A Changing Growth Dynamic

-

China decelerates

China’s e-commerce sector is experiencing a slowdown in growth as the market matures and policymakers shift their focus to the rural economy. Over the next five years, e-commerce is expected to grow 23.6% from 2020 levels. That’s still healthy, but nowhere near the 70.6% growth rate for the previous five years.

Slowing growth rates are already apparent. Alibaba sales for 2021 Singles Day, the mammoth annual shopping event, were $84.5 billion – a record and up 8.5% from 2020 – but the smallest increase in growth since the start of the festival in 2009.

-

10 Years of Growth in 3 Months in the U.S., but …

At the outset of the pandemic, the United States witnessed a decade’s worth of growth in e-commerce penetration in just three months’ time, according to McKinsey. Consumers continue trying new stores, websites, brands and types of shopping experiences.

Globally, though, the 2021 e-commerce growth rate is unlikely to match the pace set in 2020. Oberlo forecasts a 17% increase in global e-commerce sales for 2021 vs. nearly 26% in 2020.

-

Emerging markets outpace others

“India, Brazil, Russia, and Argentina are all projected to post at least 26% growth in retail ecommerce sales this year,” says eMarketer.

The Brookings Institution says the “latent demand for e-commerce in emerging markets remains large.”

Changes in the Warehouse

-

Smarter robots

Gartner predicts that warehouse automation and digital transformation will reduce inventory carrying costs by 30% in North America and Europe by 2024. Driving much of that reduction will be the arrival of upskilled, multi-skilled or dual-purpose robots to replace robots that specialize in a single task. The next generation of machines will be able to perform more than one job. Imagine a smart machine that could conduct warehouse inventory, replenish the shelves — and clean the floors.

-

AI-led warehouse configuration

Amazon’s new fulfillment center in Sydney, Australia will use artificial intelligence to store 50% more per square meter, accelerating shipping times and allowing for greater product selection.

-

More micro-fulfillment

Retailers everywhere are experimenting more with micro-fulfillment centers – small, on-premise spaces devoted to processing online orders intended for pickup by customers or third-party delivery specialists. Walmart is among the many companies expanding the use of micro-fulfillment, which typically allows shoppers to drive up and scan codes to receive their orders.

Investment in businesses such as Fabric, a U.S.-based company that provides automated micro-fulfillment technology for grocers and general merchandise retailers, is surging along with growth in the same-day delivery market.

Look for more retail lockers – known in the business as Forward Deployment Fulfillment Centers (FDFCs) — in supermarkets, malls, office buildings, and other public places.

Changes in Delivery

-

Low-emissions and no-emissions delivery

B-Line Urban Delivery in Portland, Oregon, has two revenue streams. One is its last-mile logistics delivery business, which delivers using large custom cargo bikes mounted with boxy containers that carry parcels. The other stream comes from selling advertising on the visually striking containers. B-Line and others are meeting the desire of cities and businesses to find ways to cut emissions and vehicle congestion.

-

Creative sell-deliverer partnerships

Bed, Bath & Beyond is going to Uber Eats to launch a baby and kids vertical that will sell and perform same-day delivery of diapers, wipes, baby food and other items to new parents. Products from 750 Bed Bath & Beyond stores are available for on-demand delivery through the Uber and Uber Eats apps.

Changes in Customer Experience

-

Increased use of voice search

E-commerce sellers need to optimize their sites for mobile voice search, which has grown in use as voice assistants on mobile phones and smart devices have improved. The number of voice shoppers is expected to grow 55% in 2022, according to Entrepreneur.

So sellers need to make sure that voice search makes commonly requested information – web address, physical address, contact number and business hours – easily accessible via voice. Entrepreneur recommends online sellers adopt strategies that identify and rank keywords and phrases most likely to be used in voice searches.

-

Augmented reality (AR) to “see” what you’re buying

Up until now, AR has been of greatest interest to apparel brands because it allows consumers to virtually try on garments they are considering for purchase. But Oracle Netsuite urges companies with other types of businesses to take note of the rapid advance of AR technology.

Consumers doing home remodeling, for instance, will want to use AR to “see” what that new room will look like before they agree to remodel. AR can show them the flooring, wall colors, furniture, artwork and more.

-

Personalization on steroids

Online sellers are relying more on artificial intelligence and machine learning to predict individual shopping habits based on their customers’ browsing and shopping histories. At the same time, Deloitte says, consumers are increasingly willing to share their personal data in return for the prospect of customized or personalized products and services. “Mass personalization” is how Deloitte describes it.

One example: Enfamil, which asks expectant mothers for their babies’ due dates and sends them personalized information throughout their pregnancies.

In one study, retailers that were able to scale personalization boosted revenue by 25%, according to Big Commerce.

On the Back End

-

Open source e-commerce

Open source software systems have been popular with smaller e-commerce players, but larger companies have tended to favor proprietary solutions. That’s changing, particularly when it comes to user interface features (marketing, product catalogs, cart & checkout, order status, chat and support, account management) and a smaller set of APIs.

McKinsey says open source software typically provides more speed and flexibility, and that large e-tailers have overcome most of their doubts about scalability, security, and support requirements.

“Open source for e-commerce is an increasingly viable option for large companies, especially for those that have the requisite engineering talent and regard e-commerce as an important strategic consideration,” McKinsey says.

Read the original article by Hassan Mikail, Head of Shipa Ecommerce, at https://www.globalbankingandfinance.com/12-top-trends-in-2022-e-commerce/

Originally published at the WEF Agenda blog on January 17th, 2019

This article is part of the World Economic Forum Annual Meeting

- Small businesses have global potential thanks to e-commerce.

- SMEs active on the internet export more than traditional businesses.

- Heightened economic activity can especially benefit women.

Globalization got a bad rap in part because, by sweeping aside barriers to the movement of capital, labour and goods, it was perceived to have favoured large corporate interests over all others.

With the unfolding e-commerce revolution, however, a fairer and more inclusive balance is reshaping the global business environment to provide more room and opportunity for small businesses, especially those headed by women.

E-commerce: small business accelerator

Today, small businesses – even one-person “social sellers” – can run as global entities thanks to the growing availability of inexpensive digital tools that allow them to source, ship, deliver, pay, collect and virtualize other key aspects of their operations. The fast-developing e-commerce ecosystem, which includes marketplaces, payment gateways and online logistics, is helping to reduce barriers to trade across borders.

Export participation rates for traditional small businesses (those that typically do not sell online) range between 2-28% in most countries. In contrast, 97% of internet-enabled small businesses export, according to the World Trade Organization.

Why is this a big deal? Because firms participating in global value chains see the strongest gains in productivity, income and quality of employment. A report by the World Bank points out that in developing countries like Ethiopia, firms that are part of global value chains are twice as productive as other firms. And in a broad number of emerging markets, companies that take part in global trade are also more likely to employ more women than others with more traditional, male-dominated business models. Female participation in the labour market, in turn, correlates strongly to societal gains in health, education and overall prosperity.

Put simply, e-commerce is creating economic employment opportunities for new sets of players. Amazon claims that the 1 million small businesses selling on its platform have created 900,000 jobs in the process. Alibaba’s Taobao, one of the largest e-commerce platforms in China, has 3,200 “Taobao villages” in rural areas where a significant percentage of the village is engaged in e-commerce transactions. No wonder then, that some non-governmental organizations and think tanks are touting e-commerce as a model for developing rural Africa.

E-commerce: gender accelerator

When it comes to the gender effect of e-commerce, the research is still emerging and much of the data is localized, but early signs are promising.

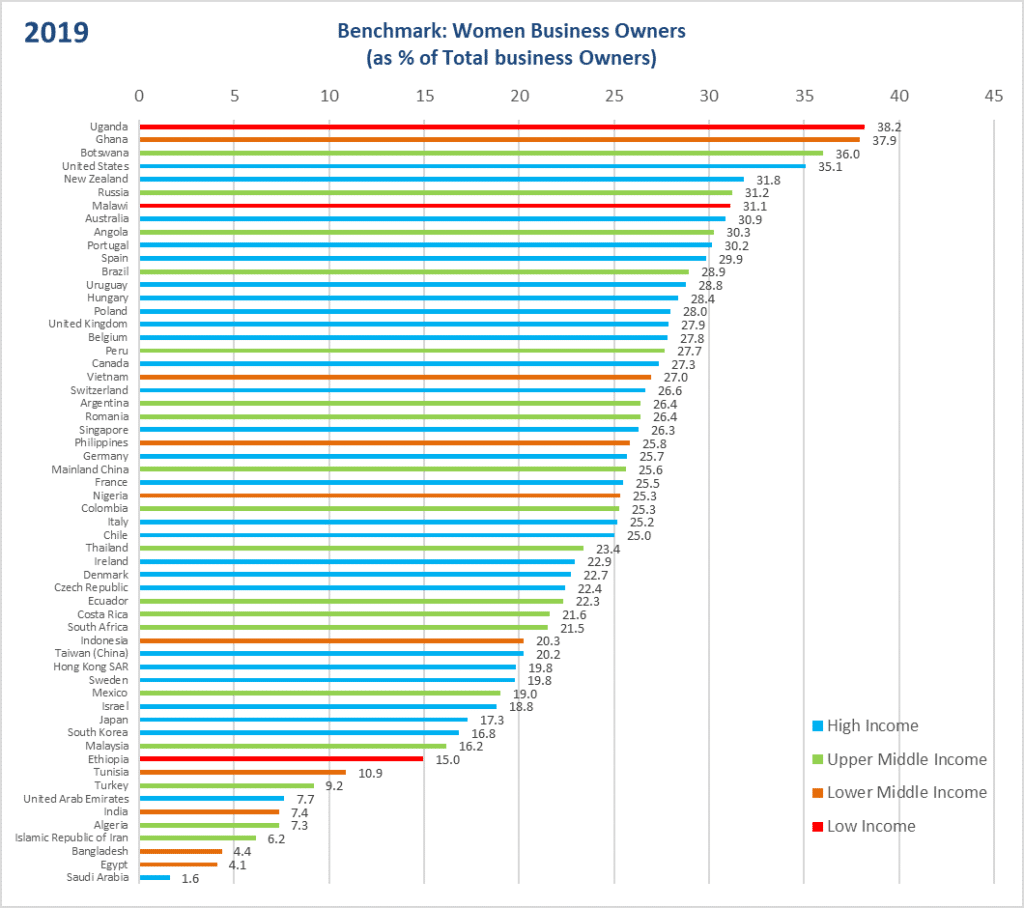

Image: Mastercard

The International Trade Centre (ITC) has found that despite having less access to technology, women use digital platforms to their advantage. The head of the ITC says four out of five small businesses engaged in cross-border e-commerce are women-owned, while just one in five firms engaged in offline trade is headed by women.

Meanwhile, there is more and more evidence to show how e-commerce and digital technology are bringing women to the fore of global trade:

- A McKinsey study on Indonesia’s e-commerce sector found that women involved in online commerce generate more revenue than that contributed by those in traditional commerce.

- Taobao says 50% of its online shops were started by women, whereas only 3.7% of businesses across 67 other industries in China are headed by females, according to the South China Morning Post.

- The World Economic Forum says one in three Middle East start-ups is female-founded. And Cairo-based ExpandCart, one of the region’s most successful e-commerce enablement platforms, says that one-third of small businesses on its platform are owned by women.

Cross-border e-commerce is the fastest-growing segment of international trade, so all of this should come as welcome news for globalization’s critics and fans alike. More importantly, it can help change the two-decade narrative about opportunity, inclusion, fairness and balance in the global economy.

Technology and e-commerce are finally democratizing access to the benefits of global trade, helping globalization live up to its original promise of shared prosperity and growth.

How GCC startups can turn online return pain into profits

E-commerce in the GCC, worth $26.9 billion in 2018, could rocket to nearly $49 billion by 2022. But as established and new players compete for market share, one area of e-commerce that’s yet to be capitalized on is online returns.

Quite often, when the goods are delivered, the journey is far from over. Online returns are often referred to as the dark side of e-commercebecause they’re painful for all involved. Turns out, supply chains don’t work as well when they have to operate in reverse.

Returned merchandise is a hassle for consumers, and expensive for retailers. New solutions are needed – in packaging, labelling, pickup, shipping, efunds and other areas – so innovators who provide these could win big. Startups are already shaking up online returns elsewhere.

In the GCC, 30% of online purchases are returned. If this remains the same as the e-commerce market grows, the value of online returns could hit a whopping $6 billion by 2020. This presents a huge business opportunity for startups in the region.

Online returns: all pain, lots to gain

To provide a winning solution for the region, it’s crucial to understand the e-commerce returns pain points for GCC consumers and retailers.

Online returns are frustrating for consumers because there’s no standard way to return merchandise bought online. Consumers are left to fend for themselves. They must figure out the returns policy, terms and conditions, cost and method of return for each of their purchases.

Customers are expected to understand where to start the process depending on how they’ve made their purchase (this could be directly from a retailer, or through a third party website selling the retailer’s products), and often have to fill out vast amounts of information to process their request. Then they repack and label their returns and figure out where to drop their parcel off, or arrange for it to be picked up by the retailer or a third party. After the return is finally processed, they’ll get a full, partial or zero refund, but this can take up to 14 days.

In the U.S. and Europe returns are often free, with immediate refunds or store credits. Consumers can use drop-off points to return goods from a range of retailers, can arrange for courier or postal service pickup, or can walk returns into brick-and-mortar stores.

According to a report from Swisslog, the cost of handling online returns is typically three to five times higher than original shipping costs, making it the main driver of logistics cost increases for retailers. So many retailers would prefer that their customers keep or destroy unwanted purchases rather than try to return them.

In the European Union, and most other parts of Europe, it’s a fairly straightforward process to deliver across borders. But in the GCC, every border has its own customs point that requires compliance checks, which add time and cost to every delivery – and which are doubled in the case of a return.

Another major headache for GCC retailers is cash – a key differentiator of the region. Cash is king for GCC consumers, and they often use it to pay for online purchases upon delivery: 67% of all payments online in Saudi Arabia and 58% in the UAE are cash-based. In the event of a return, the seller needs a way to hand money back to the consumer, and then bear the financial burden if anything happens to the goods in transit.

GCC consumers and retailers both suffer from this complicated returns process and both groups want to see inventive new solutions.

How startups can light up the dark side of e-commerce

For the GCC, an ideal e-commerce returns solution would be a retailer-agnostic digital platform that consumers can use to request a return for their online purchases. It should come with a standard returns policy – better than anything already offered in the region – that puts the customer first. A policy that retailers signing up to the platform would have to adhere to.

The policy should be clearly displayed on the website, along with FAQs, and terms and conditions must be clear and easily understood, so that consumers know exactly how long it takes to receive a refund or account credit. Everything should be clearly spelled out in Arabic, and there should be dedicated customer support through chat, email and phone.

The platform should be flexible, offering the consumer the option to either drop off their purchase or have it picked up. Home pick-ups could work particularly well for the GCC because large extended families often live together or there is domestic help, meaning there’s often someone at home. Consumers should receive immediate refunds, less fees. Finally, returns would be consolidated for return to retailers.

The startup bringing the platform to market would need to partner with an established logistics player that can take care of the back-end of the process, ensuring goods are collected quickly and securely and delivered to retailers. Key to success would be a logistics partner with a cross-border network throughout the region to ensure ease, speed and compliance when it comes to border controls.

The $6 billion business opportunity

In the GCC, consumers have shown a willingness to pay the price for an online returns service if it guarantees quick and easy returns from their door. If consumers are willing to pay for convenience, the fulfillment and processing costs can be covered, leaving a healthy profit margin for the provider of the solution.

The best answer is a platform that is technology-driven and asset light. A lean and low-risk business model makes this opportunity an ideal proposition for SMEs. The flexible, agile nature of startups could also put them in the best position to take advantage of the huge scale-up opportunity offered, given the $6 billion potential of the online returns market in the GCC.

The market is wide open: there are currently no regional independent players. All returns are managed and processed by retailers.

It’s time for startups to transform the e-commerce returns market in the GCC and bring consumers, retailers and shippers into the light.

Warehousing is in the midst of a tech-driven revolution as companies race to identify and adopt emerging technologies that cut costs, optimize operations and improve overall supply chain efficiency. In some of the largest economies and companies, warehouse drones and robots already have been employed.

It’s not just logistics giants who are adopting innovative tech-based solutions. With the cost of automation falling, increasing numbers of SMEs and startups are investing in these efficient technologies. The top nine technologies shaking up the traditional warehousing scene:

1. Drones to automate inventory and asset management

Small maneuverable drones are appearing in warehouses as companies around the world seek to automate inventory and asset management. With stock stored up to ceilings as high as 12 meters in many warehouses, hard-to-reach barcodes have traditionally meant hours of labor using equipment such as forklifts and ladders. Scanner-carrying drones increase speed and accuracy by navigating warehouse shelves and taking automatic registry of stock. RFID tags can be read and located through cameras from a distance of 10m. Still needed are advancements that allow numerous drones to navigate tight spaces without colliding.

2. Robots for automated order packing

Robots are a game changer. They are programmed to guide themselves and to pick and pack orders into waiting carts or trucks. Some warehouses have already made the shift to full automation through use of robots. The distribution warehouse at online British supermarket Ocado uses thousands of robots to pack groceries into individual boxes. The robots run on complex algorithms that teach them where to pick up inventory and guide them to the exact grocery bag to drop it into, all while making sure that they don’t collide as they roam around filling orders.

3. Better batteries to improve efficiency

Batteries might not seem directly linked to warehousing, but they can power the machines that facilitate warehouse operations. So how can the latest innovations in battery technology advance warehousing?

Advancements in lithium-ion power cells have created impressive battery lives that can last up to ten years before needing to be replaced. Tesla’s latest batteries focus on alternative and affordable energy sources, drawing on solar power and energy from nearby power grids. Just think how powerful, efficient and cost effective robots, electric forklifts and other warehouse machines could be if they utilized these battery technologies. Heating and cooling warehouse space can consume large amounts of energy, so using improved batteries to power these systems could also mean significant savings on this front.

4. 3D Printing

3D printing could shake-up the entire global supply chain by bringing manufacturing closer to consumers and other end users. Take the example of auto parts now made in Asia for vehicles assembled in Mexico and sold in the United States. Production of some parts is likely to move closer to the market to cut down on shipment times and costs. 3D printing could reduce costs associated with complex trade and customs red tape for vast amounts of goods, because they could just be printed on demand near their final destination.

5. Automated Guided Vehicles

Automated Guided Vehicles (AGVs) differ to robots because instead of operating more autonomously they follow guided routes around warehouses. A huge advantage of AGVs is that they replace forklift trucks, so it’s not necessary to change the basic configuration of a warehouse. AGVs are also designed to come to a safe stop if they run into anything. This increases efficiency as AGVs can run continuously without breaks. AGVs are expected to become practical in even the smallest distribution centers, such as those of SMEs, as their cost continues to decrease.

6. Cloud Technologies

As with other industries, cloud storage is revolutionizing the productivity of warehousing as the instantaneous and self-updating systems cut down maintenance, infrastructure and the labor costs associated with the upkeep of management systems. Cloud technologies are also user-friendly and can be used by all employees, leaving companies less vulnerable if highly-skilled tech workers move on.

7. On-demand Warehousing

The “uberization” of warehousing – on-demand warehousing – is an emerging way of buying warehousing services and space on a pay-per-use basis. This method of warehousing gives customers more choice and flexibility over location, cost and supplier, either as a complete substitute to owning warehouses, or as partial replacements when new warehousing locations become necessary. The biggest disadvantage logistics companies face when adopting on-demand warehousing is that they’re exposed to fluctuating market rates for space, which is often overpriced in locations near ports, airports, rail spurs, major roads and urban centers.

8. Internet of Things

Internet of Things (IoT) technologies are not new on the logistics scene, and devices such as wearables, sensors and radio-frequency identification tags (RFID) are already used in many warehouses. By communicating relevant information to other IoT devices, the technologies reduce human error and the need for manual labor. Warehouse managers also get real-time visibility of order fulfillment, allowing them to process goods more efficiently.

Security concerns have blocked some of these advancements from reaching their potential, but a number of emerging technologies are being developed to enhance the safety of applying IoT sensor technology to large logistics operations. Microchips that allow more efficient encryption are one of the innovations that will ease security concerns about adopting the IoT in warehousing, and drastically increase efficiency in the future.

9. Composite Panel Technology

Clever developments in the construction and maintenance of warehouses are set to optimize insulation, air-tightness and durability through the use of new materials in composite panels. The latest panel technology can improve warehouse energy efficiency by around 20%. The cost and emission savings will be especially important in cold-storage facilities such as chilled and frozen food warehouses, where maintaining the correct temperature requires significant resource.

Composite panel technology is set to have global impact on the logistics supply chain: not only does it increase sustainability, it can also decrease warehouse build time and costs by one fifth.