to invest in sustainable fuels and is asking the flying public to help make sustainable aviation fuel a reality. United wants passengers to consider contributing to the fund – from $1 to $7 – whenever they book a flight.

On the road

Electric vehicle (EV) adoption continued to grow in 2022 (80% in China year-over-year; 40% in the US). The pace of future growth is likely to be dependent on the availability of incentives such as government subsidies and tax breaks, on the one hand, and the expansion of EV infrastructure such as battery cell production and charging networks, on the other hand.

In trucking, battery-powered EVs are already on the road for drayage, last-mile, and short-haul routes. Range limitations have been the obstacle in long-haul trucking, but some in the industry expect EV freight haulers to be on the road covering the same distances as diesel trucks by 2027.

Enthusiasm for mobility and power generation that rely on lithium-ion batteries has been tempered by worry about the supply of lithium ore and the social and environmental effects of lithium mining. That explains the exuberance at recent international auto shows where carmakers have unveiled EVs using sodium-ion batteries, a cheaper source of potential electrification using a more abundant raw material.

On the farm

Ultra-efficient energy use, water conservation and emissions reduction have turned tiny Holland into the world’s second largest exporter of agricultural products (by value) after the US. The Netherlands, worried a generation ago that it couldn’t feed itself, is feeding Europe today. It is a pioneer in vertical farming, seed technology, robotics for harvesting and milking, lab-grown meat, and conventional livestock production.

Revolution upon revolution

The energy transformation is also a materials and construction revolution. Buildings consume roughly 40% of the energy we generate. Transparent aerogels made from abundant cellulose biopolymers are going into windows and skylights that can now outperform other thermal barriers when it comes to reducing heat and cooling loss. Non-transparent versions provide powerful insulation for pipes and building facades.

Micropyramid technology, which involves precise stacks of small lenses, is enhancing solar panels, increasing the amount of light they can capture each day and boosting capture on dreary days.

Developers building in some cities face mandates to reduce emissions. Some are doing so by creating buildings that are airtight envelopes with triple-pane glass, 4-inch wall insulation, and advanced ventilation systems. They say they can do more if they can obtain affordable steel made at foundries powered by green hydrogen and cement that is used to store captured carbon. In one experiment, carbon emissions from two large gas boilers in a Manhattan apartment tower are captured, liquefied and trucked to a concrete plan to be mixed with cement and sealed in blocks.

More plastics are coming from sustainable sources such as sugarcane, while Zara, H&M, Gucci and others are scaling the use of recycled fibres in apparel. SkyNano is using carbon emissions as a feedstock for low-cost, sustainable manufacturing of advanced carbon materials for batteries, tyres, and plastics.

Technology is helping us make huge improvements in stubborn areas that generate lots of waste. One example is in made-to-fit packaging, where e-commerce giants such as Walmart and Amazon are on the threshold of a major breakthrough thanks to new technology that allows them to essentially customise the size of parcels to slash packaging waste and shipping costs. Elsewhere, AI-powered robots are being deployed to address the biggest hurdle to recycling: trash sorting.

Signs of progress

In less than two years, renewables will overtake coal as the world’s number one source of power, according to the International Energy Agency (IEA). And over the next five years, the world will add more renewable energy than it has in the past two decades, equal to the entire power capacity of China. Renewables have already surpassed coal in the US.

More than 90% of the new electricity capacity added between now and 2027 will be from renewable sources. Growth in renewables is accelerating at rates that outstrip even recent forecasts by the IEA and others.

It feels like a tipping point.

This blog was originally published by the World Economic Forum.

The challenges businesses face today demand courageous leadership and a new model of collaboration. What are the winning strategies, technologies, and business-models that can keep companies competitive while also building better, greener, and fairer economies? Hear from the speakers of Agility’s Tandem Talks breakfast series at the World Economic Forum’s Annual Meeting 2023.

WEF Tandem Talks: Macro Pairing | Money Pairing | Movement Pairing | Mindset Pairing

Agility Tandem Talks: Hassan El-Houry | Paul Baldassari | Sarah Chen-Spellings | Claude Letourneau | Beth Ann Lopez | Nadir Salar Qureshi

WEF Tandem Talks – Macro Pairing

WEF Tandem Talks – Money Pairing

WEF Tandem Talks – Movement Pairing

WEF Tandem Talks – Mindset Pairing

Agility Tandem Talks – Hassan El-Houry

Agility Tandem Talks – Paul Baldassari

Agility Tandem Talks – Sarah Chen-Spellings

Agility Tandem Talks – Claude Letourneau

Agility Tandem Talks – Beth Ann Lopez

Agility Tandem Talks – Nadir Salar Qureshi

By Tarek Sultan

CEO, Agility

There are plenty of flashing lights warning us of the possibility of a sharp economic slowdown in 2023.

We know that COVID-19 has reversed years of progress in global development. It has widened gaps in education, health, income and access to opportunity. It brought on the steepest economic decline since World War II and, by World Bank estimates, pushed 97 million people into extreme poverty.

Today, the global economy is slowing amid a flood of risks: depleted national budgets, war in Ukraine, high inflation, traumatized labor markets, tightening credit, disruptive climate events, a COVID-challenged China, and unprecedented supply chain instability.

As we look ahead, we face three key questions:

- How can we limit, repair and reverse the damage done by the pandemic and its aftermath?

- How can we create a system that’s more open, transparent and fair for the poor, developing countries, women, and small businesses?

- How do we ensure shared prosperity as we speed our transition to a low-carbon future?

It seems obvious, right? We should work to make sure the next phase of global growth includes geographies, businesses and people who’ve traditionally been left out. “The idea of inclusive growth has emerged as a central theme animating discussions on recovery and growth in the post-COVID world,” the World Bank says.

Not everyone agrees. Growth-first advocates view inclusion as a dangerous diversion that could sidetrack economic revival. They want us to focus on growth because they see any recovery as a rising tide that lifts all boats.

That’s a hard sell to those demanding inclusion. They warn that we could see a massive economic divergence between rich and poor, haves and have-nots. And they note that even before the pandemic, we were witnessing the highest levels of income and wealth inequality on record.

“This inequality has disproportionately affected communities of color, women, those less physically abled, and certain geographies,” McKinsey says.

Growth or inclusion is a false choice. Insufficient economic inclusion is — in itself — “a threat to prosperity,” as McKinsey says.

The consulting firm cites research showing that economies grow faster, more vigorously and for longer periods of time when the fruits of that growth are shared and distributed more equally across the population. Up to 40% of the GDP growth in the U.S. economy from 1960 to 2010 can be attributed to the increased participation of women and people of color in the labor force, McKinsey says.

At the same time, you can’t have inclusion and sustainability without growth as the foundation. So where will it come from?

There are four areas where technology can clearly be a powerful force for both inclusion and growth.

1. For small businesses.

Small businesses provide 70% of jobs worldwide and contribute 50% of GDP in developing countries, according to the International Labor Organization.

In the supply chain industry, a host of inexpensive new digital tools are bringing efficiency to smaller shippers and carriers. Among them:

- AI-driven load matching (Frete, Flock Freight) – that allow shippers to pool goods on trucks and bypass freight hubs

- Digital payments for carriers and other stakeholders (Relay Payments, FreightPay)

- Credit, working capital and payments platforms (PayCargo)

- Customs and security digitization products (MDM)

- Online logistics platforms that combine a lot of these features (Shipa)

All of these tools improve cash flow and streamline financial operations by digitizing payments, reconciliations and discrepancies between shippers and carriers, dramatically reducing Accounts Receivable/Accounts Payable errors and processing time.

Digital tools also make sustainability viable for smaller businesses and startups, allowing them to take climate action and build more resilient businesses.

- Free or inexpensive measurement tools

- Resources such as playbooks, and matchmaking platforms that link them with potential partners and vendors (SME Climate Hub, SME360X)

- Supply chain mapping tools that help small businesses do due diligence, customs compliance, environmental and social sustainability tracking, in addition to operations and business continuity planning (Sourcemap)

2. For women.

How can we do more to draw on the talents of women in the workforce, particularly in emerging markets countries, where they are most underrepresented?

One way is by making it safer, faster and more affordable to get to work. That’s what Swvl is doing in Egypt, Pakistan and other emerging markets countries with tech-oriented transportation.

3. For the unconnected poor.

Thirty-seven percent of the world’s population – about 2.9 billion people – has never used the Internet, the International Telecommunications Union says. Most live in developing countries. Nearly all are poor.

Poverty, illiteracy, and lack of connectivity and electricity contribute to this alarming digital divide. In Afghanistan, Yemen, Niger, Mozambique and the poorest countries, nearly 75% of people have never connected. That means remote learning was out of the question during the pandemic – and a major threat to a whole a generation of school children. Connectivity is the only way to address the dangerous “learning loss” that we experienced during COVID.

4. For those whose jobs are at risk from automation & digitization.

So-called frontier technologies are here. Many take advantage of digitalization and connectivity: artificial intelligence (AI), the Internet of Things, big data, blockchain, 5G, 3D printing, robotics, drones, gene editing, nanotechnology and solar photovoltaic.

While they offer incredible promise and productivity gains, these technologies will eliminate jobs. And without massive, targeted, well-resourced upskilling and retraining programs, the adoption of next-generation technologies could profoundly deepen inequality by shutting large numbers of people out of meaningful employment.

The World Bank’s Gallina Vincelette identifies four pillars for inclusive growth. They are life-long learning, removal of barriers to firm entry, trade that fosters competition, and a faster green transition.

Technology can supercharge all four, while bringing down costs, improving productivity and creating good new jobs.

IBM CFO Jim Kavanagh calls technology “the only true deflationary” force in a global economy where companies are struggling to cope with inflation driven by higher human capital costs – salaries, recruiting, retention, churn, overall cost of talent acquisition – plus higher materials costs, fuels costs, transportation costs, borrowing costs, currency volatility costs and other factors.

Growth and inclusion aren’t in conflict. They’re the essential ingredients of a better world.

Nothing illustrates today’s supply chain craziness like the world’s sudden glut of shipping containers.

A few months ago, shippers were paying record ocean freight rates that were five to 10 times higher than pre-pandemic levels as the result of a capacity crunch and a global shortage of containers. Now Drewry estimates there is an excess of six million 20-foot metal shipping containers – known as TEUs – flooding the market.

The same wild imbalances pop up all across the supply chain. Shortages of semiconductors, packaging materials and auto parts. Oversupplies of apparel, home appliances, power tools and outdoor furniture. Dangerously tight supplies of commodities such as oil and grain.

All of that uncertainty adds cost, increases risk and complicates planning. In the U.S. alone, supply chain upheaval sent business logistics costs soaring 22% last year, according to the Council of Supply Chain Management Professionals.

So should businesses be playing offense or defense? The answer is both. Here’s how companies are dealing with the volatility.

1. Resetting inventory

Big retailers with bulging warehouses and inventory gluts are turning to liquidators that buy excess and returned merchandise and sell it at discounted prices. Other retailers are trimming the number of SKUs they put on their shelves, pausing procurement, or asking suppliers to delay or reduce shipments of goods on order.

Many inventory-heavy retailers and e-commerce companies are strapped for cash. They are pushing suppliers to extend payment windows or offer financing to help them better manage their working capital.

But even as some businesses fight to slim down, others are racing to bulk up.

Some high-end and specialty brands such as Lululemon continue to put a premium on speed and availability, spending heavily on air freight to make sure that they don’t experience stockouts. Likewise, even amid signs of a cooling housing market, home builders and apartment developers are accelerating procurement of certain items such as bathroom fixtures and hot tubs that have been nearly impossible to get during the pandemic.

Meanwhile, the auto industry faces a huge backlog of orders and is unable to meet consumer demand because of the lack of computer chips and other critical parts. General Motors said it couldn’t deliver 100,000 vehicles in the second quarter for lack of components.

Rising interest rates have created a tricky balance. Businesses normally slash inventory when interest rates go up, as they have been this year. That’s because higher interest rates usually translate to higher inventory carrying costs.

“If you know anyone who works in demand forecasting or inventory management for a retailer, they could maybe use a hug,” says industry watcher Ben Unglesbee of Retail Dive.

2. Renegotiating contracts

Ocean and trucking rates show signs of softening from record highs. As a result, shippers are trying to reopen carrier contracts to renegotiate their rates, or choosing to buy space on the spot market when spot prices dip below their contract rates.

Even so, Xeneta, an ocean and air freight benchmarking platform, says rates in negotiated shipping agreements in July 2022 were typically 112% above those for July 2021 – and 280% higher than rates in July 2019.

“The carriers have enjoyed staggering rate rises, driven by factors such as strong demand, a lack of equipment, congestion and COVID uncertainty, for 17 of the last 19 months,” said Xeneta CEO Patrick Berglund. “July has seen yet more upticks … but the signs are clear there is a ‘shift’ in sentiment as some fundamentals evolve.”

3. Shuffling suppliers, manufacturing locations and production cycles

Semiconductor companies are adding suppliers, diversifying production locations, and trying to bulk up with buffer stock amid a global chip shortage. In contrast, Clorox is dumping suppliers that it brought on during the pandemic when it needed to guarantee supplies.

Lego and Gap are among the companies expanding their manufacturing and sourcing footprints to serve key markets, reduce dependence on China, or cut logistics costs. There is a mini-boom in construction of new manufacturing capacity in the U.S., driven by frustration with port bottlenecks, parts shortages and sky-high transportation costs, Bloomberg says.

Target, Gap and others have accelerated new product design and orders of certain goods to get them into overseas production early. By stretching out production cycles, they hope to ensure adequate supplies of items they think will be popular sellers, even at the risk they could misfire on consumer tastes.

4. Charging for returns

Consumers have come to expect free returns for online purchases, but that might be changing. Footwear News recently identified 23 retailers that had introduced returns fees this year.

Apparel brand Zara recently instituted charges on returns of e-commerce purchases in some European countries, although buyers can return online purchases for free at Zara stores. UK retailers Boohoo and Asos recently said rising returns are hurting net sales, and Boohoo announced that it might impose fees for returns.

5. Giving workers new flexibility

Global food distributor Sysco has shifted to a four-day work week to improve employee retention and position itself as “an even more preferred employer.” Sysco’s new policy applies to truck drivers and warehouse associates. What’s more, it comes as the company converted its delivery model from five days a week to six days a week to improve asset utilization, virtually guaranteeing an increase in the amount of employee overtime that Sysco will pay.

6. Accelerating tech, automation, investment

The pace and scale of investment in technology and automation are breathtaking. Nike recently announced its largest-ever spend on digital transformation. Hoping to improve productivity and efficiency, Nike will roll out a new ERP system across its global network starting this year.

Meanwhile, Procter & Gamble is betting big on Microsoft cloud computing to boost efficiency in manufacturing, move products to customers faster, improve overall productivity and reduce costs. Heinz and Unilever also have made sizeable investments in new predictive analytics, digital twinning and data modeling capabilities.

At the same time, the software and artificial intelligence powering warehouse robotics is pushing them into the mainstream. A report by the trade group Material Handling Institute indicates that adoption of robotics in warehouses will jump 50% or more in the next five years.

PitchBook Data says private equity firms invested a record $50.6 billion in logistics in 2021 – three times the amount invested in 2020 and 34% more than in 2019, the previous record year. Ongoing supply chain challenges have them on the hunt for more disruptive opportunities this year, PitchBook says.

7. Emphasizing “revenue quality”

Giant delivery specialists UPS and FedEx have boosted revenue and profits while delivering fewer parcels and packages. Both have invested in visibility technology and service quality aimed at large business customers and passed on additional costs such as fuel surcharges. And both have signaled customers and the market that they are focused on revenue and profit per parcel, and content to let others handle less enticing pieces of the business.

8. Putting off expansion

The race to add warehousing capacity and distribution and fulfillment capability appears to be slowing. Amazon is the latest to announce its intention to slow further expansion in the near term in response to cooling demand.

FreightWaves, the supply chain market intelligence firm, sums it up this way: “Supply chains are never returning to normal.”

We’re living in an era shaped by technology. But how can we ensure that technology drives positive change? Alongside the World Economic Forum’s Annual Meeting at Davos, C-level business leaders examine how technology can be used for the greater good: to improve health outcomes, underpin sustainability efforts and ameliorate the human experience.

Agility Breakfast Highlights

Levelling Up Supply Chains

AI and Healthcare Transformation

The Metaverse, Tech and Social Inclusion

Logistics industry executives see record freight rates and port disruption lingering well into 2022 – but are surprisingly optimistic about the global economy. They offer insights into strategic priorities, investments, sustainability, technology and digital forwarding in the 2022 Agility Emerging Markets Logistics Index, which ranks the world’s 50 top emerging markets by logistics infrastructure, business conditions and digital readiness.

This blog was originally published by the World Economic Forum

By Tarek Sultan

CEO, Agility

The global supply chain continues to sputter and break down more than two years into the pandemic. Each day comes news of choked ports, out-of-place shipping containers, record freight rates, and other problems that cause disruption and defy easy answers.

Unless you’re the one waging the day-to-day battle to move cargo for your organization, you should find a moment to take a deep breath. Step back and look at the larger picture because when ports eventually clear and rates come down, the way we manage and think about the supply chain will be very different.

How? Let’s look at the changes in the supply chain brought about by the COVID-19 pandemic.

1. Supply chain is on the front-burner for good

The supply chain finally has the C-suite’s attention, and chief supply chain officers are its new stars. In October, for the first time, corporate CEOs in a McKinsey survey identified supply chain turmoil as the greatest threat to growth for both their companies and their countries’ economies. Bigger than the COVID-19 pandemic, labor shortages, geopolitical instability, war, and domestic conflict.

At about the same time, Bank of America noted that mentions of “supply chain” in Q3 earnings calls by Fortune 500 companies had risen an astonishing 412% from Q3 2020 and 123% from Q2 2021 earnings calls, when the boardroom focused on the issue was already red hot. Fifty-nine percent of companies say they have adopted new supply-chain risk management practices over the past 12 months, including diversifying to reduce overreliance on China.

“We’re seeing a supply chain that is being tested on a daily basis,” Kraft Heinz CEO Miguel Patricio said recently.

2. Flexibility + resiliency + business continuity > cost

Before the pandemic-driven supply chain disruption, cost reduction and productivity enhancement were driving supply chain process improvements, digitization, and investment. Those drivers remain essential, but the unprecedented chaos triggered by COVID threatened the competitive position — even the survival — of many businesses that found they could no longer meet customer expectations.

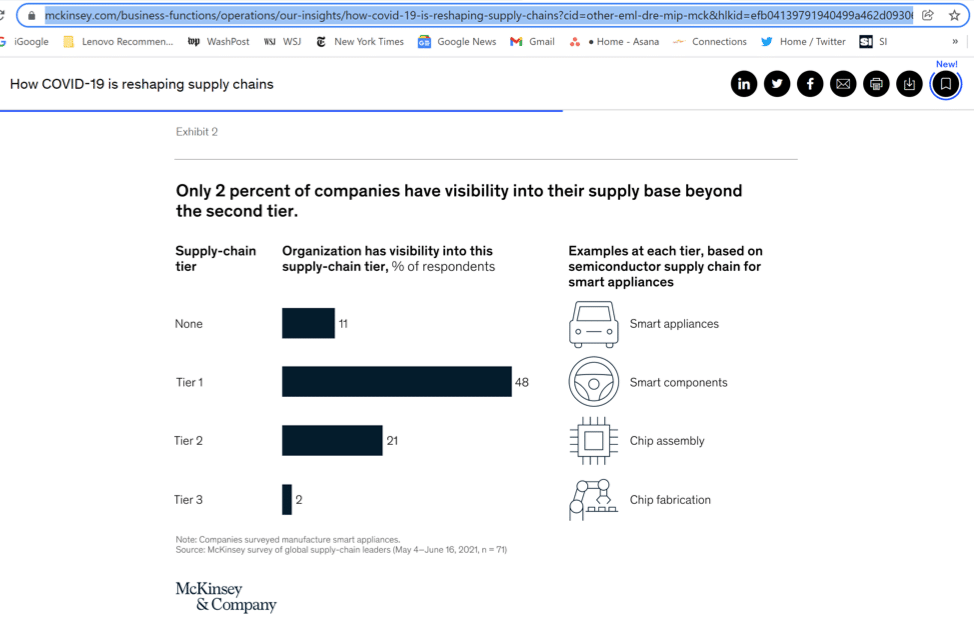

The existential crisis brought on by the pandemic has forced companies to shift the focus of innovation and restructuring efforts to ensure business continuity by building resiliency and flexibility. McKinsey highlighted the vulnerability of manufacturers by showing how few had any visibility into their supplier networks beyond Tier 1 suppliers.

Clorox is one of many companies taking action. It is investing $500 million to upgrade its digital capabilities, citing the need for real-time visibility and better demand planning.

“Supply chain and operations teams must develop new capabilities―and quickly. Playing to a more balanced scorecard will require many changes: reducing the carbon footprint, building greater resilience in the supply chain, creating more transparency, and ensuring accountability,” says Bain & Co. in a new report.

3. Buyer-supplier relations have been altered

In certain industries, the failure of critical links in the supply chain has led to new alliances and co-development ventures between OEMs and suppliers. Alarmed by the shortage of semiconductors, for instance, Ford and General Motors have formed strategic agreements with chipmakers.

More broadly, there is a recognition that resiliency is impossible unless buyers, suppliers, and other parties along a value chain are willing to share data and collaborate. A new Reuters report, Where’s My Stuff? suggests that businesses could share sensitive, closely held data with partners by creating “cleanrooms” where joint teams can perform analysis without fear that competitive information will leak. Blockchain technology, which enables secure, access-controlled data exchange, also could be valuable in data sharing. It allows data storage and distribution through a decentralized network where there are no owners.

“With the benefits of increasing collaboration through data sharing and visibility into deeper tiers becoming more obvious, addressing mistrust becomes a key objective and will require concerted and directed efforts. … (O)rganizations will need to move closer to their suppliers and build relationships and trust, but they can also use smart approaches to data sharing to make progress,” the Reuters report says.

4. Business lines are blurred and ‘workarounds’ are SOPs

Bold companies are not waiting for supply lines to untangle themselves. Retailers short on storage space are buying warehouses. Shippers that can’t find containers are making their own. Companies unable to book with ocean carriers are chartering vessels themselves. Those unhappy with their online sales are buying e-commerce fulfillment operators.

Amazon and ocean giants Maersk and CMA CGM are placing orders for aircraft and moving into air freight. Maersk and CMA CGM, in fact, appear to be on a collision course with Amazon and Alibaba in logistics, forwarding, and delivery.

Nimble shippers and manufacturers know they have to keep adjusting. They are using alternative ports, reformulating products, shifting to air freight, boosting in-house trucking, taking advantage of off-peak port hours, and diverting resources from low-margin products to bigger moneymakers.

In its healthcare unit, GE is redesigning products, using dual sources, and expanding factory capacity as it struggles to cope with semiconductor shortages and other supply chain changes and challenges that have caused turmoil in the medical technology industry.

GE and Stanley Tools are among the many companies that have sought to secure goods by shifting production, using forward contracting, turning to contract manufacturers, fast-tracking plant expansion, building new contract manufacturing hubs, using dual-source manufacturing, and nearshoring, or making hard-to-get parts with 3D printing.

5. The inventory playbook has been ripped up

Companies know that disappointed customers might not come back. That’s why some consumer product brands are desperate to conceal stockouts and disguise low inventory, even reconfiguring in-store displays and using decoys to hide shortages.

More fundamentally, others are questioning the supply chain models they have worked so hard to make hyper-efficient. Automakers that spent decades fine-tuning and perfecting just-in-time systems have started to break with JIT practices because they don’t work when there are shortages of critical components. Toyota, Volkswagen, Tesla, and others are stockpiling batteries, chips, and other key parts and racing to lock up future deliveries.

“The just-in-time model is designed for supply-chain efficiencies and economies of scale,” said Ashwani Gupta, Nissan Motor Co.’s chief operating officer. “The repercussions of an unprecedented crisis like COVID highlight the fragility of our supply-chain model.”

To ensure they have enough to sell, retailers Nordstrom, PVH, and Gap have tried “pack-and-hold” strategies — over-ordering to prevent stockouts with the gamble that they can stash away unsold inventory and sell it as new next year rather than having to discount deeply.

In other industries built on lean inventories, there is a debate about whether we are seeing a permanent change in strategy – toward larger inventory and more safety stock – or a temporary one necessary because of higher demand.

The Reuters report suggests that more companies are prepared to implement aggressive Continuous Replenishment Programs and automate more of their ordering to avoid getting caught flatfooted without sufficient stocks.

What’s clear is that nearly two years after the world first learned of COVID, the supply chain is still experiencing an unfortunate series of firsts. A historic level of carrier unreliability. Record-high freight rates. Record-low warehouse vacancies. And more.

It will pass. When it does, look for more intelligent options that offer supply chain resilience for both the short and long term.

A Changing Growth Dynamic

-

China decelerates

China’s e-commerce sector is experiencing a slowdown in growth as the market matures and policymakers shift their focus to the rural economy. Over the next five years, e-commerce is expected to grow 23.6% from 2020 levels. That’s still healthy, but nowhere near the 70.6% growth rate for the previous five years.

Slowing growth rates are already apparent. Alibaba sales for 2021 Singles Day, the mammoth annual shopping event, were $84.5 billion – a record and up 8.5% from 2020 – but the smallest increase in growth since the start of the festival in 2009.

-

10 Years of Growth in 3 Months in the U.S., but …

At the outset of the pandemic, the United States witnessed a decade’s worth of growth in e-commerce penetration in just three months’ time, according to McKinsey. Consumers continue trying new stores, websites, brands and types of shopping experiences.

Globally, though, the 2021 e-commerce growth rate is unlikely to match the pace set in 2020. Oberlo forecasts a 17% increase in global e-commerce sales for 2021 vs. nearly 26% in 2020.

-

Emerging markets outpace others

“India, Brazil, Russia, and Argentina are all projected to post at least 26% growth in retail ecommerce sales this year,” says eMarketer.

The Brookings Institution says the “latent demand for e-commerce in emerging markets remains large.”

Changes in the Warehouse

-

Smarter robots

Gartner predicts that warehouse automation and digital transformation will reduce inventory carrying costs by 30% in North America and Europe by 2024. Driving much of that reduction will be the arrival of upskilled, multi-skilled or dual-purpose robots to replace robots that specialize in a single task. The next generation of machines will be able to perform more than one job. Imagine a smart machine that could conduct warehouse inventory, replenish the shelves — and clean the floors.

-

AI-led warehouse configuration

Amazon’s new fulfillment center in Sydney, Australia will use artificial intelligence to store 50% more per square meter, accelerating shipping times and allowing for greater product selection.

-

More micro-fulfillment

Retailers everywhere are experimenting more with micro-fulfillment centers – small, on-premise spaces devoted to processing online orders intended for pickup by customers or third-party delivery specialists. Walmart is among the many companies expanding the use of micro-fulfillment, which typically allows shoppers to drive up and scan codes to receive their orders.

Investment in businesses such as Fabric, a U.S.-based company that provides automated micro-fulfillment technology for grocers and general merchandise retailers, is surging along with growth in the same-day delivery market.

Look for more retail lockers – known in the business as Forward Deployment Fulfillment Centers (FDFCs) — in supermarkets, malls, office buildings, and other public places.

Changes in Delivery

-

Low-emissions and no-emissions delivery

B-Line Urban Delivery in Portland, Oregon, has two revenue streams. One is its last-mile logistics delivery business, which delivers using large custom cargo bikes mounted with boxy containers that carry parcels. The other stream comes from selling advertising on the visually striking containers. B-Line and others are meeting the desire of cities and businesses to find ways to cut emissions and vehicle congestion.

-

Creative sell-deliverer partnerships

Bed, Bath & Beyond is going to Uber Eats to launch a baby and kids vertical that will sell and perform same-day delivery of diapers, wipes, baby food and other items to new parents. Products from 750 Bed Bath & Beyond stores are available for on-demand delivery through the Uber and Uber Eats apps.

Changes in Customer Experience

-

Increased use of voice search

E-commerce sellers need to optimize their sites for mobile voice search, which has grown in use as voice assistants on mobile phones and smart devices have improved. The number of voice shoppers is expected to grow 55% in 2022, according to Entrepreneur.

So sellers need to make sure that voice search makes commonly requested information – web address, physical address, contact number and business hours – easily accessible via voice. Entrepreneur recommends online sellers adopt strategies that identify and rank keywords and phrases most likely to be used in voice searches.

-

Augmented reality (AR) to “see” what you’re buying

Up until now, AR has been of greatest interest to apparel brands because it allows consumers to virtually try on garments they are considering for purchase. But Oracle Netsuite urges companies with other types of businesses to take note of the rapid advance of AR technology.

Consumers doing home remodeling, for instance, will want to use AR to “see” what that new room will look like before they agree to remodel. AR can show them the flooring, wall colors, furniture, artwork and more.

-

Personalization on steroids

Online sellers are relying more on artificial intelligence and machine learning to predict individual shopping habits based on their customers’ browsing and shopping histories. At the same time, Deloitte says, consumers are increasingly willing to share their personal data in return for the prospect of customized or personalized products and services. “Mass personalization” is how Deloitte describes it.

One example: Enfamil, which asks expectant mothers for their babies’ due dates and sends them personalized information throughout their pregnancies.

In one study, retailers that were able to scale personalization boosted revenue by 25%, according to Big Commerce.

On the Back End

-

Open source e-commerce

Open source software systems have been popular with smaller e-commerce players, but larger companies have tended to favor proprietary solutions. That’s changing, particularly when it comes to user interface features (marketing, product catalogs, cart & checkout, order status, chat and support, account management) and a smaller set of APIs.

McKinsey says open source software typically provides more speed and flexibility, and that large e-tailers have overcome most of their doubts about scalability, security, and support requirements.

“Open source for e-commerce is an increasingly viable option for large companies, especially for those that have the requisite engineering talent and regard e-commerce as an important strategic consideration,” McKinsey says.

Read the original article by Hassan Mikail, Head of Shipa Ecommerce, at https://www.globalbankingandfinance.com/12-top-trends-in-2022-e-commerce/