How Better Warehouses Increase Trade in Africa

Kuwait-based Agility Logistics Parks customers can log-on to view contracts and make payments.

UK MOD personnel can log-in to the GRMS portal to schedule household relocation shipments.

Kuwait-based Agility Logistics Parks customers can log-on to view contracts and make payments.

UK MOD personnel can log-in to the GRMS portal to schedule household relocation shipments.

By Henadi Al-Saleh

Chairperson, Agility

As the COVID-19 pandemic wanes, policymakers and corporate leaders have arrived at a long overdue conclusion: small business really matters. There’s a consensus that smaller enterprises are critical to the world’s two most pressing challenges. The first of these is how to spur broad-based, equitable and sustainable economic growth. The second is how to decarbonise to meet Net-Zero climate goals.

Supporting small and medium-sized businesses (SMEs) to rise to meet these challenges is not purely a governmental responsibility. Large corporates must also play a part when it comes to supporting SMEs in skills-building, especially around digitization and helping create the ecosystem for environmental transition, including unlocking financing.

SMEs, largely overlooked in the 2008-2009 global downturn, were not an afterthought when COVID-19 hit three years ago. In many countries, they were quickly targeted with direct government assistance, public loan guarantees, tax relief and other aid intended to keep them afloat and provide them with incentives to avoid shedding workers. Despite this help, a look at SMEs in 32 countries found that most lost 30% to 50% of their revenue between February 2020 and April 2021.

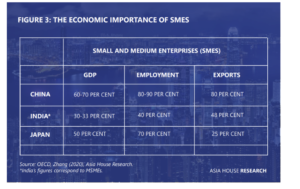

Small businesses represent 90% of all companies and generate nearly 70% of jobs and GDP globally. SMEs are the bedrock of developed and developing economies. They are at the heart of economic growth strategies for most emerging markets looking to climb the development curve.

Image: OECD Zhang (2020) Asia House Research

The long-term viability of many micro-enterprises, startups, entrepreneur-led organizations and other SMEs will be determined by their ability to go digital. Digital transformation is underway in businesses of all sizes, sectors and geographies. But small enterprises are generally less digitalised than medium-sized companies, which, in turn, are less digitalised than big corporations. One reason is that so many digital tools and solutions are priced and tailored to the needs of larger organizations.

In the case of small businesses, the challenge of going digital is especially difficult, but the need to do so is increasingly apparent. Research shows that the largest 10% of companies in digital channels reap 60% to 95% of digital revenues. If we want a future with shared prosperity and sustainable growth, we must ensure that SMEs are part of the digital transformation.

SME development has historically been led by governments through national champion programmes that offer formal management training, goal setting, peer-to-peer networking and guidance on tailored financial services. These yield strong results worldwide. Singapore and Malaysia, for example, say their small business outreach programmes are a critical factor in boosting their participants’ exports and growth.

But big businesses are also increasingly aware that they have a role to play, particularly in helping close the financing and digitization gap for SMEs. About 13,000 business owners have graduated from Goldman Sachs’ 10,000 Small Business programme, which began in the US in 2009 and expanded to France and the UK. This course covers entrepreneurship, advice on getting loans and opportunities to meet government officials. A similar initiative by Unilever provides access to digital tools, financial services and entrepreneurship support to 1.2 million SMEs in eight Asian countries. And, Google has launched Google Hustle Academy, training entrepreneurs and business owners in Africa in growth strategies, digital marketing and how to pitch for funding.

These efforts are paying off. Goldman Sachs says 70% of its handpicked graduates reported that their companies had higher revenues and more than half hired additional employees in the two years after they completed the programme.

If digitization represents a challenge, the scale of transformation required for a Net Zero world is even more daunting for SMEs.

The need to put SMEs at the heart of any discussion on climate is clear. Smaller businesses generate 60%-70% of industrial emissions. A study by the environmental non-profit CDP says that the “combined carbon footprint of SME suppliers is on average five times greater than their large corporate counterparts.”

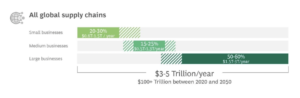

Segmentation as follows: small business <50 employees /<$10M turnover, medium business 50-250employee/<$50M turnover, large businesses >250 employees and over $50m in turnover Image: Image: WEF and BCG report on net zero supply chains, GFMA & BCG report on the 150Trillion opportunity, Orbis database, literature review, BCG analysis

The barriers to change, however, are enormous. A study by Boston Consulting Group (BCG) and HSBC asserts that global supply chains need $100 trillion of investment by 2050 to achieve Net-Zero. It found that as much as half of that investment must come from small businesses, which have to rethink product design, invest in climate tech and improve data gathering. To date, however, small companies are recipients of less than 3% of total support for greening.

Large corporates are directly affected. As ESG regulations change around the world, big businesses are realizing that they have a small business problem. Banks and large corporates facing pressure to show progress on ESG goals and emissions targets have recognized that they will struggle to measure their climate impact, meet reporting requirements and hit their goals. This is because too many of their small business suppliers and customers lack the means to collect and report accurate data on their emissions, waste, energy use and environmental impact.

Resources, such as the SME Climate Hub, built in partnership with corporate climate leaders, are a good step forward, as are new sustainability technology solutions that target SMEs. Long term though, larger businesses must support their suppliers in making the switch.

Walmart is one of the companies that concluded smaller suppliers couldn’t keep up. It acted so that SMEs in its vendor network could comply with the sustainability requirements in its Project Gigaton drive, which aims to cut 1 gigaton of CO2 emissions from the company’s global supply chain by 2030. The retailer provides small businesses with help and resources to make ESG reporting easier. And, it is working with HSBC to make preferential financing available to small vendors to reduce emissions in six categories: energy, waste, nature, packaging, transportation and product use and design. Similarly, Gucci is helping its SME suppliers access loans on favourable terms if the supplier becomes more sustainable. While IKEA is financing sustainability investments in innovative companies that help it meet its sustainability goals.

At Agility, we believe that SME empowerment is a critical future growth driver and change agent. This is especially true of emerging markets that power many of our businesses. We’ve built this belief into our business model: from building warehousing and light-industrial facilities catering specifically to SME needs across the Middle East and Africa, to an online freight forwarding and e-commerce logistics business that helps SMEs trade across borders. We’ve also built this belief into our investment approach. Agility is proud to be a founding member of the First Mover Coalition, which is creating a market for sustainable innovation across the supply chains of heavy industry.

For policymakers and corporate leaders alike, it’s time to acknowledge the obvious: without small business, there is no sustainable growth and no green transition.

This blog was originally published by the World Economic Forum.